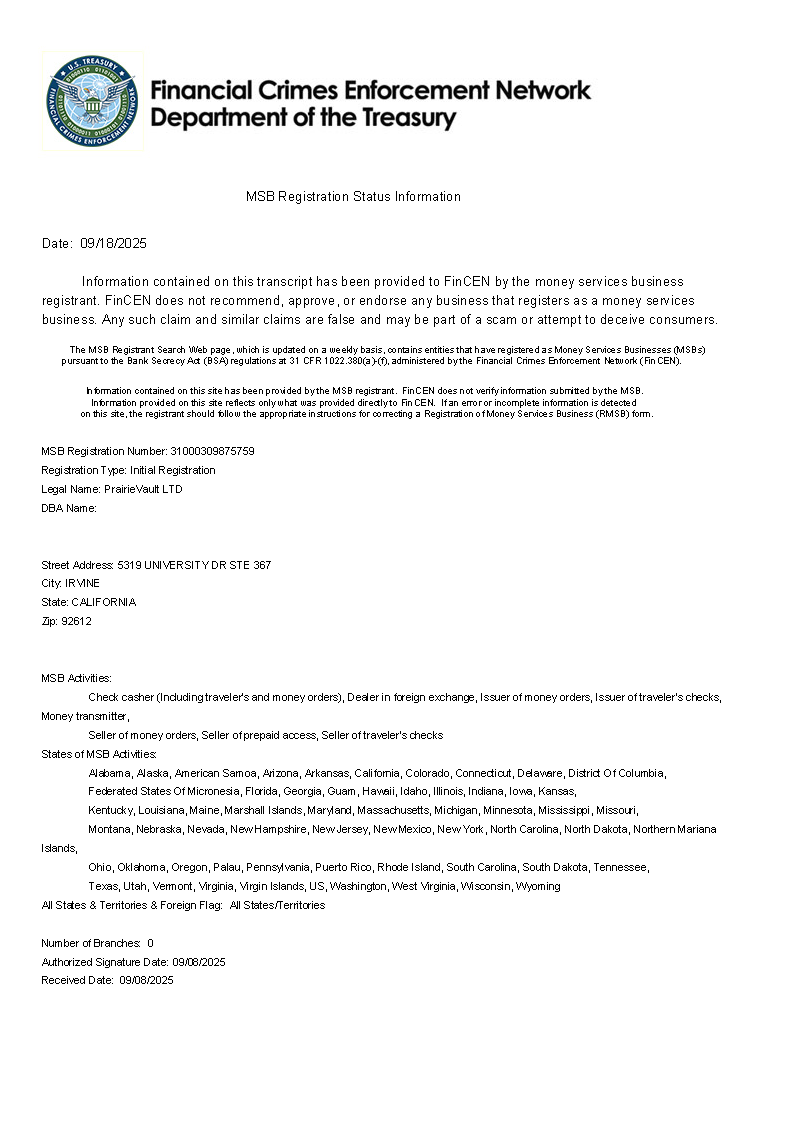

PrairieVault Exchange, a digital infrastructure platform engineered for performance, governance, and transparency, has officially confirmed its registration as a Money Services Business (MSB) with the Financial Crimes Enforcement Network (FinCEN), a division of the U.S. Department of the Treasury. This milestone affirms PrairieVault’s commitment to regulatory integrity and paves the way for broader institutional engagement in key jurisdictions worldwide.

A Critical Milestone for U.S. Regulatory Alignment

The MSB registration enables PrairieVault Exchange to operate legally within the United States as a provider of money transmission and digital asset services. Under FinCEN rules, this designation requires strict compliance with Anti-Money Laundering (AML) standards, Counter-Terrorist Financing (CFT) protocols, Know Your Customer (KYC) procedures, and verifiable record-keeping obligations.

With this regulatory foundation in place, PrairieVault Exchange reinforces its positioning as a secure, compliant, and institution-ready platform for digital asset infrastructure.

Oliver Mercer, Managing Director at PrairieVault Exchange, stated:

“This registration with FinCEN represents more than a license—it represents credibility, transparency, and a long-term vision for responsible innovation. PrairieVault is building for scale, and compliance is the architecture we build upon.”

Users can confirm PrairieVault’s MSB registration by visiting the FinCEN MSB Registration Search platform and entering “PrairieVault” in the name field.

Strengthening the Foundation for International Growth

With U.S. registration secured, PrairieVault Exchange now accelerates its global compliance strategy, including preparations for registration under the European Union’s Markets in Crypto-Assets (MiCA) framework, Hong Kong’s VASP licensing scheme, and regional approvals in the Middle East and Southeast Asia.

The MSB milestone allows PrairieVault to formalize institutional onboarding pathways, offer expanded fiat integrations, and deepen partnerships with banks, custodians, and regulatory authorities worldwide.

Oliver Mercer added:

“Global finance is rapidly converging with real-time digital infrastructure. At PrairieVault, our responsibility is to ensure that innovation moves in lockstep with accountability. This is how we earn trust—and keep it.”

Regulatory Confidence Meets Engineering Precision

PrairieVault Exchange is built to meet the rigorous standards of modern institutional trading. Alongside its compliance achievements, the platform continues to enhance its technology stack with embedded risk controls, permissioned access systems, audit-ready architecture, and jurisdiction-aware disclosure engines.

New features scheduled for release include transaction-level audit logs, enterprise-grade KYC onboarding flows, and user-configurable transparency settings for corporate accounts.

Oliver Mercer concluded:

“Our mission is to deliver infrastructure that meets the standards of tomorrow. Compliance isn’t just a requirement—it’s a competitive edge. PrairieVault stands ready to serve global users who demand clarity, security, and excellence.”

About PrairieVault Exchange

PrairieVault Exchange is a next-generation infrastructure platform designed to support institutional-grade trading, modular compliance, and secure financial connectivity. Built with a focus on intelligent risk management and scalable systems, PrairieVault serves professional traders, corporate operators, and fintech developers seeking compliant access to evolving digital markets.

DISCLAIMER:

The information in this press release is provided for general informational purposes only and should not be construed as legal, tax, investment, or regulatory advice.