CHICAGO, April 15, 2025 (GLOBE NEWSWIRE) -- Zero Hash, the leading infrastructure for stablecoins and crypto, today announced it powered more than $2 billion in tokenized fund flows within the last four months - fueling the rise of on-chain capital markets.

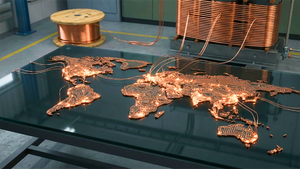

As adoption of tokenized funds accelerates, Zero Hash has emerged as a core enabler of the on-chain markets ecosystem. Its infrastructure underpins the payment rails for tokenized funds, including BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL) in partnership with Securitize, as well as Franklin Templeton’s BENJI Token and the Hamilton Lane Private Infrastructure Fund (HLPIF) in partnership with Republic. Zero Hash facilitates compliant, real-time, 24/7/365 funding across seven stablecoins, underpinned by 22 blockchains.

Tokenization has the potential to fundamentally reshape financial markets by enabling instant, always-on settlement. Traditional payment systems, however, aren’t designed to support this level of availability and remain a bottleneck. Stablecoins unlock the true utility of tokenized assets, including stable instruments, enabling them to move as flexibly as the blockchain allows. Zero Hash payment rails are an essential tool for institutions looking to unlock blockchain technology and enable completely on-chain transactions, from asset origination to redemption, without having to manage the complexities of accepting stablecoins.

In his annual Letter to Investors, BlackRock Chairman and CEO Larry Fink wrote, “Every stock, every bond, every fund – every asset – can be tokenized. If they are, it will revolutionize investing. Markets wouldn't need to close. Transactions that currently take days would clear in seconds. And billions of dollars currently immobilized by settlement delays could be reinvested immediately back into the economy, generating more growth.” This vision is already in motion – and Zero Hash is powering the payment rails underpinning tokenized assets.

“Tokenized finance is no longer theoretical. Institutions are deploying real capital to tokenization and need the payment infrastructure to match,” said Edward Woodford, CEO and Founder of Zero Hash. “Our rails enable fully on-chain transactions end-to-end, real-time, 24/7/365. Zero Hash abstracts the blockchain complexity and meets the regulatory standards required by the largest financial firms.”

Zero Hash’s infrastructure is trusted by global businesses that require enterprise-grade stablecoin payment rails. This is because Zero Hash addresses two of the most pressing barriers to institutional adoption: regulatory compliance around source-of-funds transparency and technical complexity. Zero Hash’s abstracts away the complexity of multi-chain, multi-stable operations – allowing issuers to operate with the simplicity of account-to-account transfers, while their infrastructure handles the complexities behind the scenes.

In less than four months, Zero Hash has facilitated over $2 billion in tokenized funding through partners including Securitize, Franklin Templeton, and Republic. The broader market reflects that momentum. The tokenized real-world asset (RWA) market grew ~85% year-over-year to hit $15.2 billion by the end of 2024. In the first quarter of 2025, another $5.44 billion was added - bringing total RWA value on-chain to $20.64 billion, as of April 11th (Source: rwa.xyz). Zero Hash’s on-ramped approximately 35% of all on-chain RWAs in Q1, solidifying its position as a foundational layer in the evolving capital markets stack.

As institutional adoption deepens, Zero Hash continues to serve as the stablecoin infrastructure partner of choice for asset managers and platforms driving the future of financial services.

About Zero Hash

Zero Hash is the leading infrastructure provider for crypto, stablecoin, and tokenized asset settlement. Its embeddable, API-first platform enables regulated money movement across fiat, crypto, and stable instruments. Clients use Zero Hash to build solutions for cross-border payments, commerce, trading, remittance, payroll, tokenization, wallets, on/off-ramps, and more.

Zero Hash Holdings is backed by investors, including Point72 Ventures, Bain Capital Ventures, and NYCA.

Zero Hash Trust Company LLC has been approved by the North Carolina Commissioner of Banks as a non-depository trust company.

Zero Hash LLC is a FinCen-registered Money Service Business and a regulated Money Transmitter that can operate in 51 U.S. jurisdictions. Zero Hash LLC and Zero Hash Liquidity Services LLC are licensed to engage in virtual currency business activity by the New York State Department of Financial Services. In Canada, Zero Hash LLC is registered as a Money Service Business with FINTRAC.

Zero Hash Australia Pty Ltd. is registered with AUSTRAC as a Digital Currency Exchange Provider, with DCE registered provider number DCE100804170-001. Zero Hash Australia Pty Ltd. is registered on the New Zealand register of financial service providers, with Financial Service Provider (FSP) number FSP1004503. Zero Hash Europe B.V. is registered as a Virtual Asset Services Provider (VASP) by the Dutch Central Bank (Relation number: R193684). Zero Hash Europe Sp. Zoo is registered as a VASP by the Tax Administration Chamber of Poland in Katowice (Registration number RDWW – 1212).

Media Contact:

Zero Hash

Shaun O’Keeffe

(855) 744-7333

media@zerohash.com