New data from Omdia has revealed notable momentum for two key TV operating system platforms in the North American TV Sets market during 1Q25. Vizio CastOS showed significant growth shipping 1.2 million units, an increase of 40.4% year-over-year (YoY). In parallel, Amazon FireTV sets increased by 21.5% year YoY to reach 1.2 million units. Overall North American TV set shipments reached 9.8 million units, representing a modest 0.55% YoY growth. Globally, TV set shipments increased by 2.4% YoY to 47.5 million units, with Latin America showing the fastest growth rate (up 9.17% YoY), followed by China (up 3.25% YoY).

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250708293325/en/

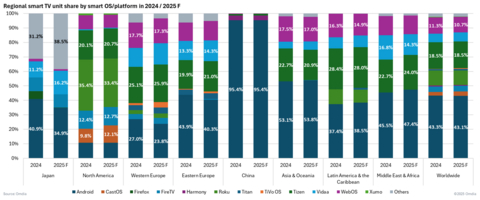

Regional smart TV unit share by smart OS/platform in 2024 F

According to Omdia’s latest TV Design and Features Tracker - Forecast - 1Q25, the competition in the TV market is increasingly focused not only on hardware features but also the battle between operating system platforms. The North American market is uniquely positioned, with major retailers now actively investing in owning and controlling TV operating systems. Companies such as Amazon and Walmart view TV OS platforms as strategic tools to deliver targeted advertising directly into consumers’ living rooms, driving further ecommerce sales on their respective platforms.

Walmart made headlines with its acquisition of Vizio, announced in February 2024, and finalized in December of that year. Following the acquisition, Walmart has aggressively expanded sales of Vizio TVs with the company recently announcing their intention to introduce the VIZIO operating system on Walmart’s onn TVs. Omdia forecasts Vizio CastOS to grow by 25.8% YoY for the full year of 2025, reaching 6.0 million units, up from 4.8 million in 2024.

Patrick Horner, Practice Leader, TV Set Research at Omdia commented, “We forecast that Vizio CastOS will reach a 12.0% unit share of the North American market by the end of 2025, up from 9.7% in 2024. During the same period of 2025 Amazon FireTV is projected to maintain a slight edge above Vizio CastOS with a 12.6% market share, rising from 12.3% in 2024.”

In the first quarter of 2025, the average selling price of Vizio TVs declined 9.6% to $227, compared to $251 in 1Q24. In contrast, the overall selling price for TVs in North America increased by 2.0% over the same period, from $401 in 1Q24 to $409 in 1Q25. With 29% of US TV consumers ranking price as the most important factor when purchasing a TV, Walmart's well-established value-driven strategy is effectively leveraging price leadership to expand Vizio CastOS’ unit share.

Horner added, “Retailer owned TV brands are beginning to challenge traditional TV manufacturers in the value-priced $200-300 segment. Walmart’s Onn brand and Vizio TV have increasingly competitive pricing, putting pressure on established market players. Meanwhile, Chinese TV set manufacturers such as TCL and Hisense are strategically shifting their focus toward more premium segments priced at $1,000 and above. They are ramping up mass production of extra-large LCD TV sets, supported by advanced technologies like Mini-LED backlights and quantum dots to deliver enhanced picture quality.“

About Omdia

Omdia, part of Informa TechTarget, Inc. (Nasdaq: TTGT), is a leading technology research and advisory group. With deep expertise in technology markets, grounded in insightful conversations with industry leaders and supported by hundreds of thousands of data points, Omdia's strategic market intelligence is our clients' competitive advantage. From R&D to ROI, we identify the most promising opportunities to drive the industry forward.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250708293325/en/

Contacts

Media contact:

Fasiha Khan – Fasiha.khan@omdia.com