US Bank has continued to be the consistent top performer in the Touchpoint Group Global Engaged Customer Score™ (ECS) Banking App Rankings across nearly every measurement.

The September ECS rankings are out, and with a score of 4.75 out of 5 US Bank has continued to lead the way globally according to Touchpoint Group’s analysis of over 100,000 submissions of customer feedback and ratings on banking apps.

US Bank is the clear leader in the four core customer feedback metrics of Security, User Interface, Reliability, and Features.

Touchpoint Group’s ECS ranking charts show the relative performance of each bank compared to their main competitors looking across the US and UK markets. Customer review data is sourced from the mobile app stores run by Apple and Google. The results reflect directly what banking customers are sharing.

US Tier 1 Banks

In this top tier market segment, US Bank and Capital One continue to dominate the customer ranking scores month-on-month. However, US Bank is beginning to increase the gap at the top of the ranking table which may be causing Capital One some concern.

At first glance Truist’s app ranks well overall and improvement of their Engaged Customer Scores can be seen, with a rise from 2.2 in February to 3.8 in September. This indicates that many of the teething issues of the recent merger of BB&T and SunTrust have been addressed. However, issues highlighted relate to problems with the check features, and a problematic issue of customer’s account balances being incorrect, or not matching up to what people expect.

Not only are the aforementioned issues frustrating for customers. Additionally, a key component is that they have a cohort of new customers acquired through the merger who not only have had to get used to the new app (and some of its interface shortfalls). For these customers matters have been made even worse as they have lost some of the features they were previously using.

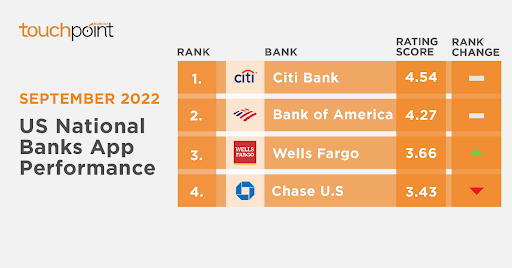

US National Banks

CitiBank and Bank of America are also consistent in their top-tier status in the ECS rankings while Chase has dropped behind Wells Fargo. Chase has been consistently jumping up-and-down indicating their approach is one where they focus on immediate problems as they arise rather than looking to address the bigger problem(s) behind the issues affecting their app.

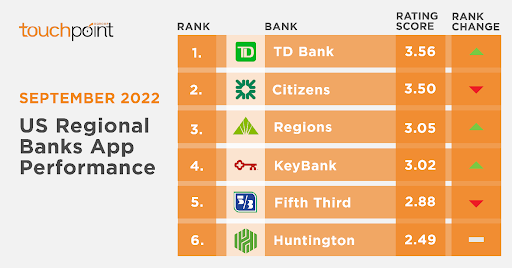

US Regional Banks

Fifth Third Bank has experienced a drop across time, and are currently sitting at the lowest point to date within the last 12 months.

The drop and subsequent movement in the scores is predominantly affecting Android users. Authentication issues such as logging in rose to 18% by September, equating to nearly 1 in 5 Fifth Third customers talking about authentication problems in their banking app.

Tony Patrick Head of Customer Intelligence at Touchpoint Group states “Connected to this problem we are seeing a massive increase in Reliability issues, now more than triple the level from July. It comes as no surprise that technical issues have more than tripled from 11% up to 35%, so more than a third of customers are talking about some sort of technical issue.

All in all, it is not very good for Fifth Third to have issues across the board. They will need to pick their act up swiftly to address the issues pertaining to version 3.65.3.”

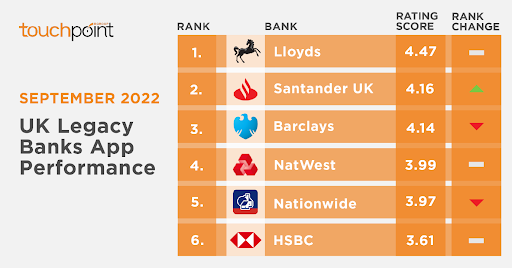

UK Legacy Banks

Previously Barclays enjoyed a good position within the UK Legacy bank category - competing well with the better performers. Since June Barclays has been slipping downwards and has not managed to turn things around. Barclays, as at September 2022, is sitting at the lowest ranking they have been at all year.

Touchpoint Group’s analysis identifies ‘Reliability’ and ‘Security & Authentication’ as the main areas affected by problems due to the most recent Android version of the app.

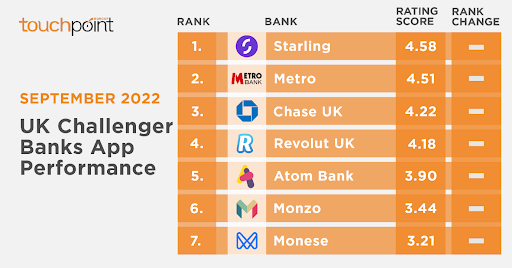

UK Challenger Banks

Looking at the ECS movement over the past year, Monzo has been up and down, however since July 2022 they have been on a steady decline, from 3.8 to now sitting at 3.4.

This indicates that there is a consistent feeling of customer dissatisfaction - which is likely to be affecting churn rates. One of the big problem areas coming through in the data for Monzo is feedback around fraud. This theme has a strong weighting,and comes up in a variety of ways with customers complaining about how Monzo deals with this issue.

Annually Touchpoint Group analyses over 1 million independent customer reviews and app scores in the iOS App Store and Google Play Android App Marketplace. Touchpoint Group leverages their proprietary AI text analytics platform, Ipiphany to provide insights to the banking industry.

For further banking industry insights and in-depth analysis of each banking app market sector view the Touchpoint Group Insights sessions

Media Contact

Company Name: Touchpoint Group

Contact Person: Brendan Bishop

Email: Send Email

Country: New Zealand

Website: https://www.touchpointgroup.com/webinars