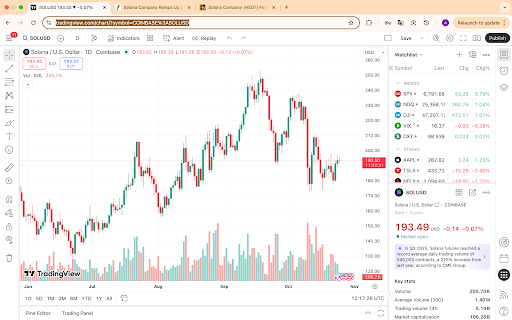

The Solana price sits near $194, but the real story is what’s happening behind the scenes. Institutional investors are now moving beyond Bitcoin and Ethereum, and Solana is quickly becoming their new favorite pick.

With Fidelity Investments adding support for Solana, big money is officially entering the picture. The shift shows that traditional finance is no longer ignoring the project’s speed, scalability, and growing adoption.

Fidelity Brings Solana to Wall Street

Fidelity, one of the world’s biggest asset managers with $5.8 trillion under management, just added Solana (SOL) to its list of supported digital assets. This means U.S. customers can now trade and store SOL directly through Fidelity’s digital platform. The move gives Solana the same institutional recognition that Bitcoin and Ethereum have enjoyed for years. Solana is now trading near $193,

Source: Tradingview

Before this addition, Fidelity only supported BTC, ETH, and LTC. By including Solana, the firm is sending a strong message that blockchain scalability and developer activity matter more than hype. For Solana, this could boost liquidity and market trust as institutions gain a compliant way to hold and trade SOL.

Public Firms Are Building Solana Treasuries

Solana’s growing appeal is not just among fund managers. HSDT, a Nasdaq-listed company, has rebranded itself as a Solana-focused treasury vehicle and now holds over 2.2 million SOL, valued at approximately $396 million, through Anchorage Digital Bank. The firm recently expanded operations by partnering with Twinstake and Helius, two top validators that handle staking for ETF and ETP products.

HSDT’s decision to double down on Solana despite its own share price collapse shows conviction. Its chairman, Joseph Chee, told Decrypt that volatility is “when conviction is tested,” adding that the company will continue to accumulate SOL when others are fearful. Meanwhile, Citadel, owned by billionaire Ken Griffin, quietly acquired a 4.5% stake in another Solana-linked firm, DeFi Development Corp., signaling rising institutional confidence.

Remittix: A PayFi Project Building the Next Institutional Bridge

While Solana attracts large treasury buyers, Remittix (RTX) is drawing attention from fintech investors for a very different reason. It is bridging crypto and global payments. The PayFi project sits at the intersection of blockchain, DeFi, and the $19 trillion global remittance market, giving it a clear use case that extends beyond speculation.

Remittix has now raised over $27.7 million and sold more than 681 million tokens, positioning it as one of the most successful payment-focused blockchain projects of 2025. It is fully verified and audited by CertiK, ranked #1 Pre-Launch Token on CertiK Skynet, and its team has completed full KYC verification. Multiple CEX listings are confirmed, including BitMart and LBank, with additional exchanges on the way.

Final Take: Institutions Want Real Utility

The wave of institutional activity around Solana proves that traditional finance is no longer sitting out the crypto revolution. With Fidelity’s backing and corporate treasuries going on-chain, Solana price predictions are looking stronger heading into Q4. But the real story might be in projects like Remittix, where blockchain meets payments and everyday use.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250K Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway