Philip Morris International (NYSE: PM) is on the radar of many income investors due to its steady dividend payments. However, many avoid the stock for fear that it's a "dividend trap," as cigarette sales remain in long-term decline.

Despite these fears, PM significantly reduces its reliance on cigarette sales and aims to generate 50% of revenue from non-smoking products by 2025.

With rising interest rates, yield curve inversions, and high inflation, the probability of a recession in the next year or so is worrying. For this reason, investors seek stocks with healthy dividend yields and those resilient to economic downturns. Philip Morris stock currently yields 5.1%.

And the tobacco industry perfectly meets those criteria. Not only do tobacco stocks like Philip Morris pay high dividends, but most smokers don't stop smoking in a recession. Philip Morris' earnings grew during the Great Financial Crisis of 2008.

In this article, we’ll review Philip Morris and why its gradual transition away from cigarettes potentially gives investors the best of both worlds: stable yields and growth opportunities.

The Rundown on Philip Morris

Philip Morris owns several well-known cigarette brands like Marlboro and Parliament. Despite the moral and regulatory problems with the tobacco business, it's solid, as seen by PM's 38% operating margins.

But the steep decline of cigarette smoking is the elephant in the room. Cigarette sales in the United States have declined roughly 70% since 1980, and the market will only get smaller over time.

PM is not blind to this long-term trend. The company's main priority is "quitting" cigarettes. It plans to maximize the value of the cigarette business while it's still strong and gradually transition to generating most of its revenue from non-smoking products.

Currently, PM makes 68% of its revenue from tobacco-product sales, while 32% comes from non-smoking products. Its ambition is to generate 50% of revenue from non-smoking products by 2025, and the company is on track to do so.

As such, this transitionary period has created some solid growth levers which make PM stock more interesting, as it has the potential to give investors the best of both worlds: stable yields and growth.

The Growth Story

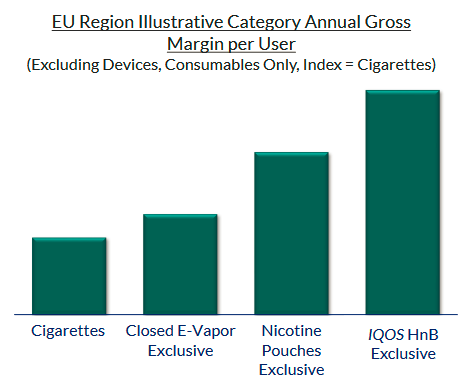

Philip Morris' aggressive campaign to reduce its reliance on cigarette sales has unearthed some high-potential growth levers in nicotine pouches and smokeless tobacco devices (IQOS). Perhaps most exciting for investors is that both products have higher margins than cigarettes while being far safer alternatives.

Looking forward, PM is on track to achieve its 2025 ambition. The company generated 32% of its revenue from non-smoke products in 2022 and targets 40% for 2023.

Nicotine Pouches

Nicotine pouches are filled with flavored nicotine powder. They’re placed under the lip and slowly release nicotine into the user's system faster than cigarettes or vapes. Nicotine pouches are tobacco-free, making them far less harmful to health than cigarettes.

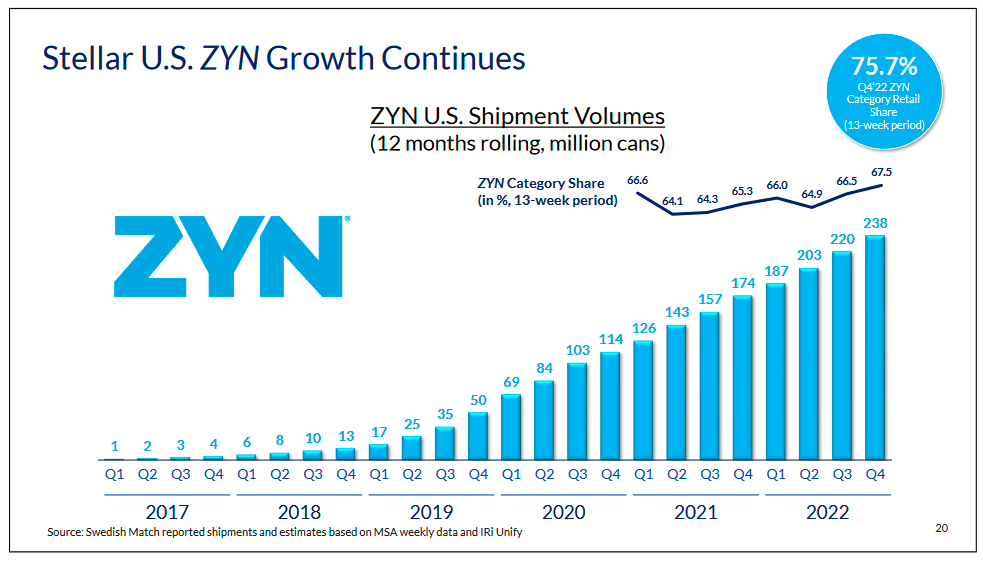

PM became a major player in the nicotine pouch business last year with its $16 billion acquisition of Swedish Match, producer of Zyn nicotine pouches. Zyn is the leader in pouches and has become as ubiquitous in the pouch industry as Juul in the e-cigarette industry.

The purchase gives PM a 76% market share in pouches, a segment that has grown at a 44% CAGR since 2020, and recent reports project it to continue to grow at a 32% CAGR through 2028.

Source: Philip Morris CAGNY Presentation

Smokeless Tobacco (“IQOS”)

IQOS is a smoking alternative that mimics the smoking experience more closely than vaping. The device heats tobacco below its burning point to create vapor, giving it an authentic tobacco flavor, an essential feature for cigarette smokers who have grown accustomed to it.

Furthermore, the "HeatSticks," which hold the tobacco, come in packs of 20, just like cigarettes. Smoking a HeatStick takes a similar amount of time as a cigarette. This is an essential behavioral aspect of cigarette smokers. Smokers like going out to smoke a cigarette. Still, alternatives like vaping don't offer that sense of completion - the "end" of a vaping session is open-ended.

While Big Tobacco has been trying and failing for decades to make smokeless tobacco a thing, Philip Morris is seeing significant success with IQOS. Multiple larger countries like Japan and Italy have adopted the IQOS in droves. Philip Morris already generates more than 50% of revenues from smoke-free products in 17 markets.

IQOS is the highest margin segment in PM’s business, as can be seen by the breakdown of realized margins in its European sales:

Source: Philip Morris CAGNY Presentation

Bottom Line

Philip Morris has historically been a stable and "boring" dividend stock, but its growth levers make it a much more exciting investment opportunity. The transition from cigarettes addresses the fears of the stock becoming a "dividend trap" while offering exciting growth opportunities in nicotine pouches and "heat-not-burn" IQOS devices.