The Middle East and North Africa (MENA) streaming video market is projected to reach $1.5 billion by the end of 2025, with subscription video-on-demand (SVOD) subscriptions crossing 27 million, according to new insights released by Maria Rua Aguete, Head of Media and Entertainment at Omdia, during her keynote address at the Comcast Technology Summit in Dubai, held in conjunction with CABSAT 2025.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250513597916/en/

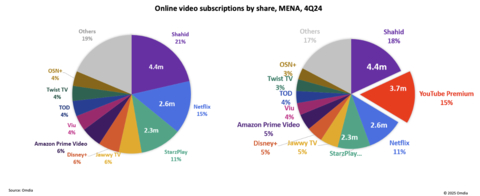

Online video subscriptions by share, MENA, 4Q24

SVOD Market Leadership and Competitive Dynamics

Omdia’s latest research highlights the continued dominance of regional and international platforms in the MENA streaming landscape. As of December 2024, the leading SVOD platforms by market share are:

- Shahid - 4.4 million subscribers

- YouTube Premium - 3.7 million* subscribers

- Netflix - 3.0 million subscribers

- StarzPlay - 2.3 million subscribers

Shahid, Netflix, and StarzPlay lead the MENA SVOD market by share, driven by strong local content strategies and platform engagement. However, when YouTube Premium is included, it surpasses Netflix in subscription volume, signaling shifting consumer preferences toward platforms offering flexible, multi-format streaming experiences.

“YouTube Premium’s momentum in MENA reflects the region’s appetite for seamless, ad-free streaming across platforms,” Rua Aguete noted. “With over 80 million users in MENA and 3.7 million YouTube Premium video subscribers, the platform is now one of the most significant players in the region’s digital media ecosystem. Saudi Arabia has emerged as one of YouTube Premium’s top 10 global markets.”

StarzPlay: Monetization Through Strategic Realignment

In 2024, StarzPlay implemented a strategic shift by streamlining its service tiers - merging standalone sports with entertainment into a single ‘Max’ bundle. This restructuring resulted in a 30% increase in average revenue per user (ARPU), while maintaining subscriber retention and limiting churn.

“StarzPlay’s emphasis on simplification and value-added bundling is driving measurable financial outcomes,” said Rua Aguete. “It’s a strong example of monetization through intelligent product strategy.”

Market Outlook: An $8.4 Billion Opportunity by 2029

Omdia projects that the online video market in MENA will grow more than fivefold, reaching $8.4 billion by 2029. Key growth drivers include expanding digital infrastructure, high mobile penetration, and a young, highly engaged population.

“MENA is undergoing a structural shift in digital video consumption,” added Rua Aguete. “The next five years represent a critical opportunity for platforms, investors, and content creators to scale and innovate.”

Notes to Editors:

*Omdia defines YouTube premium subscribers as users actively engaging with the video component of the product. Music-only subscribers and free trial users are excluded.

ABOUT OMDIA

Omdia, part of Informa TechTarget, Inc. (Nasdaq: TTGT), is a technology research and advisory group. Our deep knowledge of tech markets combined with our actionable insights empower organizations to make smart growth decisions.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250513597916/en/

Contacts

Media Contact

Fasiha Khan

Director, PR and Communications

fasiha.khan@omdia.com