HazardHub Provides High-Resolution Insights Into Hurricane Risk and Storm Surge

Following an intense hurricane season in 2024, experts are projecting above-average storm activity this year. According to forecasts from NOAA and North Carolina State University (NCSU), warmer-than-average Atlantic waters and shifting El Niño–Southern Oscillation (ENSO) conditions will contribute to heightened risk across key coastal states. In response, insurers and communities can rely upon high-resolution insights from Guidewire HazardHub to better understand which properties and communities are most vulnerable to hurricane wind and storm surge.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250729589638/en/

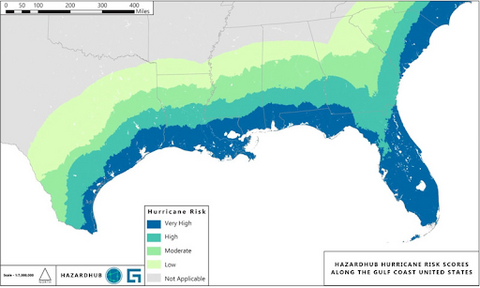

HazardHub U.S. Hurricane Risk Map highlights hurricane risk exposure based on historical storm paths, surge zones, and property vulnerability.

The 2024 Atlantic hurricane season saw 18 named storms, 11 hurricanes, and 5 major hurricanes, including multiple Category 5 events. For the 2025 hurricane season, NOAA forecasts 19 to 25 named storms, 7 to 11 hurricanes, and 3 to 6 major hurricanes (Category 3+). Colorado State University predicts a 125% increase in activity over historical averages. Warmer Atlantic sea surface temperatures and climate patterns, specifically the expected transition to neutral ENSO conditions in August, drive these forecasts.

Hurricane Trends: Rising Intensity and Risk

Long-term trends underscore hurricane risks. According to the National Climate Assessment, there has been a measurable increase in the intensity and duration of North Atlantic hurricanes over the past two decades. Rapid intensification events, storms escalating from Category 1 to major hurricane strength within 24 hours, have more than doubled since the 1990s, according to AP News.

Research from NASA and other climate organizations links warming sea surface temperatures and climate risks to stronger winds, more intense rainfall, higher base sea level, and higher storm surges. While overall storm frequency has held steady, the proportion of major hurricanes (Cat 3+) has steadily increased, according to the EPA.

Guidewire HazardHub Hurricane Risk Scores offer the highest-resolution insights and visibility into hurricane vulnerability. These insights are powering smarter decisions for insurers, communities, and homeowners.

HazardHub Insights by U.S. Region

Florida: Epicenter of Hurricane Risk

- Florida has the highest overall concentration of “D” and “F” rated properties in the U.S. for hurricane vulnerability, according to the HazardHub Hurricane Risk Score.

- 3 million homes in Florida are at risk of storm surge flooding.

- 34% of all housing units in the state are vulnerable to surge flooding.

Texas: Under Increased Threat

- HazardHub identifies Texas as a high-risk state for future hurricane landfalls, with the Houston-Galveston corridor facing particularly elevated exposure.

- Approximately 5% of homes in Texas are vulnerable to storm surge flooding. Due to the state’s large population, this equates to millions of properties and residents at risk.

Gulf Coast States: Louisiana, Mississippi, Alabama

- Louisiana leads the nation in surge vulnerability, with 52% of homes at risk, approximately 910,000 properties.

- Mississippi (9% of homes at high risk) and Alabama (3%) also show significant exposure along the coast.

- These states are frequently affected by both Category 1+ hurricane activity and slow-moving, flood-producing systems.

Southeast Corridor: South Carolina, Georgia, North Carolina

- South Carolina: 21% of housing units are at risk of storm surge.

- Georgia: 4% of homes are at risk, mostly in coastal zones like Savannah.

- North Carolina: 7% of homes face hurricane-related surge threats and wind damage.

Mid-Atlantic & Northeast: Delaware, Virginia, New Jersey, New York

- Delaware: 20% of homes are exposed to storm surge.

- Virginia: 13% surge exposure rate.

