New Financing Platform Provides Quick, Flexible Capital Access to Help Small Businesses Grow and Succeed

Cantaloupe, Inc. (Nasdaq: CTLP), a global leading provider of end-to-end technology solutions for self-service commerce, is excited to announce its newest platform, Cantaloupe Capital, in collaboration with Fundbox, a leading working capital platform for small businesses. This new offering provides small businesses with streamlined access to capital for expansion through equipment investments and flexible access to cash flow.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250205421401/en/

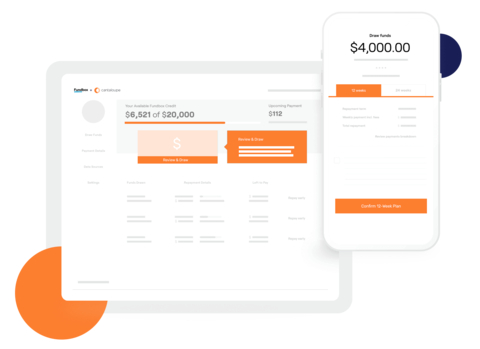

Cantaloupe, Inc., is collaborating with Fundbox to launch Cantaloupe Capital, providing small businesses with streamlined access to capital for expansion through equipment investments and flexible cash flow. (Graphic: Business Wire)

In the self-service retail industry, small businesses often face challenges accessing traditional financing options. In fact, according to the 2024 Federal Reserve Small Business Startup Credit Survey, only 43% of startup small businesses (with employees) that applied for traditional financing received funding and only 29% of owner-operated startups received funding.

The Cantaloupe Capital offering directly addresses these financing-related pain points by focusing on factors like steady business performance and growth potential. With eligibility criteria tailored to small businesses, the platform ensures that more operators can access the capital they need to thrive.

"The majority of our customers are small and growing businesses, many of them sole proprietors. Cantaloupe understands their need for accessible financing solutions that can help them scale their operations," said Elyssa Steiner, Chief Marketing Officer of Cantaloupe, Inc. "With Cantaloupe Capital, we're breaking down barriers to funding by facilitating quick and easy online access to capital for owner-operators that will allow them to invest in new equipment, manage seasonal fluctuations, and capitalize on growth opportunities in the rapidly evolving self-service retail space."

The Cantaloupe Capital platform offers several key advantages for small business operators:

- Streamlined online application process with rapid funding decisions.

- Transparent, competitive interest rates and flexible repayment terms.

- Comprehensive support for equipment purchases and working capital needs.

- User-friendly interface designed for busy business owners.

“Traditional banks and financing options don’t always meet the needs of startups or growing small businesses,” noted Steiner. "By launching Cantaloupe Capital in collaboration with Fundbox, together we're not only offering a full platform of financial services and products but also offering small business operators a simple and efficient pathway to expand their operations and achieve their business goals."

“We are excited to collaborate with leading platforms like Cantaloupe to empower small business customers with seamless access to capital, helping them unlock new opportunities for growth and success,” said Rina Jariwala, Chief Operating Officer of Fundbox. “As someone from a family of small business owners running vending machines and storefronts, I’ve seen how access to capital can be a game-changer. This collaboration brings innovative solutions to the entrepreneurs who will drive our economy forward.”

The Cantaloupe Capital platform represents a significant expansion of Cantaloupe's comprehensive suite of business solutions, reinforcing the company's commitment to supporting operators across all aspects of their business operations. The platform combines Cantaloupe's expertise in payment processing and business management software with Fundbox’s proven lending capabilities, creating a powerful tool for business growth and success.

To learn more about Cantaloupe Capital, visit cantaloupe.com/capital.

About Cantaloupe Inc.

Cantaloupe, Inc. (Nasdaq: CTLP), is a global technology leader powering self-service commerce. Cantaloupe offers a comprehensive suite of solutions including micro-payment processing, self-checkout kiosks, mobile ordering, connected point of sale systems, and enterprise cloud software. Handling more than a billion transactions annually, Cantaloupe’s solutions enhance operational efficiency and consumer engagement across sectors like food & beverage markets, smart automated retail, hospitality, entertainment venues and more. Committed to innovation, Cantaloupe drives advancements in digital payments and business optimization, serving over 30,000 customers in the U.S., U.K., EU countries, Australia, and Mexico. For more information, visit cantaloupe.com or follow us on LinkedIn, Twitter (X), Facebook, Instagram or YouTube.

About Fundbox

Fundbox is the pioneer of embedded working capital solutions for SMBs, leading the charge in best-in-class embedded finance offerings since 2015. Fundbox empowers the small business economy by offering fast, simple access to working capital through the digital tools businesses already use. Fundbox has partnered with leading SMB platforms to help over 125,000 small businesses unlock growth with fast, simple access to over $5B of capital.

Cashtag $CTLP

G-CTLP

View source version on businesswire.com: https://www.businesswire.com/news/home/20250205421401/en/

Contacts

Jenifer Howard | 202-273-4246

jhoward@jhowardpr.com

media@cantaloupe.com

fundbox@avenuez.com