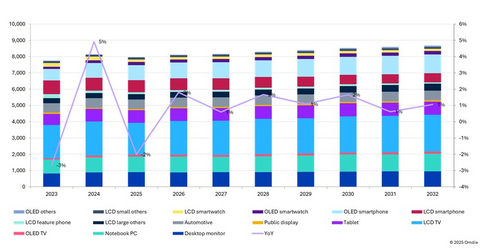

Global shipments for Display Driver ICs (DDICs) are projected to experience a 2% year-on-year (YoY) decline in 2025, followed by a modest recovery with 2% YoY growth in 2026, according to Omdia’s latest Display Driver IC Market Tracker.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250909479249/en/

Figure 1: DDIC yearly demand forecast by application. Source: Omdia

Large-Area DDICs: TV Market Declines While IT Segment Grows

Shipments for large-area DDICs are forecast to decline by a slight 0.5% YoY. This is driven by contrasting trends in their main segments:

- LCD TV Segment: Accounting for 40% of the large-area market, DDIC demand is expected to fall by 6.6% YoY. This is largely due to the increasing adoption of more efficient dual-rate driving (DRD) and triple-rate driving (TRD) technologies, even as panel shipments see a smaller decline of 0.7% YoY.

- IT Applications: In contrast, DDIC shipments for IT applications are estimated to increase by 3% YoY.

Small & Medium-Area DDICs: Smartphones Dip While Smartwatches Fall

Projections for small and medium-area DDIC shipments show a more significant decrease of 5% YoY:

- Smartphone Segment: Demand is expected to decline by a slight 1% YoY decline, as a 4% growth in AMOLED smartphone DDICs is offset by a 7% drop in LCD smartphone DDICs.

- Smartwatch Segment: Demand is anticipated to decline sharply for LCD smartwatch DDICs, falling by 28% YoY.

- Other Segments: While tablet PC and automotive panel sizes are growing, the demand for sizes 9 inches and below (categorized as small/medium) is decreasing.

“The 2025 decline is driven by two key factors: technology and economics,” said Queenie Jiang, Senior Analyst at Omdia. “While the increasing adoption of more efficient dual and triple-rate driving is reducing DDIC demand in the large-display sector, the overall consumer electronics market faces an uncertain outlook due to unstable tariff policies and challenging global economic conditions.”

Looking ahead to 2026, the market is expected to rebound. LCD TV panel shipments are forecast to increase by 1% YoY, while the penetration of 4K LCD panels will increase from 61% in 2025 to 66% in 2026. As a result, shipments of LCD TV DDICs will likely grow by 6% YoY, despite the continued adoption of DRD and TRD. Conversely, shipments of DDICs for IT applications, LCD smartphones, and LCD smartwatches are anticipated to decline. As a result, global DDIC shipments are projected to experience modest growth, increasing by 2% YoY in 2026.

ABOUT OMDIA

Omdia, part of Informa TechTarget, Inc. (Nasdaq: TTGT), is a technology research and advisory group. Our deep knowledge of tech markets grounded in real conversations with industry leaders and hundreds of thousands of data points, make our market intelligence our clients’ strategic advantage. From R&D to ROI, we identify the greatest opportunities and move the industry forward.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250909479249/en/

“The 2025 decline is driven by two key factors: technology and economics,” said Queenie Jiang, Senior Analyst at Omdia.

Contacts

Fasiha Khan: fasiha.khan@omdia.com