Schwab clients were net buyers in February, with the most pronounced buying within the Information Technology, Utilities and Health Care sectors

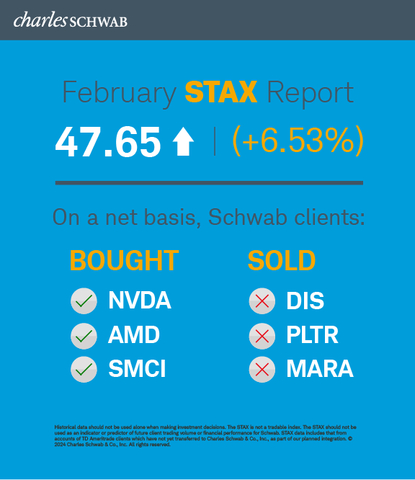

The Schwab Trading Activity Index™ (STAX) increased to 47.65 in February, up from its score of 44.73 in January. The only index of its kind, the STAX is a proprietary, behavior-based index that analyzes retail investor stock positions and trading activity from Schwab’s millions of client accounts to illuminate what investors were actually doing and how they were positioned in the markets each month.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240304841142/en/

Schwab Trading Activity Index February 2024 (Graphic: Charles Schwab)

The reading for the four-week period ending February 23, 2024 ranks “moderate low” compared to historic averages.

“The STAX score has been on the rise since November of last year, making this the fourth consecutive month Schwab clients have increased exposure to the markets,” said Joe Mazzola, Director of Trading and Education at Charles Schwab. “Just as they did last month, more clients bought equities than sold in February, contributing to the record-setting ascent in the equity markets during the period even as they continued to demonstrate cautious optimism and discernment in their purchases and allocations.”

U.S. equity markets soared to new all-time highs during the February STAX period as investors shrugged off several key indicators that came in hotter than expected. On January 31, U.S. Federal Reserve Chairman Jerome Powell commented that the Fed remained concerned about stubbornly high inflation. The Fed left interest rates unchanged as Powell signaled the Fed would remain noncommittal to the timing of potential rate cuts or easing of monetary policy. The U.S. Bureau of Labor and Statistics’ Employment Situation Summary released on February 2 showed that nonfarm payrolls increased by 353,000 in January, a much higher figure than the 185,000 expected. The unemployment rate remained unchanged at 3.7%.

In February, the Consumer Price Index (CPI) rose by 0.3% for the month of January to 3.1% year-over-year, a greater increase than anticipated. The Producer Price index (PPI) came in at 0.3%, hot compared to expectations of 0.1%. On February 15, the U.S. Census Bureau reported that U.S. Retail Sales for January increased 0.6% year-on-year, following a downwardly revised 5.3% increase in December. When it came to corporate earnings, on the whole, companies performed better than analysts had predicted.

Bullish investors appeared to put more stock into earnings growth than macro headwinds, driving both the Nasdaq and S&P 500 to new all-time highs late in the February STAX period; On February 23, the Nasdaq Composite reached 16,134.22 while the S&P 500 (SPX) rose to 5,111.06. The CBOE Volatility Index (VIX) rose 3.3% from 13.31 to 13.75, reflecting a modest increase in risk premium. The 10-year Treasury yield persisted above 4% throughout the period, closing at 4.26%. The U.S. Dollar Index strengthened, ending at 103.94. April Crude Oil Futures moved fractionally lower, settling at $76.49 per barrel.

Popular names bought by Schwab clients during the period included:

- NVIDIA Corp. (NVDA)

- Alphabet Inc. (GOOGL/GOOG)

- Advanced Micro Devices (AMD)

- Super Micro Computer Inc. (SMCI)

- Arm Holdings PLC (ARM)

Names net sold by Schwab clients during the period included:

- Walt Disney Co. (DIS)

- Palantir Technologies Inc. (PLTR)

- Marathon Digital Holdings Inc. (MARA)

- Ford Motor Co. (F)

- General Motors Co. (GM)

About the STAX

The STAX value is calculated based on a complex proprietary formula. Each month, Schwab pulls a sample from its client base of millions of funded accounts, which includes accounts that completed a trade in the past month. The holdings and positions of this statistically significant sample are evaluated to calculate individual scores, and the median of those scores represents the monthly STAX.

For more information on the Schwab Trading Activity Index, please visit www.schwab.com/investment-research/stax. Additionally, Schwab clients can chart the STAX using the symbol $STAX in either the thinkorswim® or thinkorswim Mobile platforms.

Investing involves risk, including loss of principal. Past performance is no guarantee of future results.

Content intended for educational/informational purposes only. Not investment advice, or a recommendation of any security, strategy, or account type.

Historical data should not be used alone when making investment decisions. Please consult other sources of information and consider your individual financial position and goals before making an independent investment decision.

The STAX is not a tradable index. The STAX should not be used as an indicator or predictor of future client trading volume or financial performance for Schwab. STAX data includes that from accounts of TD Ameritrade clients which have not yet transferred to Charles Schwab & Co., Inc., as part of our planned integration.

TD Ameritrade, Inc., member FINRA/SIPC, a subsidiary of The Charles Schwab Corporation. TD Ameritrade is a trademark jointly owned by TD Ameritrade IP Company, Inc. and The Toronto-Dominion Bank.

About Charles Schwab

At Charles Schwab, we believe in the power of investing to help individuals create a better tomorrow. We have a history of challenging the status quo in our industry, innovating in ways that benefit investors and the advisors and employers who serve them, and championing our clients’ goals with passion and integrity.

More information is available at aboutschwab.com. Follow us on X, Facebook, YouTube, and LinkedIn.

0324-NJ1N

View source version on businesswire.com: https://www.businesswire.com/news/home/20240304841142/en/

Contacts

At the Company

Margaret Farrell

Director, Corporate Communications

(203) 434-2240

margaret.farrell@schwab.com