While New York and New Jersey are not among the most exposed states by percentage, HazardHub flags specific coastal regions, including Long Island and the Jersey Shore, as vulnerable to surge flooding and hurricane wind damage in the event of northern-shifting storms.

Top States for Hurricane Risk

The top ten states for hurricane risk, based on the percentage of properties rated as “D” (high) or “F” (very high) risk for hurricane damage in the Guidewire HazardHub Hurricane Risk Model, are:

- Florida

- Louisiana

- South Carolina

- Texas

- Mississippi

- North Carolina

- Delaware

- Georgia

- Alabama

- Virginia

These states face the highest hurricane risk, based on factors such as the likelihood of Category 1 or stronger hurricanes, coastal proximity, and the frequency of tropical and subtropical systems.

States at Risk of Storm Surge

The percentage of housing units at risk of storm surge flooding in high-risk hurricane states, based on an 'F' rating in the HazardHub SurgeMax Storm Surge Flooding Model, are:

- Louisiana - 52%

- Florida - 34%

- South Carolina - 21%

- Delaware - 20%

- Virginia - 13%

- Mississippi - 9%

- North Carolina - 7%

- Texas - 5%

- Georgia - 4%

- Alabama - 3%

The HazardHub SurgeMax Score is designed to help assess the risk associated with storm surge events, which can be a significant threat in coastal areas, particularly during severe hurricanes.

Building Resilience

While HazardHub highlights where risks are highest, it also empowers proactive resilience. Across the U.S., many high-risk states are taking bold steps to mitigate flood threats—investing in stormwater retention systems, flood barriers, green infrastructure, and voluntary buyout programs. Leading the way are states like Louisiana, Florida, South Carolina, Virginia, and New York, each implementing measurable and innovative solutions:

- Louisiana – Coastal Master Plan: A nationally recognized blueprint that integrates levees, marsh restoration, and storm surge barriers. One standout example is the Barrier Island and Ridge Restoration initiative, which rebuilds protective natural features using dredged sediment to strengthen defenses against hurricanes and coastal erosion.

- Florida – Resilient Coastlines Program: Provides grants to support vulnerability assessments and infrastructure adaptation. The Adaptation Planning Grant Program helps communities design and implement projects such as stormwater management systems and shoreline stabilization to reduce flood risk.

- South Carolina – Office of Resilience (SCOR): Coordinates statewide efforts to manage floodplains, upgrade infrastructure, and reduce community risk. A key initiative is the Voluntary Buyouts Program, which acquires flood-prone properties and converts them into open green spaces that absorb floodwaters and reduce future losses.

- New York – NY Rising and Resiliency Institute: Created in response to Hurricane Sandy, this initiative led to citywide zoning reforms that support flood-resilient construction. Notably, new codes enable the elevation of buildings and promote the use of flood-resistant designs in vulnerable coastal zones.

AboutHazardHub

HazardHub is an advanced property risk assessment solution from Guidewire that equips insurers with the highest resolution insights on wildfires, floods, earthquakes, hailstorms, hurricanes, and other perils. HazardHub provides access to more than 1,000 data points and 50 peril scores for every property across the United States, as well as property risk data for more than 20 countries across the Americas, Europe, and the Asia-Pacific region. For more information, visit the HazardHub page.

About Guidewire

Guidewire is the platform P&C insurers trust to engage, innovate, and grow efficiently. More than 570 insurers in 42 countries, from new ventures to the largest and most complex in the world, rely on Guidewire products. With core systems leveraging data and analytics, digital, and artificial intelligence, Guidewire defines cloud platform excellence for P&C insurers.

We are proud of our unparalleled implementation record, with 1,700+ successful projects supported by the industry’s largest R&D team and SI partner ecosystem. Our marketplace represents the largest solution partner community in P&C, where customers can access hundreds of applications to accelerate integration, localization, and innovation.

For more information, please visit www.guidewire.com and follow us on X (formerly known as Twitter) and LinkedIn.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250729589638/en/

Contacts

Melissa Cobb

Director, Public Relations

Guidewire Software, Inc.

+1.650.464.1177

mcobb@guidewire.com