On December 29, the 2024 China Cultural Industry IP Influence Report was officially released during the Shenzhen Forum of Renmin University of China 2024 – Forum Culture Policy in Shenzhen, China. The report was compiled by the Creative Industry and Technology Research Institute of Renmin University of China.

The report highlights works created or adapted between January 2023 and September 2024, spanning various formats such as novels, anime, TV series, films, games, and offline derivatives. It reveals the Top 50 Cultural Industry IPs of 2024, with Joy of Life, Black Myth: Wukong, Soul Land, Three-Body, and Battle Through the Heavens occupying the top five spots.

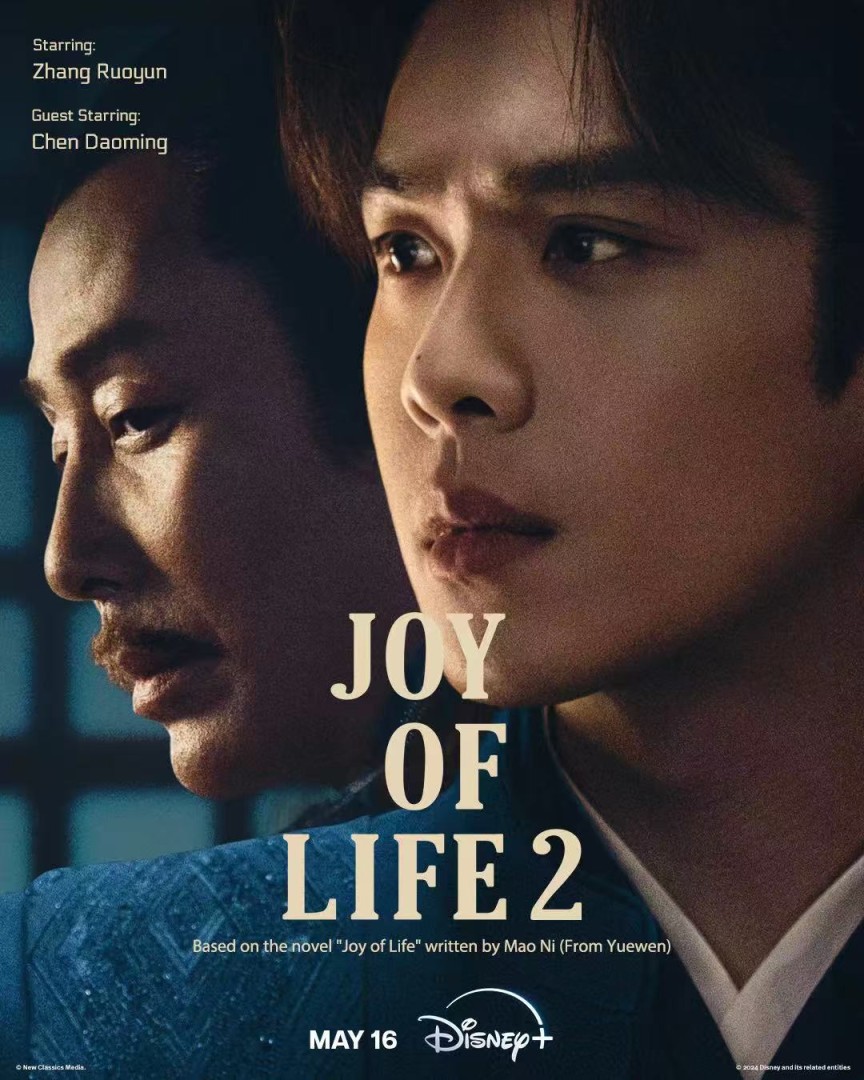

The number one IP on the list is Joy of Life, a novel originally published on Qidian, a platform under Yuewen. In November 2024, the novel was added to the British Library’s collection. It has been translated into multiple languages, including English, Korean, and Indonesian. The live-action TV adaptation, which has aired two seasons, ranks 13th and 17th on MyDramaList, one of the world’s largest TV rating sites. The second season became the highest-rated Chinese drama ever on Disney+ and is currently being translated into 14 languages for international release.

Black Myth: Wukong, a game developed as China’s first AAA title, claims the second spot. With over 23 million copies sold on Steam, the game has generated more than $1.01 billion in revenue. It has also won prestigious awards, including the 2024 Golden Joystick Award for Game of the Year, Best Visual Design, and TGA 2024’s Best Action Game.

According to the report, more than 40% of the top 50 IPs come from online literature, cementing it as the largest source of cultural IP in China. Over recent years, China has built a highly advanced IP industry chain, with online literature being adapted into print, audiobooks, anime, TV series, films, games, and various other derivatives. This expansion has significantly boosted the commercial value of these IPs, fueling the growth of China’s IP licensing market.

The 2024 Global Licensing Market Report released by the Licensing International in July shows that China’s retail sales of licensed products and services reached $13.77 billion in 2023. This marks the first time China has surpassed Germany, making it the world’s fourth-largest licensing market, behind only the U.S., the U.K., and Japan.

This trend is also reflected in 2024 China Brand Licensing Industry Development White Paper, published by the China National Light Industry Council and the China Toy & Juvenile Products Association. According to the report, by 2023, the proportion of domestically licensed IPs in China had surpassed that of Europe and the U.S. for three consecutive years, making China the largest source of IPs for licensing.

As China’s IP licensing market matures, the cultural industry is increasingly intersecting with sectors like technology, tourism, and consumer goods. For example, the concept of “gaming-inspired travel” has emerged as a new trend in tourism. Several real-world locations featured in Black Myth: Wukong have become popular tourist attractions, with related videos on Bilibili, China’s well-known video danmaku (bullet screen) platform, amassing over 10 billion views.

Media Contact

Company Name: Yuewen

Contact Person: Dave Dai

Email: Send Email

Phone: +86-021-61870500

City: Shenzhen

Country: China

Website: www.yuewen.com