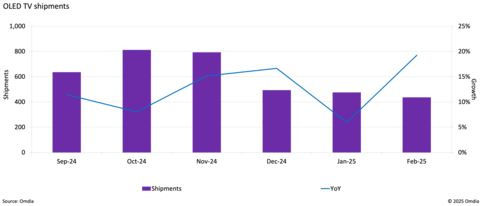

Omdia’s latest TV monthly tracking data reveals a 19.2% year-on-year growth in global OLED shipments for February 2025. This follows a strong close to 2024, with quarterly OLED shipments surpassing 2 million in the last quarter of 2024, for the first time since 2022. In Europe, OLED continues to dominate as the premium technology of choice, accounting for 23% of TV revenue in 2024, despite representing just 8% of volume. However, the growing challenge from Mini LED is quickly gaining momentum.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250410477146/en/

OLED TV shipments

According to Omdia’s latest TV Sets Market Tracker - February 2025, LCD shipments fell by 2.4% in February, in contrast to OLED’s 19.2% growth. While OLED has continued its growth streak, after a strong final quarter of 2024, Mini LED is expanding even faster, reaching a shipment volume of 3 million units in 4Q24, outpacing the 2 million achieved by OLED for the first time.

This global view on TV technology consumption is influenced by a surge in Mini LED demand in China, driven by local incentive schemes, aimed at promoting energy-efficient technology. It also signals a major upcoming challenge for the European TV market, where OLED has been long defined as the premium technology.

Matthew Rubin, Principal Analyst, TV Set Research, Omdia explains: “With over 14% of TV shipments in Western Europe priced above $1,000, compared to just under 9% globally, European consumers clearly prioritize premium technology. This is partly due to limited space which has restricted screen size growth, a trend that has spurred the US market. Over recent years, OLED technology has solidified its position in European markets, capturing a large and growing share of revenue. However, major Chinese vendors, such as Hisense and TCL, which have avoided OLED, are now building momentum behind Mini LED, including newly launched RGB Mini LED, positioning it as a challenger in the premium segment.“

Mini LED offers several enticing benefits for consumers, including high brightness, better contrast and enhanced color vibrancy. Crucially, it is cheaper to manufacture than OLED, particularly for larger screen sizes. However, all is not lost for brands reliant on OLED, such as LG, Panasonic, and to a lesser degree Samsung. There remain key barriers to Mini LED adoption, such as consumer terminology confusion (educating buyers on the difference between standard LED LCD, Mini LED and now RGB LED), and the intrinsic brand value that OLED has built in consumers’ minds as the go-to premium technology.

“Overcoming these challenges will take time, but brands must make strategic decisions soon regarding product range and technology positioning. Few brands will want, or be able, to cover all bases, offering both OLED and Mini LED as premium options, as this could dilute their marketing initiatives. However, making the wrong choice or opting for late adoption could have serious consequences, particularly in the highly competitive European market,” concluded Rubin.

ABOUT OMDIA

Omdia, part of Informa TechTarget, Inc. (Nasdaq: TTGT), is a technology research and advisory group. Our deep knowledge of tech markets combined with our actionable insights empower organizations to make smart growth decisions.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250410477146/en/

Contacts

Fasiha Khan – Fasiha.khan@omdia.com