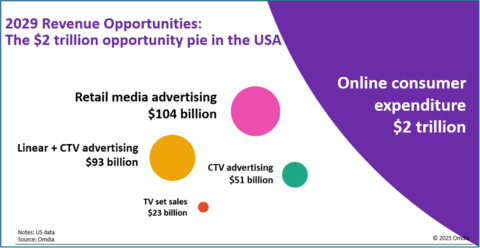

According to Omdia, online consumer spending is set to reach $4.4 trillion in 2025, with the U.S. contributing $1.4 trillion. By 2029, this figure will surge to $6.6 trillion, with the U.S. accounting for $2 trillion of total online expenditure.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250311592168/en/

2029 revenue opportunities (Graphic: Business Wire)

The projected growth in online consumer spending outpaces even the expansion of the media and entertainment sector, which is expected to grow from $1.07 trillion in 2025 to $1.3 trillion by 2029. Video content continues to lead this charge, driving 70% of global revenues, with online video (up 13%), cinema (12%), and gaming (7%) seeing the most significant growth in 2025.

While media and entertainment remain a key growth area, the acceleration of online consumer spending presents the most significant opportunity. Retail media and shoppable TV are driving a transformation in how content, commerce, and advertising intersect, creating new avenues for businesses to capitalize on.

With digital commerce continuing to expand rapidly, leading retailers are pivoting to adapt. Amazon has surpassed Walmart as the world’s largest retailer, highlighting the e-commerce shift. In response, Walmart has positioned itself as a digital-first powerhouse, making strategic moves like its recent acquisition of Vizio to enhance its digital advertising capabilities and integrate shoppable TV into its offerings. Currently, 20% of Walmart’s revenue comes from digital channels, and this figure is expected to grow significantly as the company invests more in retail media and connected TV (CTV).

As CTV adoption accelerates, TV operating systems (TV OS) are becoming essential in shaping the future of advertising and commerce. The integration of CTV, TV OS, and retail media is creating seamless pathways from content consumption to purchase, unlocking new revenue streams for broadcasters, advertisers, and retailers alike.

“Shoppable TV presents a massive opportunity for retailers, advertisers, and content creators. However, challenges remain such as seamless checkout, consumer trust, and platform integration which must be addressed before its full potential is realized,” said Omdia Senior Research Director, Maria Rua Aguete.

As shoppable TV and retail media continue to mature, the industry will see new partnerships and innovations emerge. The convergence of entertainment and commerce is reshaping the digital media landscape. Companies that successfully integrate CTV, TV OS, and retail media into their strategies will be well-positioned to capture significant market share and drive growth in the next era of digital commerce.

ABOUT OMDIA

Omdia, part of Informa TechTarget, Inc. (Nasdaq: TTGT), is a technology research and advisory group. Our deep knowledge of tech markets combined with our actionable insights empower organizations to make smart growth decisions.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250311592168/en/

Contacts

Fasiha Khan: fasiha.khan@omdia.com