VANCOUVER, British Columbia, Aug. 15, 2024 (GLOBE NEWSWIRE) -- Solaris Resources Inc. (TSX: SLS; NYSE: SLSR) (“Solaris” or the “Company”) is pleased to report drill results from its ongoing 60,000m and 8-rig drilling program at its Warintza Project (“Warintza” or “the Project”) in southeastern Ecuador. Highlights are listed below with detailed results in Figure 1 and Tables 1-2.

Highlights

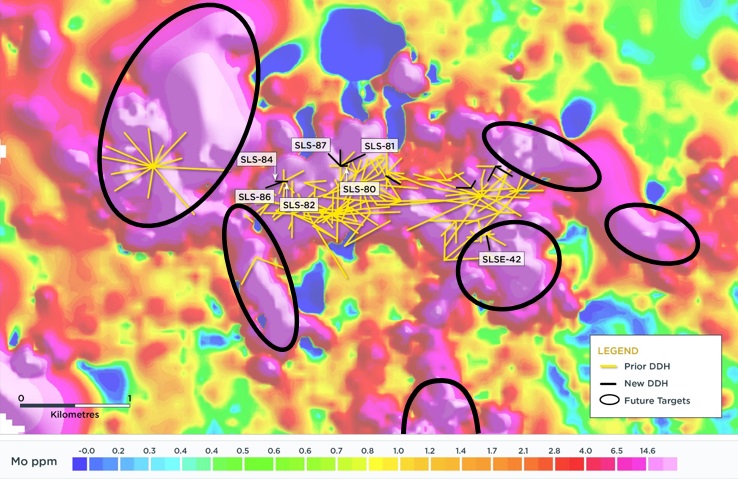

Additional drilling has extended near surface, high-grade mineralization to the north, northwest and southeast of the Mineral Resource Estimate (“MRE¹”). Ongoing drilling continues to focus on open lateral extensions of mineralization with infill drilling aimed at upgrading mineral resources and converting waste. The primary open vectors are to the northwest, southwest and to the southeast.

A series of holes from a step-out platform extended mineralization to the northwest with high-grades from near surface. Mineralization in this direction comes into contact with a tabular granodiorite unit that separates and underlies the Central deposit from Warintza West and a large, undrilled molybdenum soil anomaly to the northwest.

- SLS-86 (drilled southwest): 57m of 1.11% CuEq² within 105m of 0.88% CuEq² from near surface

- SLS-84 (drilled west): 69m of 0.82% CuEq² within 102m of 0.64% CuEq² from near surface

- SLS-82 (drilled east): 69m of 0.77% CuEq² within 249m of 0.38% CuEq² from surface

The Company has constructed a series of step-out platforms to the northwest to test the potential of this anomaly and the connection to West and Central. Drilling is underway from the first platform, approximately 1.3km northwest of SLS-86. The same approach is being taken with step-out platforms to the southwest. These represent opportunities for a major expansion of the MRE in a significantly enlarged pit.

Extensional drilling collared on the northern limit of the MRE has extended mineralization to the north, while infill drilling in hole SLS-83 has converted waste within the pit:

- SLS-87 (drilled northwest): 33m of 0.81% CuEq² within 114m of 0.38% CuEq² from surface

- SLS-81 (drilled northeast): 165m of 0.54% CuEq² within 327m of 0.33% CuEq² from surface

- SLS-80 (drilled east): 191m of 0.43% CuEq² from near surface

Extensional drilling in the southeast sector has extended mineralization to the south where it remains opens for approximately 600m within a large 0.8km x 0.8km undrilled molybdenum soil anomaly that defines the growth target in this area, with SLSE – 42 returning 300m of 0.57% CuEq² within 359m of 0.53% CuEq² from surface.

Additional drilling at Warintza East to the northeast encountered low grade mineralization in holes SLSE-37 – 43 that serve to convert undefined waste within the MRE pit shell, with further drilling planned in this direction and to the east.

Complementary district exploration efforts are underway with geotechnical drilling in the Caya-Mateo target area encountering epithermal clay alteration in the sandstone and high temperature alteration in the underlying volcanics. This drilling is expected to provide information to aid in more focused targeting efforts. Fieldwork in the emerging Celestina epithermal gold/silver area continues with the next batch of results expected soon.

