New York, USA. October 7, 2025. Bitcoin (BTC) extended its remarkable climb above $126,000, according to CoinDesk,propelled by ETF inflows, institutional buying, and a weaker U.S. dollar. Analysts describe the surge as a “perfect macro storm,” with liquidity pouring into digital assets amid growing concerns about fiscal instability and inflation. The rally also lifted Ethereum (ETH) to $4,600, Dogecoin (DOGE) by 9%, and XRP to $2.97, signaling a broad market recovery supported by real utility and global adoption.

1. Bitcoin’s Macro Surge and Market Momentum

Ethereum’s expanding smart-contract ecosystem continues to reinforce the blockchain’s dominance as developers accelerate tokenized finance and AI integrations. Institutional giants such as BlackRock and Fidelity are broadening exposure, driving adoption of digital financial infrastructure that powers cross-chain transactions and yield models.

2. The Institutional Shift Toward Digital Infrastructure

Coinbase’s “super app” strategy, unveiled last month, reflects the exchange industry’s pivot toward multi-service digital financial ecosystems. These platforms now link payments, decentralized lending, and tokenized assets through automated settlement layers, turning digital assets into fully functional components of the global economy.

3. RI Mining’s Role in the New Financial Base

RI Mining is a legal and compliant platform registered in the UK in 2014 and active in more than 190 countries, is shaping this transformation. Built on AI-optimized, renewable-powered architecture, RI Mining provides users with seamless access to the digital asset base. Its automated systems process returns every 24 hours, ensuring transparent yield generation across Bitcoin, Ethereum, and XRP.

4. Corporate Adoption and the Productivity of Assets

Tesla and other corporate adopters have demonstrated how digital assets can serve as both treasury diversification and infrastructure investment.

RI Mining extends this principle by transforming idle holdings into productive assets within the settlement layer, offering participants consistent returns without hardware or conversion costs.

- Register an Account - Access RI Mining’s official platform to connect with the digital finance base. New users receive $15 worth of electricity computing power and participate risk-free

- Activate with Digital Assets - Engage instantly by depositing BTC, ETH, or XRP, For example: $100 ÷ $2.97 ≈ 33.67 XRP - a tangible entry point that merges accessibility with real participation. (Minimum threshold contract)

- Track Daily Settlements - Yields are credited transparently within 24 hours, contributing to the settlement layer of digital finance.

- Everyone participates and everyone benefits

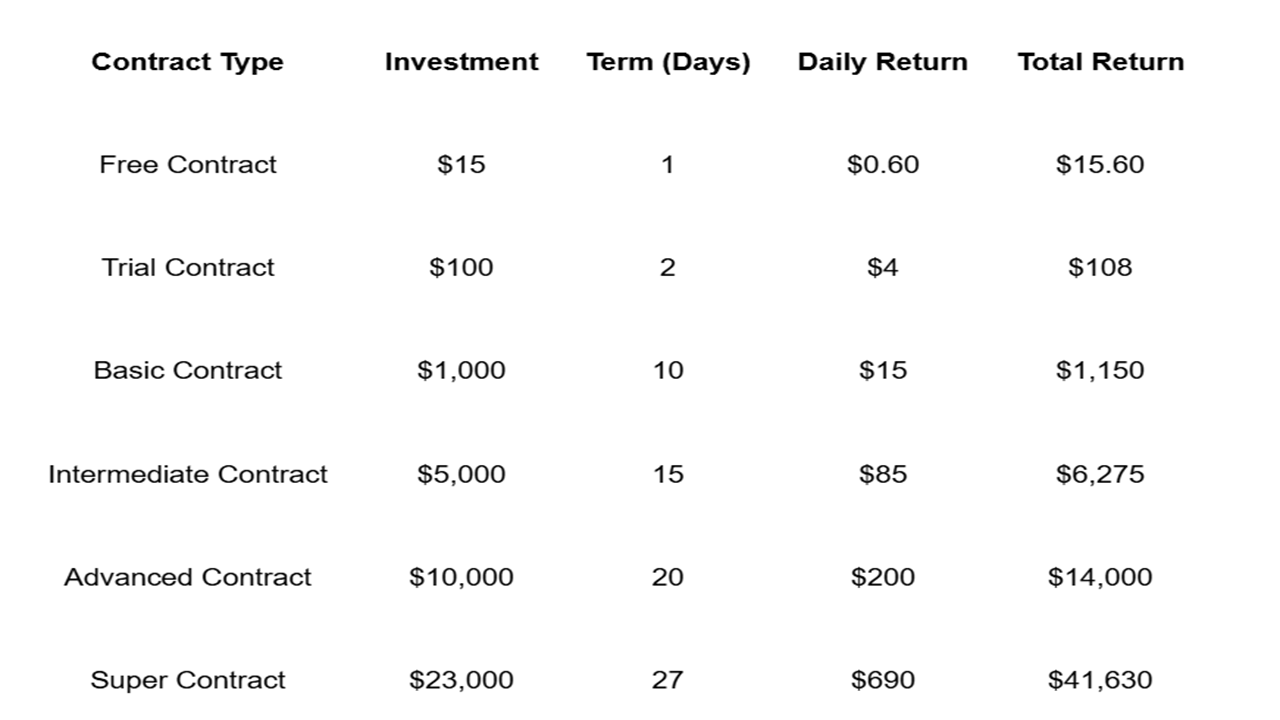

The following is a demonstration of the potential returns from the contract:

All contract profits are settled every 24 hours and can be transparently withdrawn to your own private wallet at any time - Click to view more contract lists

5. Analysts See a Structural Shift, Not a Speculative Spike

Goldman Sachs strategists emphasize that the current rally signals structural adoption rather than a temporary bubble. Platforms like RI Mining, powered by AI automation and renewable energy, have become the backbone of the digital financial infrastructure, balancing stability and profitability even under macroeconomic pressure.

6. Global Media Endorse the Infrastructure Narrative

Bloomberg Intelligence and MarketWatch report a growing consensus: the crypto rally’s true driver is infrastructure, not hype. The maturation of digital asset ecosystems-combined with real yield generation-marks the evolution from speculation to sustainable participation in the settlement layer of digital finance.

7. Visionaries Reinforce the Digital Future

Recent comments on decentralized systems have heightened optimism. The assertion that “finance will thrive on innovation, not inflation” underscores the increasing view that sustainable digital income will be a cornerstone of global wealth creation.

Click here to download the app

Summary

In a market reshaped by macro turbulence and institutional entry, RI Mining stands at the center of digital financial infrastructure-empowering participants worldwide with automation, transparency, and sustainable yield as the foundation of next-generation finance.

To learn more, visit RI Mining official website.