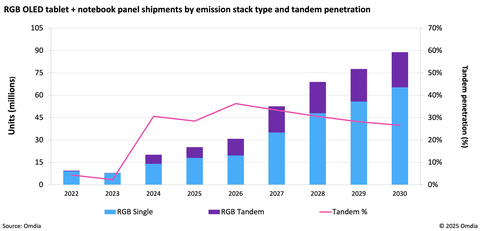

According to recent display industry research from Omdia, tandem RGB penetration into the OLED tablet and notebook panel markets surged from almost zero to more than 30% in 2024.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250424217085/en/

RGB OLED tablet + notebook panel shipments by emission stack type and tandem penetration

The surge in tandem panel shipments is attributed to the release of Apple’s OLED-based iPad Pro models. Apple’s initial OLED tablet and notebook strategy targets the premium segment of the mobile PC market, using tandem to clearly differentiate display quality, setting its products apart from both competitors and its own legacy devices.

Omdia’s research shows that tandem penetration is predicted to jump again to 36% in 2026 when Apple is expected to introduce its first OLED-based MacBook Pro models.

Tandem OLEDs —featuring double-stacked RGB emission layers— can theoretically deliver up to twice the brightness and four times the lifespan, offering significant benefits which are highly appealing enhancements to both set makers and consumers alike.

Even so, the performance gains offered by tandem OLEDs come with trade-offs. “Image quality may be degraded by variations between the double set of emission layers, and the increase of common layers makes the panel more susceptible to crosstalk”, stated Charles Annis, Practice Leader in Omdia’s Display Research group.

“Tandem OLEDs also require more evaporation steps and fine metal masks (FMM) which not only increases material consumption but also negatively affects production yields,” added Annis. “As a result, tandem tablet and notebook panels are 50% to 75% more expensive to manufacture compared to single-layer OLEDs.”

In applications where brightness and lifetime command a premium, tandem OLEDs are poised to win share rapidly. Automotive displays are a prime example, with tandem penetration already approaching 50%. In contrast, adoption in smartphones, where high resolution exacerbates yield issues, is expected to remain limited due to higher costs.

RGB notebook and tablet displays fall in between these two applications, where tandem OLED unit shipments are modeled to grow at a high 25% compound annual growth rate (CAGR) from 2024 to 2030. At the same time, the market for single-layer OLED tablet and notebook panels is forecast to grow at a 29% CAGR, driven by consumers who want a step up in quality from LCDs, but are unwilling to pay an extra premium for higher brightness.

ABOUT OMDIA

Omdia, part of Informa Tech Target, Inc. (Nasdaq: TTGT), is a technology research and advisory group. Our deep knowledge of tech markets combined with our actionable insights empower organizations to make smart growth decisions.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250424217085/en/

Contacts

Fasiha Khan: Fasiha.khan@omdia.com