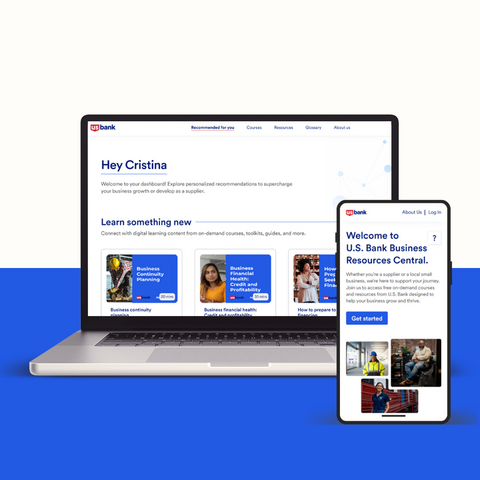

U.S. Bank has launched a new online education platform called U.S. Bank Business Resources Central that provides educational courses and other tools to help small business owners run and grow their businesses. The platform, which is free, is designed to help U.S. Bank clients and non-clients, as well as small businesses that are suppliers to the bank.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250728750734/en/

U.S. Bank Business Resources Central, which is free, is designed to help U.S. Bank clients and non-clients, as well as small businesses that are suppliers to the bank.

The new resource hub aligns with a commitment at U.S. Bank to support small businesses, which are a driving force in the economy and a vital source of employment. As part of this effort, U.S. Bank offers business access advisors in more than a dozen markets around the country, helping small business owners get access to expertise, connections, and funding resources to fuel the growth of their businesses. The bank also has procurement specialists who help small businesses that may want to become vendors to the bank.

"Small businesses are vital to the U.S. economy," said Shruti Patel, chief product officer for business banking at U.S. Bank. "We aim to support them with access to capital and financial education. Our new private learning platform offers essential resources, and our team will work closely with business owners for any follow-up assistance."

The hub was created in collaboration with Next Street, a firm that provides training and other solutions for small businesses. Small businesses can create free accounts to access courses on topics such as “business continuity planning” and “how to prepare to seek financing.” There are also links to U.S. Bank resources such as product pages and Financial IQ articles.

“Small business suppliers often struggle with access to the right networks and getting good advice to help them succeed,” said Craig McKenney, chief procurement officer at U.S. Bank. “Now our business access advisors and procurement specialists can direct those small business suppliers to a private learning platform, which has resources to help them.”

In working with Next Street, U.S. Bank is collaborating with an organization that provides end-to-end solutions — from ecosystem assessments and strategies to resource platforms and accelerators — that propel small businesses in their communities and supply chains.

“Next Street is dedicated to helping every small business realize its potential,” said Next Street CEO Charisse Conanan Johnson. “Small businesses make critical contributions, from spurring innovation to creating jobs, within local communities and supply chains. In doing so, small businesses propel new economic growth across the nation. Next Street is proud to partner with U.S. Bank on a new resource hub to ensure small businesses have access to the experts, networks, and capital they need to reach their dreams.”

To learn more about the platform, visit usbank.nextstreet.com.

Disclosures

Investment and insurance products and services including annuities are:

Not a deposit • Not FDIC insured • May lose value • Not bank guaranteed • Not insured by any federal government agency.

U.S. Bank and its representatives do not provide tax or legal advice. Your tax and financial situation is unique. You should consult your tax and/or legal advisor for advice and information concerning your particular situation.

Loans and lines of credit are offered by U.S. Bank National Association. Deposit products are offered by U.S. Bank National Association. Member FDIC.

About U.S. Bank

U.S. Bancorp, with approximately 70,000 employees and $686 billion in assets as of June 30, 2025, is the parent company of U.S. Bank National Association. Headquartered in Minneapolis, the company serves millions of customers locally, nationally and globally through a diversified mix of businesses including consumer banking, business banking, commercial banking, institutional banking, payments and wealth management. U.S. Bancorp has been recognized for its approach to digital innovation, community partnerships and customer service, including being named one of the 2025 World’s Most Ethical Companies and one of Fortune’s most admired superregional banks. Learn more at usbank.com/about.

About Next Street

For more than 20 years, corporations, governments, and philanthropies have hired Next Street to strengthen the small businesses they rely on. As a firm, Next Street provides end-to-end solutions — from ecosystem assessments and strategies to resource platforms and accelerators — for their clients to propel the small businesses in their communities and supply chains. Next Street solutions ultimately help small businesses, whether they are solo entrepreneurs or advanced suppliers, to unlock new revenue, build wealth, and reinvest in their communities.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250728750734/en/

"Our new private learning platform offers essential resources, and our team will work closely with business owners for any follow-up assistance," said Shruti Patel, chief product officer for business banking at U.S. Bank.

Contacts

Rick Rothacker, U.S. Bank Public Affairs and Communications

richard.rothacker@usbank.com

Katie Beach, Next Street

kbeach@nextstreet.com