A structured Stock Strategy is critical for consistent results in dynamic financial markets, mitigating risk associated with market volatility, and moving beyond reliance on intuition. This guide covers the process of acquiring, creating, evaluating, and applying a reliable trading framework.

1. The Foundation of a Trading Strategy

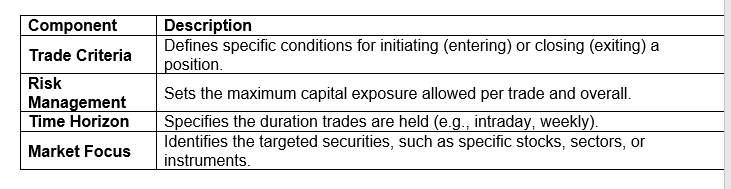

A Stock Strategy serves as a systematic plan with objective rules for key decisions, helping to minimize emotional trading.

2. Personalizing Your Trading Approach

The chosen strategy must align with your personal goals, availability, and risk tolerance. Key trading styles include:

• Day Trading: Positions are opened and closed within the same session.

• Swing Trading: Holding positions for a few days to weeks to capture medium-term price swings.

• Position Trading (Trend Following): Capturing major market trends over weeks or months.

• Scalping: Executing numerous rapid, small trades for minimal gains per trade.

3. Acquiring and Developing Strategies

Traders can obtain strategies through external resources or build them independently.

Acquiring a Strategy

• Educational Programs: Structured training offering proven methodologies.

• Signal Providers: Subscription services that deliver actionable trade alerts.

• Vetted Strategies: Publicly available methods with documented performance (backtested records).

• Mentorship/Communities: Learning from seasoned traders.

Always verify the performance history of any external strategy provider before application.

Creating a Stock Strategy

Developing a personalized strategy involves a step-by-step framework:

1 Define Objectives: Clearly establish your available time commitment, target returns, and risk appetite.

2 Select Market and Timeframe: Choose your trading universe (e.g., large-cap stocks) and the corresponding holding period.

3 Choose Analytical Tools: Base the strategy on objective analysis, typically relying on Technical Analysis (chart patterns, indicators like moving averages, RSI) or Fundamental Analysis (company financials), often in combination. Focus on a few clear indicators to prevent analysis paralysis.

4 Establish Clear Rules: Write down specific, repeatable, and objective conditions for both entry (buying/selling) and exit (profit-taking and loss-cutting).

4. Essential Risk Control

Effective risk management is the paramount factor for a strategy's sustainability.

• Position Sizing: Determine the capital to allocate per trade (e.g., limit risk to 1–2% of total capital).

• Stop-Loss Orders: Automatically limit potential losses if the market moves unfavorably.

• Risk-Reward Ratio: Ensure the potential profit justifies the potential loss (e.g., aiming for 2:1 or higher).

• Drawdown Limits: Define the maximum acceptable portfolio decline before pausing trading activities.

5. Evaluation and Implementation

Before risking real capital, rigorous testing is mandatory.

• Historical Testing (Backtesting): Apply the strategy's rules to past market data to assess performance metrics like win rate, average profit, and drawdowns.

• Simulated Trading (Paper Trading): Practice the strategy in real-time with a simulated account to confirm its practicality and your psychological response to market movements.

• Gradual Launch: Start live trading with minimal position sizes, increasing capital only as confidence and positive results grow.

• Journaling: Maintain a detailed log of trades, outcomes, and emotional state to facilitate refinement and identify recurring errors.

6. Continuous Monitoring and Adaptation

Financial markets evolve, meaning a strategy's effectiveness is not permanent. Regular performance reviews and a willingness to adapt rules to shifting market dynamics are essential for long-term success. The most successful traders refine their strategies while maintaining the core principles of discipline and risk control.