Figure 1 – Warintza Drilling and Future Targets

Table 1 – Assay Results

| Hole ID | Date Reported | From (m) | To (m) | Interval (m) | Cu (%) | Mo (%) | Au (g/t) | CuEq² (%) |

| SLS-87 | Aug 15, 2024 | 0 | 114 | 114 | 0.23 | 0.02 | 0.05 | 0.38 |

| Including | 81 | 114 | 33 | 0.64 | 0.02 | 0.06 | 0.81 | |

| SLS-86 | 54 | 159 | 105 | 0.58 | 0.04 | 0.11 | 0.88 | |

| Including | 60 | 117 | 57 | 0.77 | 0.05 | 0.13 | 1.11 | |

| SLS-85 | 0 | 123 | 123 | 0.12 | 0.02 | 0.04 | 0.23 | |

| Including | 102 | 123 | 21 | 0.41 | 0.01 | 0.03 | 0.51 | |

| SLS-84 | 54 | 156 | 102 | 0.38 | 0.04 | 0.07 | 0.64 | |

| Including | 54 | 123 | 69 | 0.52 | 0.04 | 0.10 | 0.82 | |

| SLS-83 | 15 | 265 | 250 | 0.15 | 0.00 | 0.14 | 0.25 | |

| SLS-82 | 0 | 249 | 249 | 0.17 | 0.03 | 0.04 | 0.38 | |

| Including | 48 | 117 | 69 | 0.47 | 0.04 | 0.12 | 0.77 | |

| SLS-81 | 0 | 327 | 327 | 0.20 | 0.02 | 0.04 | 0.33 | |

| Including | 84 | 249 | 165 | 0.35 | 0.03 | 0.04 | 0.54 | |

| SLS-80 | 69 | 260 | 191 | 0.34 | 0.01 | 0.04 | 0.43 | |

| SLSE-43 | 0 | 295 | 295 | 0.13 | 0.01 | 0.02 | 0.18 | |

| SLSE-42 | 0 | 359 | 359 | 0.38 | 0.02 | 0.06 | 0.53 | |

| Including | 21 | 321 | 300 | 0.42 | 0.02 | 0.06 | 0.57 | |

| SLSE-41 | 0 | 258 | 258 | 0.07 | 0.00 | 0.02 | 0.09 | |

| SLSE-40 | 6 | 39 | 33 | 0.13 | 0.00 | 0.02 | 0.16 | |

| SLSE-39 | 60 | 318 | 258 | 0.19 | 0.01 | 0.04 | 0.26 | |

| Including | 60 | 102 | 42 | 0.30 | 0.01 | 0.04 | 0.38 | |

| SLSE-38 | 93 | 152 | 59 | 0.19 | 0.00 | 0.03 | 0.23 | |

| Including | 108 | 132 | 24 | 0.26 | 0.00 | 0.05 | 0.31 | |

| SLSE-37 | 153 | 258 | 105 | 0.12 | 0.02 | 0.02 | 0.23 | |

| Including | 360 | 419 | 59 | 0.11 | 0.02 | 0.01 | 0.21 |

Notes to Table 1: True widths are interpreted to be very close to drilled widths due to the bulk-porphyry style mineralized zones at Warintza.

Table 2 - Collar Locations

| Hole ID | Easting | Northing | Elevation (m) | Depth (m) | Azimuth (degrees) | Dip (degrees) |

| SLS-87 | 800198 | 9648473 | 1338 | 295 | 315 | -60 |

| SLS-86 | 799685 | 9648332 | 1374 | 251 | 250 | -50 |

| SLS-85 | 800199 | 9648475 | 1336 | 274 | 0 | -60 |

| SLS-84 | 799684 | 9648330 | 1374 | 200 | 270 | -69 |

| SLS-83 | 800621 | 9648398 | 1332 | 265 | 120 | -58 |

| SLS-82 | 799682 | 9648329 | 1373 | 302 | 90 | -85 |

| SLS-81 | 800198 | 9648471 | 1339 | 400 | 65 | -52 |

| SLS-80 | 800200 | 9648473 | 1338 | 260 | 90 | -77 |

| SLSE-43 | 801615 | 9648467 | 1104 | 296 | 210 | -60 |

| SLSE-42 | 801528 | 9647849 | 1154 | 360 | 170 | -70 |

| SLSE-41 | 801612 | 9648466 | 1105 | 259 | 120 | -50 |

| SLSE-40 | 801616 | 9648469 | 1104 | 141 | 90 | -75 |

| SLSE-39 | 801385 | 9648268 | 1244 | 318 | 270 | -67 |

| SLSE-38 | 801615 | 9648469 | 1104 | 152 | 0 | -90 |

| SLSE-37 | 801388 | 9648263 | 1243 | 419 | 30 | -80 |

Notes to table: The coordinates are in WGS84 17S Datum.

Endnotes

- Refer to press release dated July 22, 2024. NI 43-101 Technical Report to be released within 45 days of the July 22, 2024 news release and available on the Company's website and Sedar+.

