The cellular IoT market is set for dramatic expansion over the next six years, with connections projected to reach 5.1 billion by 2030, according to new research from Omdia.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250716332297/en/

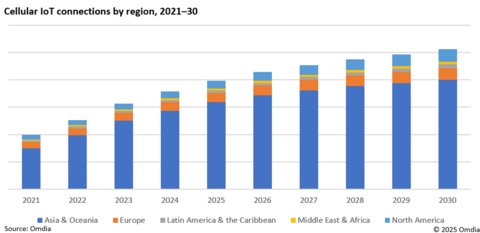

Cellular IoT connections by region 2021-30

This comprehensive study reveals how 5G technologies are fundamentally transforming the cellular IoT landscape, with three key technologies emerging as primary growth drivers: 5G RedCap, 5G Massive IoT, and 4G LTE Cat-1bis modules.

5G RedCap: The Mid-Tier Connectivity Solution

The research identifies 5G RedCap as a particularly significant development, with adoption expected to accelerate from 2025 onward. RedCap is positioning itself as the ideal mid-tier connectivity solution for 5G devices that don't require the premium specifications of Ultra-Reliable Low Latency Communications (uRLLC) or Enhanced Mobile Broadband (eMBB).

RedCap also delivers essential futureproofing benefits as the industry prepares for the gradual phase-out of 4G networks beyond 2030. Despite these advantages, the research notes that RedCap adoption has experienced slower initial deployment than originally anticipated.

"We are beginning to see 5G SA rollouts accelerate again after a brief period of slowdowns, which has delayed 5G RedCap mass adoption by a couple of years," explains Alexander Thompson, Senior Analyst for IoT at Omdia. "We are also seeing the first devices emerge on the market in the US, starting the transition of mid-tier connectivity from 4G to 5G."

Asia & Oceania Leading Global IoT Growth

Omdia's latest research reveals that the Asia & Oceania region will contribute over 67% of worldwide IoT module shipments, representing approximately 80% of total IoT connections in 2024.

The automotive industry has emerged as a significant catalyst in this growth trajectory, primarily driven by increasing consumer demand for intelligent vehicles with integrated 5G connectivity features.

"The dominance of the Asia & Oceania region in the IoT market cannot be overstated," notes Andrew Brown, Practice Lead, IoT at Omdia. "With 80% of total IoT connections concentrated in this region, we're witnessing a significant shift in global technology leadership that will shape IoT innovation and deployment strategies for years to come.”

This substantial regional concentration underscores Asia & Oceania's pivotal role in shaping global IoT deployment strategies and highlights the region's technological leadership in connected device ecosystems.

Omdia's Cellular IoT Market Tracker 2021-2030 highlights the latest trends in the cellular IoT market, providing key analysis by region, air interface and application of module shipments, module revenues, connections (installed base) and connectivity revenues.

ABOUT OMDIA

Omdia, part of Informa TechTarget, Inc. (Nasdaq: TTGT), is a technology research and advisory group. Our deep knowledge of tech markets grounded in real conversations with industry leaders and hundreds of thousands of data points, make our market intelligence our clients’ strategic advantage. From R&D to ROI, we identify the greatest opportunities and move the industry forward.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250716332297/en/

"We are beginning to see 5G SA rollouts accelerate again after a brief period of slowdowns, which has delayed 5G RedCap mass adoption by a couple of years," explains Alexander Thompson, Senior Analyst for IoT at Omdia.

Contacts

Fasiha Khan – Fasiha.khan@omdia.com