Third Federal Savings and Loan Association of Cleveland, MHC (the “MHC”) is pleased to announce that it received the non-objection of the Federal Reserve Bank of Cleveland to waive receipt of dividends on the shares of stock it owns of TFS Financial Corporation (NASDAQ: TFSL) (the “Company”), up to $1.13 per share during the 12 months ending July 9, 2025. Actual dividends during that period are declared at the discretion of the Company’s board of directors.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240809722180/en/

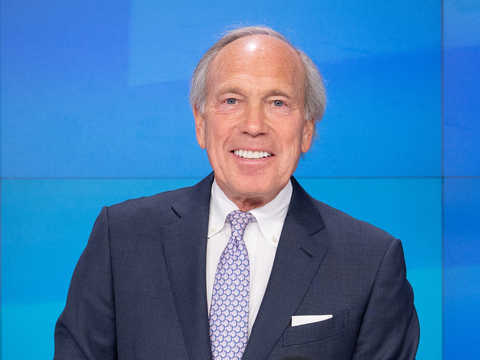

Chairman and CEO Marc A. Stefanski (Photo: Business Wire)

“We appreciate the ongoing support of our members for the MHC dividend waiver and are pleased to announce the non-objection from the Federal Reserve,” said Chairman and CEO Marc A. Stefanski. “The result will allow us the opportunity to maximize the capability to offer dividends to our institutional and individual shareholders. This, along with a focus on capital preservation, and a proactive approach to our business, keeps us strong, stable, and safe.”

The MHC is the mutual holding company and owner of 227,119,132 shares, or 80.9% of the Company’s common stock outstanding, and on July 9, 2024 received the approval of its members (mainly depositors of Third Federal) with respect to the waiver. The members approved the waiver by casting 58% of the eligible votes, with 97% of the votes cast in favor of the waiver. The MHC previously waived the receipt of dividends paid by the Company in an aggregate amount of $1.13 per share during the four quarters ended June 30, 2024.

Third Federal Savings and Loan Association is a leading provider of savings and mortgage products, and operates under the values of love, trust, respect, a commitment to excellence and fun. Founded in Cleveland in 1938 as a mutual association by Ben and Gerome Stefanski, Third Federal’s mission is to help people achieve the dream of home ownership and financial security. It became part of a public company in 2007 and celebrated its 85th anniversary in May, 2023. Third Federal, which lends in 26 states and the District of Columbia, is dedicated to serving consumers with competitive rates and outstanding service. Third Federal, an equal housing lender, has 21 full service branches in Northeast Ohio, two lending offices in Central and Southern Ohio, and 16 full service branches throughout Florida. As of June 30, 2024, the Company’s assets totaled $17.03 billion.

This news release contains forward-looking statements as defined in the Securities Exchange Act of 1934 and is subject to the safe harbors created therein. The forward-looking statements contained herein include, but are not limited to, the Company’s plans regarding its dividends. These forward-looking statements involve risks and uncertainties that could cause the Company’s results to differ materially from management’s current expectations.

The Company’s risks and uncertainties are detailed in its filings with the Securities and Exchange Commission, including our Annual Report on Form 10-K for the fiscal year ended September 30, 2023. Forward-looking statements are based on the beliefs and assumptions of our management and on currently available information. The Company undertakes no responsibility to publicly update or revise any forward-looking statement.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240809722180/en/

Contacts

Jennifer Rosa

(216) 429-5037