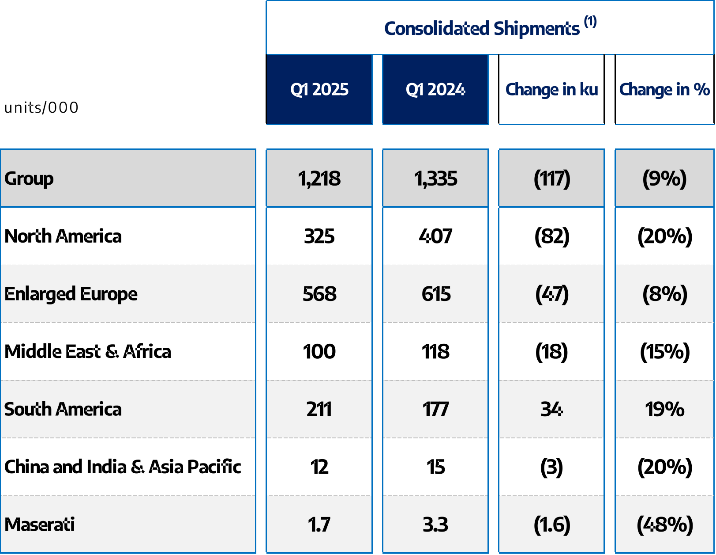

Stellantis Reports Q1 2025 Consolidated Shipment Estimates of 1.2 Million Units Globally, -9% y-o-y

Commercial Recovery Efforts Drive Initial Rebound in EU30 Market Share vs. H2 2024, Stabilization in U.S. Retail Share

AMSTERDAM, April 11, 2025 – Stellantis N.V. today published global quarterly consolidated shipment estimates and provided commentary on related business trends. The term “shipments” describes the volume of vehicles delivered to dealers, distributors, or directly from the Company to retail and fleet customers, which drive revenue recognition.

Consolidated shipments for the three months ending March 31, 2025, were an estimated 1.2 million units, representing a 9% decline y-o-y, primarily reflecting lower North American production as a consequence of extended holiday downtime in January, and in Enlarged Europe due to the impacts of product transitions and lower light commercial vehicle (LCV) volumes.

Commercial progress in the first quarter of 2025, included the launch of all new and refreshed models including the Citroën C3 Aircross, Opel Frontera, Fiat Grande Panda, Ram 2500 and 3500 heavy-duty trucks, helping to drive positive momentum in order intake, while maintaining normalized dealer inventory levels.

- In North America, Q1 shipments declined approximately 82 thousand units compared to the same period in 2024, representing a 20% y-o-y decline, mainly reflecting lower January production, a consequence of extended holiday downtime, as well as the initial ramp up of the updated 2025 Ram heavy duty trucks. Looking at U.S. sales performance, Jeep® Compass, Grand Cherokee and Ram 1500/2500 each saw volumes rise >10% y-o-y in Q1 2025. Also encouraging, March new retail orders were at the highest level since July 2023.

- Enlarged Europe Q1 shipments declined approximately 47 thousand units, representing a 8% y-o-y decline, two-thirds due to transition gaps in certain A and B-segment vehicles replacing prior-generation products discontinued at the end of H1 2024, and one-third from a decline in LCV volumes. Switching over to European sales performance, Q1 2025 EU30 market share was 17.3%, an increase of 1.9 percentage points compared to Q4 2024, reflecting in part the sales contributions of recent new product launches.

- Across Stellantis’ “Third Engine”, shipments grew collectively 13 thousand units, representing a 4% increase driven mainly by a 19% increase in South America, more than offsetting shipment declines in Middle East & Africa, China and India & Asia Pacific. Stellantis maintained its leadership in South America while benefiting from higher industry volumes, especially in Brazil and Argentina. In Middle East & Africa the 15% decline in shipments was mostly driven by the impact of import restrictions in Algeria, Tunisia and Egypt.

(1) Consolidated shipments only include shipments by Company’s consolidated subsidiaries, which represent new vehicles invoiced to third party (dealers/importers or final customers).

Consolidated shipment volumes for Q1 2025 presented here are unaudited and may be adjusted. Final figures will be provided in our official revenue/shipments report. Analysts should interpret these numbers with the understanding that they are preliminary and subject to change.