- Copper-equivalence grade calculation for reporting assumes metal prices of US$4.00/lb Cu, US$20.00/lb Mo, and US$1,850/oz Au, and recoveries of 90% Cu, 85% Mo, and 70% Au based on preliminary metallurgical testwork. CuEq formula: CuEq (%) = Cu (%) + 5.604 × Mo (%) + 0.623 × Au (g/t).

Technical Information and Quality Control & Quality Assurance

Sample assay results have been independently monitored through a quality control/quality assurance (“QA/QC”) program that includes the insertion of blind certified reference materials (standards), blanks and field duplicate samples. Logging and sampling are completed at a secure Company facility located on site. Drill core is cut in half on site and samples are securely transported to ALS Labs in Quito. Sample pulps are sent to ALS Labs in Lima, Peru and Vancouver, Canada for analysis. Total copper and molybdenum contents are determined by four-acid digestion with AAS finish. Gold is determined by fire assay of a 30-gram charge. In addition, selected pulp check samples are sent to Bureau Veritas lab in Lima, Peru. Both ALS Labs and Bureau Veritas lab are independent of Solaris. Solaris is not aware of any drilling, sampling, recovery or other factors that could materially affect the accuracy or reliability of the data referred to herein. The drillhole data has been verified by Jorge Fierro, M.Sc., DIC, PG, using data validation and quality assurance procedures under high industry standards. Heliborne magnetic, LIDAR and other layers of data quality for Warintza district exploration were validated by a qualified external professional using data validation procedures under high industry standards. The data has been verified by Jorge Fierro, M.Sc., DIC, PG, using data validation and quality assurance procedures under high industry standards.

Qualified Person

The scientific and technical content of this press release has been reviewed and approved by Jorge Fierro, M.Sc., DIC, PG, Vice President Exploration of Solaris who is a “Qualified Person” as defined in National Instrument 43-101 Standards of Disclosure for Mineral Projects. Jorge Fierro is a Registered Professional Geologist through the SME (registered member #4279075).

On behalf of the Board of Solaris Resources Inc.

“Daniel Earle”

President & CEO, Director

For Further Information

Jacqueline Wagenaar, VP Investor Relations

Direct: 416-366-5678 Ext. 203

Email: jwagenaar@solarisresources.com

About Solaris Resources Inc.

Solaris is advancing a portfolio of copper and gold assets in the Americas, which includes a world class copper resource with expansion and discovery potential at its Warintza Project in Ecuador; a series of grass roots exploration projects with discovery potential in Peru and Chile; and significant leverage to increasing copper prices through its 60% interest in the La Verde joint-venture project with a subsidiary of Teck Resources in Mexico.

Cautionary Notes and Forward-looking Statements

This document contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). The use of the words “will” and “expected” and similar expressions are intended to identify forward-looking statements. These statements include statements that ongoing drilling continues to focus on open lateral extensions of mineralization with infill drilling aimed at upgrading mineral resources and converting waste, the primary open vectors are to the northwest, southwest and to the southeast of the Mineral Resource Estimate (“MRE”), the Company has constructed a series of step-out platforms to the northwest to test the potential of this anomaly and the connection to West and Central, drilling is underway from the first platform, approximately 1.3km northwest of SLS-86, the same approach is being taken with step-out platforms to the southwest. These represent opportunities for a major expansion of the MRE in a significantly enlarged pit, extensional drilling in the southeast sector has extended mineralization to the south where it remains opens for approximately 600m within a large 0.8km x 0.8km undrilled molybdenum soil anomaly that defines the growth target in this area, additional drilling at Warintza East to the northeast encountered low grade mineralization in holes SLSE-37 – 43 that serve to convert undefined waste within the MRE pit shell, with further drilling planned in this direction and to the east, complementary district exploration efforts are underway with geotechnical drilling in the Caya-Mateo target area encountering epithermal clay alteration in the sandstone and high temperature alteration in the underlying volcanics, this drilling is expected to provide information to aid in more focused targeting efforts, fieldwork in the emerging Celestina epithermal gold/silver area continues with the next batch of results expected soon. Although Solaris believes that the expectations reflected in such forward-looking statements and/or information are reasonable, readers are cautioned that actual results may vary from the forward-looking statements. The Company has based these forward-looking statements and information on the Company’s current expectations and assumptions about future events including assumptions regarding the exploration and regional programs. These statements also involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements, including the risks, uncertainties and other factors identified in the Solaris Management’s Discussion and Analysis, for the year ended December 31, 2023 available at www.sedarplus.ca. Furthermore, the forward-looking statements contained in this news release are made as at the date of this news release and Solaris does not undertake any obligation to publicly update or revise any of these forward-looking statements except as may be required by applicable securities laws.