As China’s innovation-driven economy accelerates, venture capitalists with both vision and resilience are playing an increasingly pivotal role behind the scenes. Among them, Fang Gang, Founder and Chairman of Cybernautea Capital, has been recognized by Caijing Magazine as one of the “Top 50 Global Chinese Venture Capitalists” in its latest 2025 ranking.

The honor coincides with another milestone for Cybernautea Capital: the successful IPO of AI unicorn Unisound (HKEX: 09678), which debuted on the Hong Kong Stock Exchange as the market’s first AGI (Artificial General Intelligence) stock—further reinforcing the firm’s reputation as a consistent backer of next-generation deep-tech ventures.

Recognizing Leadership in Capital and Innovation

Published annually by Caijing, the “Top 50 Global Chinese Venture Capitalists” list highlights individuals who are reshaping global industries through investment, strategy, and innovation. Evaluation criteria include fund performance, IPO activity, global footprint, and contributions to economic development and technological progress.

This year’s list features high-profile figures from across the venture landscape, including leading partners from ZhenFund, Shunwei Capital, and former Alibaba CEO Wei Zhe. Fang Gang was selected for the “Trailblazers” category, reflecting his influence in China's fast-growing tech investment scene.

Cybernautea Capital, under Fang’s leadership, has grown into a leading private equity firm with over RMB 30 billion in assets under management. The firm manages 26 funds, operates 10 fully controlled subsidiaries, and invests more than RMB 2 billion annually—placing it firmly among China’s top-tier VC institutions.

A Strategic Pivot: From Silicon Valley to China’s Industrial Transformation

Cybernautea Capital ’s roots trace back to Silicon Valley in 2005, where Fang Gang co-founded Cybernaut Investment Group alongside Zhu Min, launching a $250 million USD fund focused on U.S.-China technology ventures. The firm achieved early success with investments in companies like Spreadtrum, Focused Photonics, iFlytek, and WeDoctor.

Recognizing the momentum of China’s innovation economy, Fang returned to China in 2015 to launch Cybernautea Capital with a focus on RMB-denominated funds and domestic strategic industries. The firm’s debut RMB fund, SaiRun Fund (RMB 700 million), was followed by several government-backed industrial funds in cooperation with the NDRC and provincial finance departments.

Cybernautea Capital quickly established a model combining public-private capital, industrial clusters, and policy support—empowering regional ecosystems across the Yangtze River Delta, Henan, Guangdong, and beyond.

Backing China’s Deep-Tech Breakthroughs with Capital and Conviction

Fang Gang’s investment philosophy centers on “capital with vision and empathy.” Beyond returns, Cybernautea Capital seeks to help Chinese deep-tech companies break through longstanding technical barriers—particularly in sectors such as industrial software, aerospace, new energy, and AI.

One example is Huatian Software , a struggling domestic CAD and PLM developer, once on the brink of collapse due to foreign market dominance. Cybernautea Capital invested RMB 50 million and guided the company through resource integration, R&D reinforcement, and long-term strategy. Today, Huazhong has become the largest industrial software provider in China and the only local firm offering a full suite of self-developed CAD/PLM solutions.

Cybernaut’s portfolio also includes:

- LandSpace, a leading private aerospace firm specializing in LOX-methane rockets

- Zony Energy, a sodium-ion battery innovator shaping the next frontier in energy storage

- LianLian Pay, Meiri Interact, Yejuyiliao, and other rising stars in digital infrastructure and healthcare tech

Each of these investments reflects Cybernautea Capital ’s commitment to being a long-term partner—not just a capital provider.

Investing Through the Cycle: A Long-Termist’s Perspective

Fang often compares his approach to the “tortoise” in the classic race: deliberate, focused, and built to last. Internally, Cybernautea Capital maintains stringent risk protocols, including independent risk review, zero tolerance for return guarantees, and a strong emphasis on regulatory compliance.

“Sometimes we walk away from short-term wins in favor of long-term integrity,” Fang said. “It’s not always the fastest path, but it’s the most sustainable one.”

The firm’s disciplined approach has garnered widespread industry recognition:

- FOFWEEKLY: Top 20 Most LP-Favored Firms in Advanced Manufacturing

- Touzijia: Best Private Equity Institution; Best Advanced Manufacturing Investor

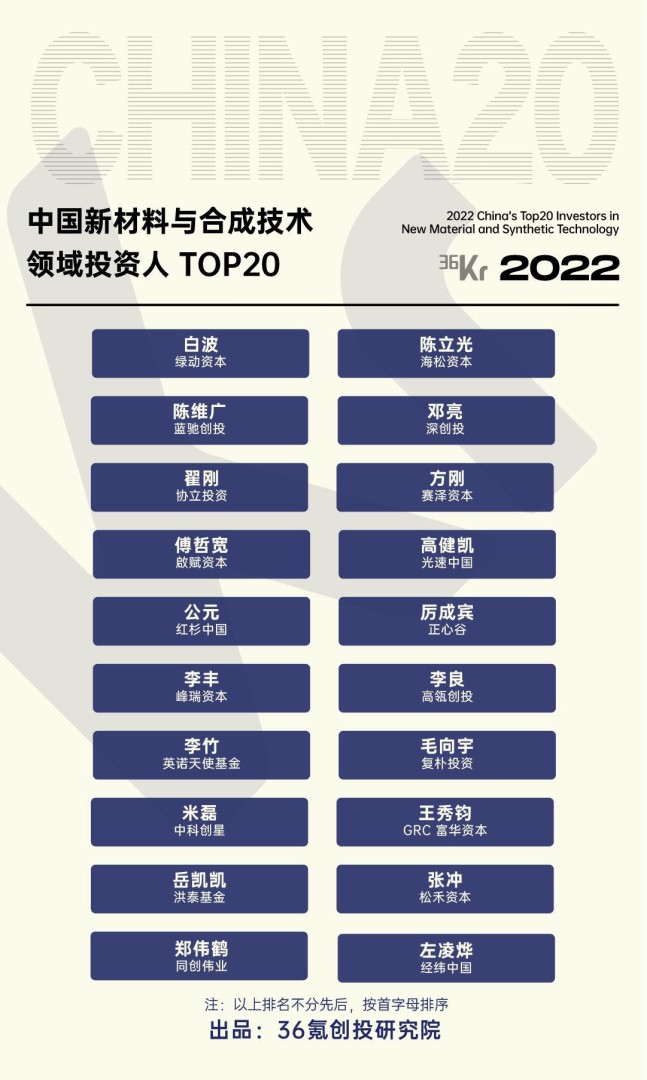

- 36Kr: “Global Chinese Power 100,” “Top 20 Investors in New Materials,” and “Top 20 in Dual-Carbon and New Energy”

In 2025, 11 of Cybernaut’s portfolio companies were named to the national “Unicorn List,” underlining the firm’s ability to identify and cultivate high-potential innovators.

Looking Ahead: Partnering with China’s Next Global Tech Champions

As China continues to climb the global innovation ladder, Cybernautea Capital is doubling down on deep-tech, clean energy, advanced materials, and AI. Fang Gang and his team remain committed to building a resilient ecosystem where capital fuels not just valuation, but long-term impact.

“We don’t just invest—we accompany innovators through their toughest moments,” said Fang. “Our goal is to be their long-term partner on the road to global relevance.”

Media Contact

Company Name: American Star News

Contact Person: Media Relations

Email: Send Email

Country: United States

Website: www.deiniolnews.com