Only $4 billion expected in 2025 as telecom operators stake claim in the global AI economy

Telecom operators are reinventing their business-to-business services to capture new AI revenues, but their efforts will only yield $4 billion in 2025, according to Omdia’s newly launched Telco B2B AI Monetization Index.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250724724137/en/

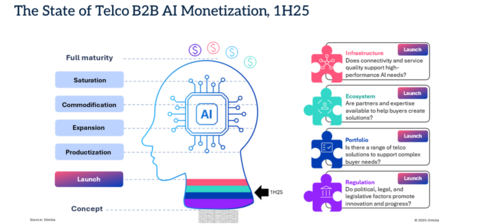

The state of telco B2B AI monetization

The index is an independent market tool that tracks how telecom operators are capitalizing on the emerging global AI economy. Index data informs Omdia’s forecast that telco B2B AI revenues will exhibit a 65% CAGR through to 2030, as telcos expand their role in providing AI infrastructure and services.

Businesses and consumers are increasingly dependent on AI-enabled decisions and experiences that require high-performance, failsafe digital infrastructure. As owners and operators of this infrastructure, telecom operators are positioned as essential stakeholders in the AI ecosystem and are just beginning to monetize their unique assets and capabilities at scale.

“Telcos have a natural role to play as local and national AI services providers and strategic partners,” said Brian Washburn, Chief Analyst, Telco B2B Solutions. “It is early days, but the index highlights that monetization opportunities for telcos in the AI economy already extend well beyond connectivity, particularly as demand for data security and sovereign services continues to grow.”

The Omdia Telco B2B AI Monetization Index benchmarks four key dimensions:

- Infrastructure: Availability of digital assets such as fiber networks, satellites and data centers that support AI workloads.

- Portfolio: Range of commercial AI services, with a focus on B2B services.

- Ecosystem: Strength in technology and partnerships across the AI value chain.

- Regulation: Codification of legal and ethical frameworks for secure AI market interactions.

Key findings from Omdia’s wider Telco B2B AI research include:

- Telcos are moving beyond connectivity into hosting AI data centers and hardware.

- A third of global network traffic will be AI-driven in 2025, representing 10 zettabytes by year end.

- Telcos’ current $4 billion in B2B AI revenues come from high-speed connectivity, hosted hardware and platforms, and professional services.

- Small and medium-sized enterprises are a common target for telcos’ new AI services.

Omdia’s Telco B2B AI Monetization Index is published quarterly as part of the Telco B2B Solutions Intelligence Service, designed to support service providers and their partners in expanding and diversifying business-to-business revenue. Related research includes Omdia’s AI network traffic reports, which track and model global and regional network traffic growth through to 2033; revenue sizing and forecasts for telco-led B2B AI services; and B2B survey insights on current and planned AI adoption. These and other Omdia Telco B2B reports are available via subscription here.

ABOUT OMDIA

Omdia, part of Informa TechTarget, Inc. (Nasdaq: TTGT), is a technology research and advisory group. Our deep knowledge of tech markets grounded in real conversations with industry leaders and hundreds of thousands of data points, make our market intelligence our clients’ strategic advantage. From R&D to ROI, we identify the greatest opportunities and move the industry forward.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250724724137/en/

“Telcos have a natural role to play as local and national AI services providers and strategic partners,” said Brian Washburn, Chief Analyst, Telco B2B Solutions.

Contacts

Fasiha Khan- fasiha.khan@omdia.com