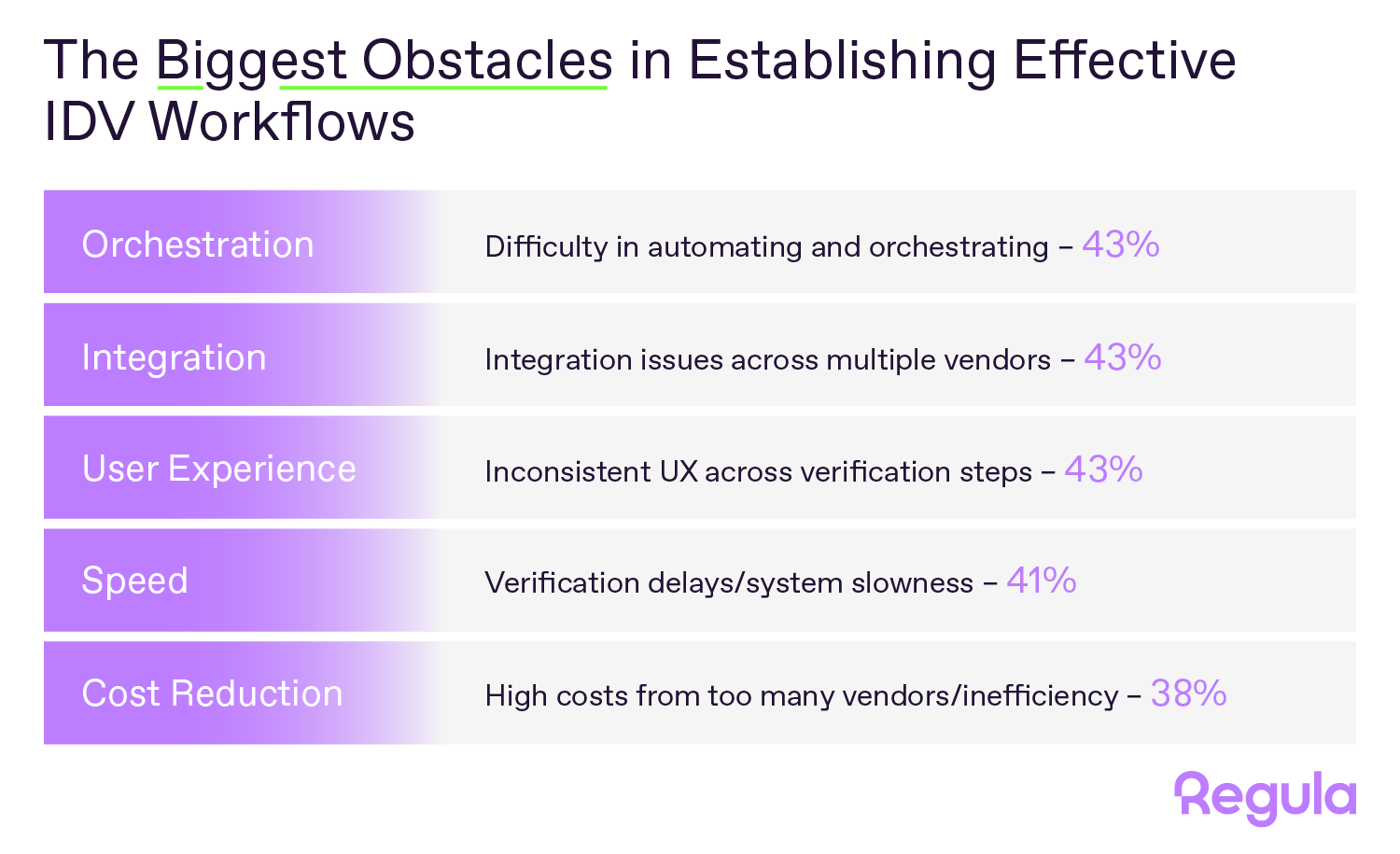

RESTON, Va., Sept. 25, 2025 (GLOBE NEWSWIRE) -- According to a new study from Regula, a global developer of identity verification (IDV) solutions and forensic devices, 43% of organizations cite lack of integration and orchestration as their biggest challenge, while almost the same share (44%) say those very capabilities top their wish list for an ideal setup. The data suggests a turning point: organizations now realize disjointed IDV tools are the new vulnerability.

This near-perfect balance reveals a simple truth: orchestration, i.e., linking all identity verification steps into a single, seamless process, once considered as nice-to-have, has become a critical requirement.

“Many companies don’t struggle because they lack IDV tools—they struggle because they have too many,” says Ihar Kliashchou, Chief Technology Officer at Regula. “Every extra component adds cost, friction, and complexity, which ultimately increases risk. Businesses know orchestration is the answer. Without it, identity verification stays fragmented and vulnerable, leaving cracks for fraudsters to exploit—for example, by passing different identities through unconnected checks. Each tool may work in isolation, but the system as a whole never verifies the complete journey.”

According to Regula research, nearly half of businesses struggle with lack of orchestration and integration of different IDV tools

Sectoral and regional pain points

Across all surveyed industries, orchestration gaps are a top-three issue. For instance:

- Crypto firms are hit hardest, with 49% citing difficulties in orchestrating IDV as their top obstacle because of maturity gaps.

- Banks (47%) struggle most with tool integration due to the prevalence of third-party legacy systems and siloed applications.

- Fintech companies (50%) say they are most preoccupied with a fragmented user experience that emerges as their businesses scale fast and new services are added sporadically.

Regional differences add nuance:

- In the US, 53% of businesses blame fragmented customer journeys as the top issue.

- In Germany and Singapore, 46% point to failed integration.

- In the UAE, 45% struggle most with orchestration and automation challenges.

The pattern intensifies with scale. Companies losing more than $5 million annually to fraud are nearly twice as likely to report orchestration as their main challenge compared to those with smaller losses.

Download the full report

These findings are part of Regula’s new survey of businesses across the US, Europe, Asia, and the Middle East. The full report, Identity Verification 2025: 5 Threats and 5 Opportunities, is available for download on Regula’s website.

About Regula

Regula is a global developer of forensic devices and identity verification solutions. With our 30+ years of experience in forensic research and the most comprehensive library of document templates in the world, we create breakthrough technologies for document and biometric verification. Our hardware and software solutions allow over 1,000 organizations and 80 border control authorities globally to provide top-notch client service without compromising safety, security, or speed. Regula has been recognized in the 2025 Gartner® Magic Quadrant™ for Identity Verification.

Learn more at www.regulaforensics.com.

Contact:

Kristina – ks@regula.us

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/5f5539ea-ad66-4547-811d-46c04d321d90