Seizing Uncertainty study from HSBC surveys over 17,500 individuals globally, including 1,500 in the US and uncovers gap in business leaders’ abilities to make confident decisions.

- 43% of American women say they’ve experienced feelings of distance and detachment from other people over the last five years compared with 26% of men

- 51% of business leaders in the U.S. say it’s harder to plan for the future than it used to be, and they fear it’s going to get worse

- 47% of Americans feel ill equipped to make decisions, and 33% regret decisions they have made

- 47% regret not taking opportunities when presented, with 25% of Americans viewing unexpected change as bringing opportunity to be explored

- 40% wish they had better access to information and resources to inform decision-making

From complex supply chains to unexpected global events, uncertainty is impacting the ability of business leaders and individuals to make confident decisions, according to a new HSBC global study, Seizing Uncertainty.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240917397845/en/

(Graphic: Business Wire)

The global study of 17,555 individuals across 12 countries, including 1,500 in the U.S., has uncovered that business decision makers and individuals planning for the future are struggling to navigate change and make decisions in their lives.

Research shows that while 79% of business leaders agree uncertainty brings more choice, possibilities and opportunities, almost a third (28%) say uncertainty paralyzes them from taking action.

The report also shows that one in three (31%) people in the U.S. are so uncomfortable with making decisions that they put them off for as long as possible. Almost two thirds (61%) of American people surveyed view change as something only to be managed or coped, and 14% wish to avoid it altogether.

“At a time when decision paralysis is becoming increasingly common, our goal is to support our clients across the U.S. and around the world by leveraging our global expertise,” said U.S. Head of Wealth and Personal Banking Racquel Oden. “We serve our clients by helping them make informed decisions about their financial futures and uncovering opportunities that might otherwise go unnoticed.”

“Across the world, change and uncertainty are the norm, not the exception,” said Professor David Tuckett, Director of the Centre for the Study of Decision-Making Uncertainty at UCL and Academic Adviser to the study. “In this context of radical uncertainty, people are facing heightened complexity and constant disruption. This is truly an issue for our times. Addressing this gap and empowering more people to be confident when making decisions will be a key factor in creating opportunities.”

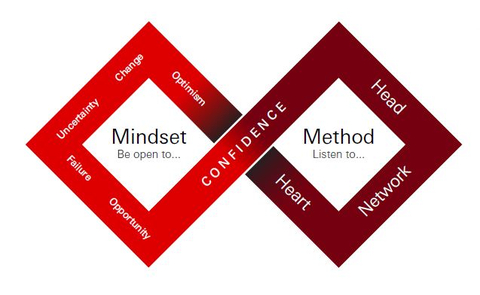

To help set our clients up for success, HSBC has created the Decision-Making Guide with Professor David Tuckett, which can help people to act, even when the outcome is uncertain.

The Decision-Making Guide helps people navigate uncertainty and seize life’s opportunities by empowering them with insights and information on how to make better, more confident decisions.

For more details on the study and HSBC’s Decision-Making Guide for more confident decision-making, visit: www.HSBC.com/SeizingUncertainty. Spokesperson interviews are available upon request.

About HSBC

HSBC Holdings plc, the parent company of HSBC, is headquartered in London. HSBC serves customers worldwide from offices in 60 countries and territories. With assets of US$2,975bn at 30 June 2024, HSBC is one of the world’s largest banking and financial services organizations.

HSBC Bank USA, National Association (HSBC Bank USA, N.A.) serves customers through Wealth and Personal Banking, Commercial Banking, Private Banking, Global Banking, and Markets and Securities Services. Deposit products are offered by HSBC Bank USA, N.A., Member FDIC. It operates Wealth Centers in: California; Washington, D.C.; Florida; New Jersey; New York; Virginia; and Washington. HSBC Bank USA, N.A. is the principal subsidiary of HSBC USA Inc., a wholly-owned subsidiary of HSBC North America Holdings Inc.

For more information, visit: HSBC in the USA

About the Study

Quantitative research was conducted by PSB Insights between 5-30 June 2024 in Australia, Mainland China, Hong Kong, India, Indonesia, Kingdom of Saudi Arabia, Malaysia, Mexico, Singapore, United Arab Emirates, United Kingdom and the United States of America.

The survey covered 17,550 online interviews across 12 markets, comprising n=1,000 general populations, n=200 affluent individuals (~top 5%) and between 150 and 500 business leaders in each market.

Detailed demographic quotas were set to ensure a nationally representative sample within each market.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240917397845/en/

Contacts

Media Enquiries

Matt Kozar

matt.kozar@us.hsbc.com