Dividend stocks come in many shapes and sizes. Large caps and small caps. Quarterly and monthly payers. High yield. Dividend growers.

And then there are dividend initiators.

The newbies of the dividend world are companies that are returning cash to shareholders for the first time. They can also be companies that reinstate a temporarily suspended dividend, a common event in the aftermath of the pandemic.

Any way it happens, initiating a dividend is a good thing. Why?

When a company issues a dividend, it is a sign of financial strength. It tells investors that cash flow is healthy and the earnings outlook bright. Sharing corporate profits increases investment return and incentivizes shareholders to hang onto their shares, if not buy more.

These three companies just joined the dividend party. To income investors, being fashionably late is better than being a no show.

Did American Eagle Resume Dividend Payouts?

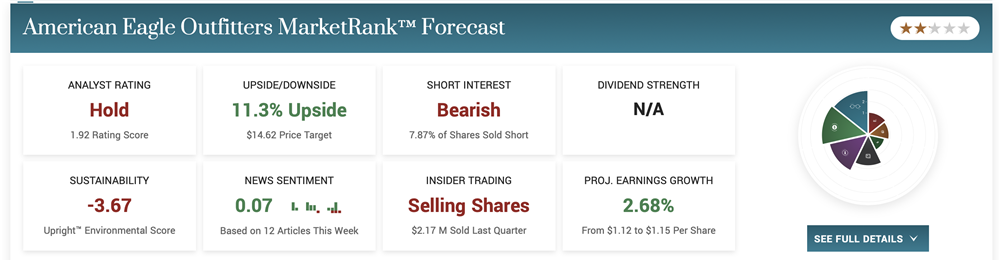

After paying a pair of quarterly dividends in 2021, American Eagle Outfitters, Inc. (NYSE: AEO) hit the pause button — and for good reason. Pandemic tailwinds quickly turned into headwinds. Supply chain disruption and a weakened macro outlook caused earnings to plunge in the quarters that followed.

But with the worst apparently over and profitability expected to improve, management reinstated the dividend last month. The casual clothing retailer has dramatically strengthened its balance sheet, affording it greater flexibility. Its long-term debt balance went from $412 million at the end of the third quarter to a mere $9 million at the end of 2022. Its debt-to-capital ratio is now less than 1% while the average S&P 500 stock is at 40%.

The $0.10 per share quarterly dividend is payable on April 21st to shareholders that own the stock as of April 6th. This means the stock has a 3.1% forward dividend yield, which also compares favorably to the S&P 500 where the average yield is 1.8%.

Improving demand, inventory levels and profit margins have driven two consecutive earnings beats at American Eagle Outfitters — and a brightened outlook. An 11x forward P/E ratio and resumed dividend make it a nice fit for value investors.

Why Did Iridium Communications Start Paying a Dividend?

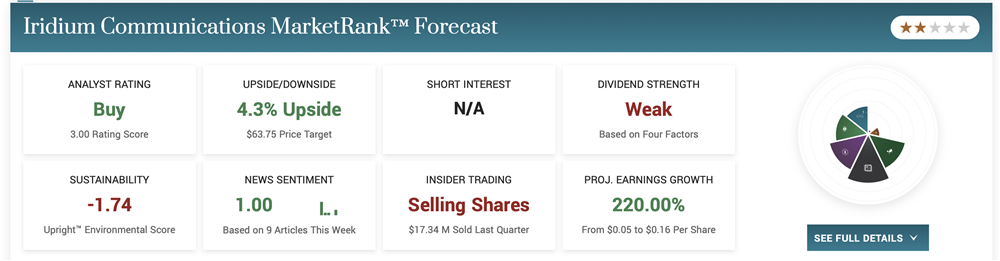

Mid-cap telecom company Iridium Communications, Inc. (NASDAQ: IRDM) has been on a tear. Its stock has doubled over the last 12 months thanks to increasing subscriber demand for equipment complemented by strong engineering and support revenues. Service revenue surged 84% in the fourth quarter largely due to a higher engagement with the U.S. government.

The company recently secured a contract from the Space Development Agency. It is also doing business with Elon Musk’s SpaceX. Later this year, Iridium is scheduled to launch as many as five ground satellites onboard a SpaceX Falcon 9 rocket. This makes it an instant favorite with rocket emoji-obsessed retail investors.

Momentum in the business along with future opportunities in the Internet-of-Things (IoT) space and a smartphone collaboration with Qualcomm gave management the confidence to initiate a quarterly dividend. The first dividend will hit shareholder accounts this week. At $0.13 per share, the forward yield is less than 1%, but it’s a start. While mature broadband players like Verizon and AT&T offer 6% to 7% yields, Iridium’s smaller size and superior growth profile make it an intriguing new dividend payer.

What Is WESCO International’s Dividend?

Earlier this month, B2B logistics services provider WESCO International, Inc. (NYSE: WCC) announced its first ever dividend. Its Board of Directors approved a generous cash dividend of $0.375 per share that will be doled out on March 31st. The dividend is the culmination of above-industry sales growth and ongoing margin expansion that have cash flow trending in the right direction.

WESCO expects that it will continue to benefit from several long-term growth trends including supply chain consolidation, vehicle electrification, industrial automation, IoT, clean energy and digitalization. For 2023, management is forecasting adjusted earnings per share (EPS) of $16.80 to $18.30. At the midpoint, this implies 7% year-over-year growth. This represents a significant slowdown from the 65% profit growth achieved last year, but any growth off a substantially higher base would be impressive.

More importantly, cash flow generation is expected to be solid and support the new quarterly dividend. Less than 10% of the earnings WESCO is projected to record over the next 12 months will go towards dividends. This leaves a ton of room for future dividend growth. What would you expect from a business that’s all about planning ahead? On top of the new 1.1% yield, WESCO has an active $1 billion stock buyback program that strengthens the stock’s value proposition.