illio, a wealth analytics app that brings efficiency to portfolio analytics is opening its doors to individual investors. After a successful launch with Interactive Brokers, and following years of success in the B2B world, illio opens its proprietary Insights to the everyday investor.

Built on the back of illio's successful institutional business, illio aims to break down the complexity of portfolio analytics and give individual investors an easy to understand and clear way to track and understand their investments.

illio's mission is to help the modern investor think like a wealth manager without the hefty price tag – which is why they are offering their monthly subscription at $10pm (not including local taxes).

This week illio, the tool that helps wealth analytics make sense to everyone, is announcing a new channel for distribution of its enterprise software – direct to consumers. The launch comes on the heels of the successful introduction of its program to individual investors with Interactive Brokers earlier this year.

Built on the back of illio's successful institutional business, illio aims to break down the complexity of portfolio analytics and give individual investors an easy to understand and efficient way to track their investments.

The rise of mobile apps like Robinhood and Webull have made it easier for younger generations to invest in the stock market with little to no fees. However, whilst 64% of millennials are willing to pay more for personalised investing products and services*, current consumer portfolio analytics fall short of those provided to professionals.

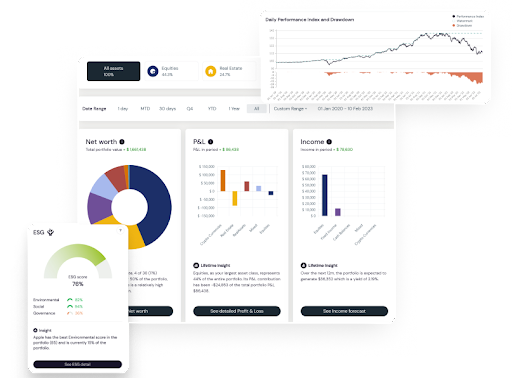

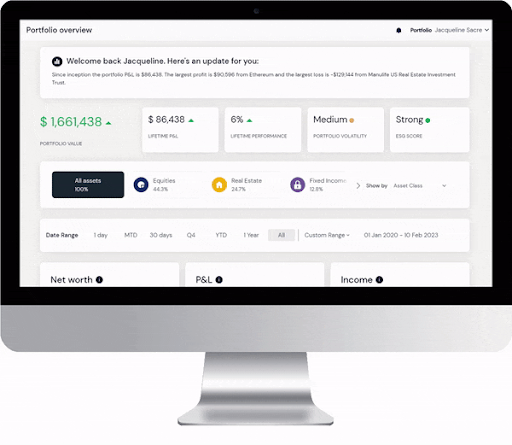

Illio, provides users with the Insights they need to make sense of their finances and take control of their future. The app offers a simple, user-friendly interface that makes it easy for individual investors to track all listed, unlisted and digital assets, condense what they need to know about their portfolio and help them learn what is likely to drive future performance.

In 2030, up to 80% of new wealth-management clients will want to access advice in a Netflix-style model - that is, data -driven, hyper personalised, continuous, and, potentially, by subscription, says McKinsey in their latest report On the Cusp of Change. And with approximately $15trn of wealth transferring to Millennials and Gen Z over the next few years, this is not a surprising statistic.

“illio is more than a wealth tracker. We wanted to provide investors with clear, actionable insights that make their investing analytics easier” says CIO and co-founder Sarang Karkhanis. “It’s not about aggregating data and spitting it out, but utilizing years of experience and know-how, to bring to the fore, the most important part of each individual portfolio. We wanted to help individual investors think like wealth managers, and our app does just that.”

illio's monthly subscription starts at $10pm (not including local taxes) for individual investors, and users will get access to the full analytics system, as well as personalized Insights across their portfolio, including net worth, P&L, risk, performance and income.

For further information, please contact Sofia Sacre at sofia@illio.com.

About illio:

Launched in 2019, illio is the brainchild of Vanessa Gibson. After 35 years running her own award-winning hedge fund and a family office, she realised the younger generation were investing in assets which went far beyond traditional stocks and bonds and that existing tools were not sufficient to support the growing needs of new investors.

With illio, people can connect to the largest brokers, trading platforms, private banks and digital wallets to track listed, unlisted and digital assets. illio’s existing B2B platform offers wealth managers & family offices the opportunity to work with their clients and share clear analytics & Insights across their portfolios.

illio already has $3.6bn assets analysed on the platform.

The new launch will open up illio’s algorithm, Insights and jargon free analytics to the every-day individual investor.

Check out illio’s website on: illio.com or subscribe to a free trial on https://app.illio.com/join

Media Contact

Company Name: Illio

Contact Person: Linnea Ekholm

Email: Send Email

Country: United States

Website: https://www.illio.com/individual-investor