Smart Grid Market: Introduction

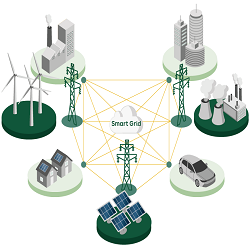

The advent of smart grid technologies has emerged as the key solution to the operational challenges that utilities face in everyday life. The smart grid technology is just an advanced and a more expensive version of a conventional grid system. It is an electricity grid that uses two way technologies to deliver electricity and enable communication between utility and consumers. Communication networks and automation and sensing devices make the smart grid functional.

The global smart grids market exhibits a substantially competitive vendor landscape. Although the market is still in its developing stages, the competition is expected to get fiercer during the forthcoming years, mainly due to the entry of new players in this field.

Get PDF sample for Industrial Insights and business Intelligence – https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=137

The smart grid market is expected to expand at a CAGR of 17.8% during the forecast period from 2021 to 2031. In this context, the smart grid market was valued at US$ 139.5 Bn in 2020 and is expected to reach US$ 845.6 Bn by 2031.

Rising Awareness about Benefits of Smart Grids Boosts Global Market

Conventional electricity grids installed in many countries across the globe are now aging and causing large-scale electrical blackouts. Thus, every nation has a growing need to reduce the cost of blackouts and power outages. A smart grid technology gives consumers and suppliers the liberty to manage and protect the distribution network, save energy, and reduce such extravagant costs. Even the governments in most of the countries are incurring massive losses due to conventional electrical grids, and hence, they are now focusing on investing in smart grid technologies.

Immediate Delivery Available | Buy this Premium Research Report – https://www.transparencymarketresearch.com/sample/sample.php?flag=EB&rep_id=137

The benefits of smart grid include improved energy efficiency and reliability of existing electrical supply, integration of more renewable energy into existing network, new solutions for customers to optimize their electricity consumption, and reduction of carbon emissions.

The global smart grid market seems to be fairly fragmented with presence of many well-entrenched enterprises. This also highlights that the competitive landscape is highly intense. Aclara, Alstom, Comverge, eMeter, GridPoint Inc, Landis+Gyr, Schneider Electric, Schweitzer Engineering Laboratories, Sensus, Siemens, ABB Ltd, Itron, Opower, and General Electric are some of the key participants of the global smart grid market.

Request for Custom Research –https://www.transparencymarketresearch.com/sample/sample.php?flag=CR&rep_id=137

Global Smart Grid Market: Segmentation

Smart Grid Market, by Technology

- Advanced Metering Infrastructure

- Distribution Automation

- Software and Hardware

- Communication Technologies

- Transmission Upgrades

- Cyber Security

More Trending Reports by Transparency Market Research –

Power Distribution Component Market – https://www.globenewswire.com/news-release/2022/09/29/2525512/0/en/Power-Distribution-Component-Market-to-Reach-US-15-3-Bn-by-2030-TMR-Study.html

Small Hydropower Market – https://www.prnewswire.com/news-releases/small-hydropower-market-to-expand-at-a-cagr-of-2-69-during-forecast-period-notes-tmr-study-301640681.html

About Us Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. The firm scrutinizes factors shaping the dynamics of demand in various markets. The insights and perspectives on the markets evaluate opportunities in various segments. The opportunities in the segments based on source, application, demographics, sales channel, and end-use are analysed, which will determine growth in the markets over the next decade.

Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision-makers, made possible by experienced teams of Analysts, Researchers, and Consultants. The proprietary data sources and various tools & techniques we use always reflect the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in all of its business reports.

Contact Information:

Nikhil Sawlani

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Blog: https://tmrblog.com

Email: sales@transparencymarketresearch.com

Website: https://www.transparencymarketresearch.com