Chief Supply Chain Officers Should Brace Their CFOs for Ongoing Cost Volatility

To help organizations navigate the ongoing impacts posed by the Israel-Iran conflict, Gartner Inc. has identified three critical priorities for chief supply chain officers (CSCOs) to implement now to secure their operations.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250625844957/en/

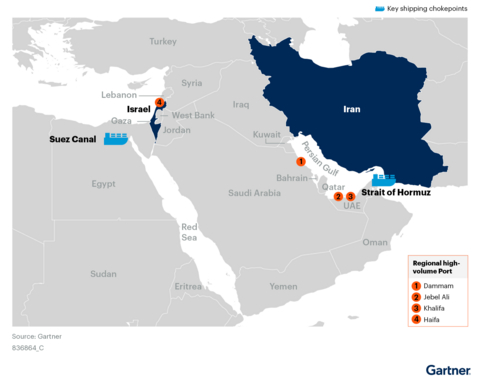

Figure 1: Global Supply Chain Vulnerability (Source: Gartner, June 2025)

In response to the ongoing impacts from the conflict, CSCOs should:

- Assess and mitigate their exposure to new global transportation bottlenecks

- Prepare CFOs for continued supply chain cost volatility

- Review supply chain resilience strategies

“As the conflict between Israel and Iran oscillates, CSCOs must leverage the resilience they have built in recent years, recognizing that the global significance of this region makes it nearly impossible to avoid adverse impacts, even if only indirect,” said David Gonzalez, VP analyst in Gartner’s Supply Chain practice.

Mitigate Regional Bottlenecks

The latest conflict is adding to significant bottlenecks across the region’s key shipping routes (see Figure 1) and logistics hubs, including:

- Red Sea and Suez Canal: Container traffic remains well below pre-crisis levels, with major shipping lines avoiding the Suez Canal. Organizations must monitor transit times and adjust expectations for longer lead times and higher costs.

- Strait of Hormuz: Heightened risk of disruption is causing delays and congestion as companies seek alternative routes. Supply chain leaders should engage partners to identify and manage new shipping options.

- Regional Ports: High-volume ports such as Jebel Ali, Khalifa Port, Dammam and Haifa face increased pressure, with some having already faced service interruptions. Contingency planning for alternative ports is essential.

- Eurasian Rail Freight: Demand for rail freight between Asia and Europe has surged, leading to congestion and longer booking times. Organizations should trial rail options where feasible, weighing higher costs against faster transit.

“Regardless of the status of the conflict, CSCOs should continue engaging with their ecosystem of partners to identify alternative routes, assess the viability of shifting volume to less impacted regional ports, and consider multimodal transportation options for some goods after conducting a cost-benefit analysis,” said Gonzalez. “This conflict should serve as a catalyst for improving organizations’ supply chain resiliency plans over the long-term.”

Prepare CFOs for Cost Volatility

Ongoing disruptions in the Middle East are driving up supply chain costs across energy, transportation, insurance, inventory, and technology. CSCOs must proactively engage CFOs to assess budget impacts and prepare for increased spending. Price volatility in crude oil and liquid natural gas (LNG) are elevating energy and fuel surcharges, while rerouted shipments and longer transit times are pushing up transportation rates. Insurance premiums for goods in transit continue to climb, and higher inventory levels are needed to safeguard against supply interruptions.

Underinvestment in supply chain technology has left many organizations exposed, making it critical to build the business case for new tools that enhance visibility and risk management. In this environment, close collaboration between supply chain leaders and CFOs is essential to navigate ongoing volatility and protect customer service levels.

Review Supply Chain Resilience Strategies

The conflict is putting previous supply chain resilience strategies to the test. CSCOs must identify risks to critical raw materials, ensure the continued flow of finished goods, and conduct cost-benefit analyses of mitigation actions in partnership with finance leaders. This includes evaluating potential impacts on margins and reviewing the product portfolio for vulnerabilities.

Gonzalez noted that while many supply chain leaders have already invested in collaborative supplier relationships and risk mitigation, ongoing trade disruptions and regional tensions require a renewed focus. CSCOs should reassess existing supplier networks, confirm the viability of current mitigation plans, and address any overreliance on specific geographies to reduce exposure and ensure business continuity.

Gartner clients can read more in Why the Israel-Iran Conflict Requires a Rapid Response From CSCOs. Nonclients can learn more in Top Supply Chain Risks and Mitigation Strategies.

About the Gartner Supply Chain Practice

The Gartner Supply Chain Practice provides actionable, objective insights for supply chain leaders and their teams, so they can respond to disruption and innovate for the future through leading-edge supply chain management practices. Additional information is available at https://www.gartner.com/en/supply-chain. Follow news and updates from the Gartner Supply Chain Practice on LinkedIn and X using #GartnerSC. Visit the Gartner Supply Chain Newsroom for more information and insights.

About Gartner

Gartner, Inc. (NYSE: IT) delivers actionable, objective insight that drives smarter decisions and stronger performance on an organization’s mission-critical priorities. To learn more, visit gartner.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250625844957/en/

This conflict should serve as a catalyst for improving organizations’ supply chain resiliency plans over the long-term.

Contacts

Justin Lavelle

Gartner

Tel +1 571 230 0816

justin.lavelle@gartner.com