(2) The “Third Engine” refers to the aggregation of the South America, Middle East & Africa and China and India & Asia Pacific segments for presentation purposes only.

# # #

About Stellantis

Stellantis N.V. (NYSE: STLA / Euronext Milan: STLAM / Euronext Paris: STLAP) is a leading global automaker, dedicated to giving its customers the freedom to choose the way the move, embracing the latest technologies and creating value for all its stakeholders. Its unique portfolio of iconic and innovative brands includes Abarth, Alfa Romeo, Chrysler, Citroën, Dodge, DS Automobiles, FIAT, Jeep®, Lancia, Maserati, Opel, Peugeot, Ram, Vauxhall, Free2move and Leasys. For more information, visit www.stellantis.com.

| @Stellantis |  | Stellantis |  | Stellantis |  | Stellantis | |

For more information, contact: investor.relations@stellantis.com communications@stellantis.com www.stellantis.com | ||||||||

Safe harbor statement

This document contains forward looking statements. Statements regarding future financial performance and the Company’s expectations as to the achievement of certain targeted metrics, including revenues, industrial free cash flows, vehicle shipments, capital investments, research and development costs and other expenses at any future date or for any future period are forward-looking statements. These statements may include terms such as “may”, “will”, “expect”, “could”, “should”, “intend”, “estimate”, “anticipate”, “believe”, “remain”, “on track”, “design”, “target”, “objective”, “goal”, “forecast”, “projection”, “outlook”, “prospects”, “plan”, or similar terms. Forward-looking statements are not guarantees of future performance. Rather, they are based on the Company’s current state of knowledge, future expectations and projections about future events and are by their nature, subject to inherent risks and uncertainties. They relate to events and depend on circumstances that may or may not occur or exist in the future and, as such, undue reliance should not be placed on them. Actual results may differ materially from those expressed in forward-looking statements as a result of a variety of factors, including: the Company’s ability to launch new products successfully and to maintain vehicle shipment volumes; changes in the global financial markets, general economic environment and changes in demand for automotive products, which is subject to cyclicality; the Company’s ability to successfully manage the industry-wide transition from internal combustion engines to full electrification; the Company’s ability to offer innovative, attractive products and to develop, manufacture and sell vehicles with advanced features including enhanced electrification, connectivity and autonomous-driving characteristics; the Company’s ability to produce or procure electric batteries with competitive performance, cost and at required volumes; the Company’s ability to successfully launch new businesses and integrate acquisitions; a significant malfunction, disruption or security breach compromising information technology systems or the electronic control systems contained in the Company’s vehicles; exchange rate fluctuations, interest rate changes, credit risk and other market risks; increases in costs, disruptions of supply or shortages of raw materials, parts, components and systems used in the Company’s vehicles; changes in local economic and political conditions; changes in trade policy, the imposition of global and regional tariffs or tariffs targeted to the automotive industry, the enactment of tax reforms or other changes in tax laws and regulations; the level of governmental economic incentives available to support the adoption of battery electric vehicles; the impact of increasingly stringent regulations regarding fuel efficiency requirements and reduced greenhouse gas and tailpipe emissions; various types of claims, lawsuits, governmental investigations and other contingencies, including product liability and warranty claims and environmental claims, investigations and lawsuits; material operating expenditures in relation to compliance with environmental, health and safety regulations; the level of competition in the automotive industry, which may increase due to consolidation and new entrants; the Company’s ability to attract and retain experienced management and employees; exposure to shortfalls in the funding of the Company’s defined benefit pension plans; the Company’s ability to provide or arrange for access to adequate financing for dealers and retail customers and associated risks related to the operations of financial services companies; the Company’s ability to access funding to execute its business plan; the Company’s ability to realize anticipated benefits from joint venture arrangements; disruptions arising from political, social and economic instability; risks associated with the Company’s relationships with employees, dealers and suppliers; the Company’s ability to maintain effective internal controls over financial reporting; developments in labor and industrial relations and developments in applicable labor laws; earthquakes or other disasters; and other risks and uncertainties. Any forward-looking statements contained in this document speak only as of the date of this document and the Company disclaims any obligation to update or revise publicly forward-looking statements. Further information concerning the Company and its businesses, including factors that could materially affect the Company’s financial results, is included in the Company’s reports and filings with the U.S. Securities and Exchange Commission and AFM.

Attachment