How It All Started

Getmancar launched in 2018 with a simple idea: make cars available on demand, straight from a mobile app. At first, the service offered just a few dozen vehicles in Ukraine, but the concept quickly gained momentum. Within a few years, the fleet grew to more than 700 cars, and the user base reached over 350,000 people. What started as a local project is now present in multiple countries, bringing flexible mobility to different markets.

The secret to this growth is adaptability. In Ukraine, Getmancar works as a classic car sharing service, letting people pick up and drop off cars in defined zones. In countries like Romania and Germany, the company offers daily rentals that look more like traditional rent-a-car — easier for new customers to understand and more suitable for local regulations.

Going International

Georgia was the first market outside Ukraine. The service started in Tbilisi and Batumi, bringing the familiar car sharing model to local users. In Moldova, Getmancar made a bolder move: the fleet included electric cars like the Renault Zoe, Volkswagen ID.3, and BYD Dolphin. It was a clear signal that the company is ready to adapt to global sustainability trends and new customer expectations.

In 2025, the company entered Romania and Germany, but with a different approach. Instead of car sharing, Getmancar launched short-term rentals. Cars can be booked for a day or longer, and drivers are free to travel across the EU. In Romania, the fleet reached around 200 cars, covering Bucharest, Constanța, Brașov, Sibiu, and Bacău. In Germany, the company began with Berlin, Frankfurt, and Munich, where the focus is on newer, more comfortable models, with higher rates than in Romania.

Franchise and Partnerships

One of the company’s biggest strengths is its franchise model. Not all cars in the fleet belong to Getmancar itself. Many are owned by private investors or franchise partners. This allows the company to grow faster without huge capital costs, while partners benefit from the brand, technology, and support system.

The franchise approach reduces the barrier to entry for local operators. They invest in cars, while Getmancar provides the platform, marketing, and operational expertise. This flexibility means the company can adjust to local markets — in one city offering car sharing, in another focusing on daily rentals.

User Experience and Technology

For mobility services, the app is everything. If booking or payment doesn’t work smoothly, users will switch to competitors. That’s why Getmancar continues to invest in a better interface, more reliable performance, and clear pricing.

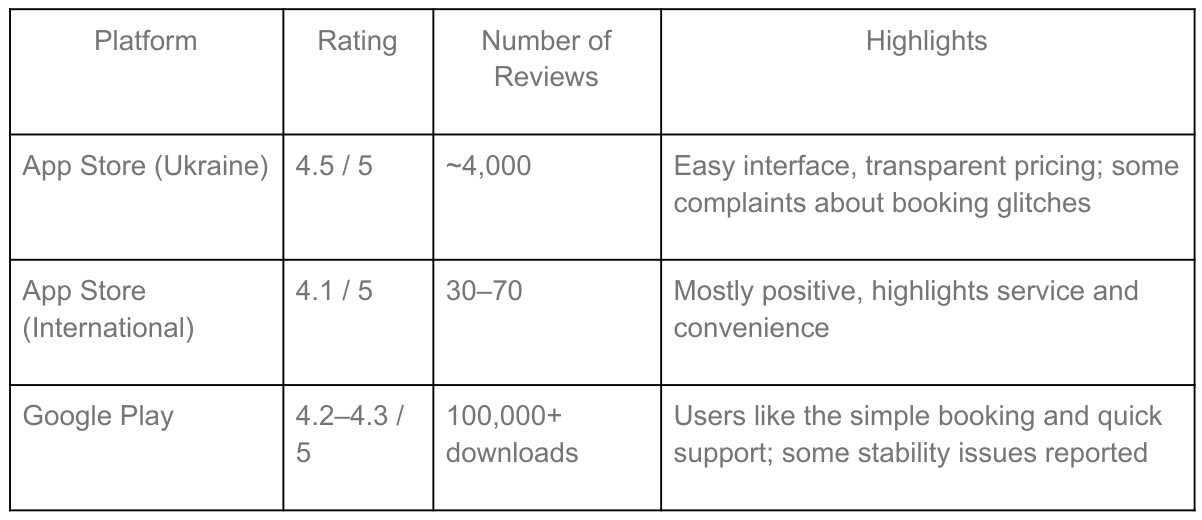

Here’s how the apps are rated in 2025:

Users like the simple booking and quick support; some stability issues reported

These ratings show that the service is well-received overall, but there’s still work to do on app stability and fast response times. On competitive markets, those details can make or break customer trust.

Challenges and Risks

Every mobility operator faces obstacles. In Ukraine, infrastructure and economic instability remain issues. In Moldova, the challenge is the lack of charging stations for electric vehicles. In Romania and Germany, the main barriers are stricter insurance rules, higher operating costs, and tougher customer expectations.

Competition is also strong. In Europe, major international players already have loyal customer bases. To stand out, Getmancar must go beyond competitive pricing. Clean cars, flexible return options, responsive support, and honest communication will be the key to long-term success.

Looking Ahead

Getmancar is actively searching for partners to expand into new countries. The franchise model and private investment approach remain central to the company’s strategy, allowing for faster scaling and reduced risk. The next step could include corporate solutions, long-term rentals for businesses, subscription models, or integration with city mobility systems.

Electric vehicles will remain a focus. With Europe pushing hard for greener transport, expanding the EV fleet could become a real competitive advantage.

The company’s future will depend on its ability to maintain service quality, strengthen its technology, and choose the right partners abroad. With a young but recognizable brand, a flexible business model, and proven experience in new markets, Getmancar has the potential to become one of the leading mobility platforms in Eastern Europe and beyond.