Kraft Heinz and Conagra Brands are in the same shape regarding their growth and outlook, yet the institutions are buying 1 and selling the other. The takeaway is that both face headwinds in the form of consumer push-back against rising prices, but Kraft, deep in its turnaround, has a better outlook for improvements than Conagra, which may continue to struggle.

This means that both stocks trade at a value and offer significantly better yields than other staples stocks and the broad market, but 1 is set up for a rebound, and the other may continue to lose share value.

Conagra Has Solid Quarter, Reaffirms Guidance, Institutions Sell

The institutions have been buying Conagra and Kraft this year, but that changed dramatically in Q3. The institutions had bought Conagra on balance for 5 consecutive quarters until Q3, when they began to sell. Selling in Conagra shares spiked to the highest level in more than 4 years, netting the bears about 3.75% of the market cap.

That reduced their holdings to about 88.9%, which is still high. At this level, the institutions won’t have to sell vigorously, just on balance, to keep the market from moving higher.

Conversely, Kraft Heinz's institutional activity has been bullish on balance for 7 consecutive quarters, with a spike in buying in Q3. The spike in buying put institutional activity at the highest level in over 4 years and netted the group about 6.25% of the market cap. Coincidentally, the spike in activity occurred, with shares of KHC trending to a 1-year low. Assuming the institutional activity trend continues, the KHC market should bottom.

The market for CAG shares is trading near comparable levels at the bottom of a trading range. It may find support at this level because of the analysts' interest, but a rebound and sustained rally are unlikely. The 11 analysts with current ratings have the stock pegged at Hold, the same as Kraft, with a price target about 26% above the current price action. Kraft’s price target is also about 26% above the current action, and both have steadied after falling earlier in the year.

Kraft Issues Better Guidance

Kraft and Conagra had similarly tough quarters in Q2 but posted growth and widened margins. Conagra had an arguably better quarter, with organic growth outpacing Kraft by 200 basis points and adjusted earnings by 350, but Kraft widened margins more than expected and produced better guidance.

Conagra expects revenue growth in the range of 1% for the year, while Kraft, leaning into a new international growth agenda, has guidance for 4% to 6% growth with margin expansion. The KHC guidance was roughly aligned with the consensus but resulted in some downward revisions; Conagra’s guidance was below consensus, resulting in downward earnings revisions.

The value and yield are there for both companies. CAG yields about 4.65%, with shares near the bottom of the long-term trading range, while KHC pays closer to 4.75%. Both trade in the 11X to 12X earnings range with the difference that KHC shares will lead CAG due to top and bottom-line outperformance. Both companies are paying about 50% of earnings regarding safety and growth, but investors should only expect distribution increases from CAG now.

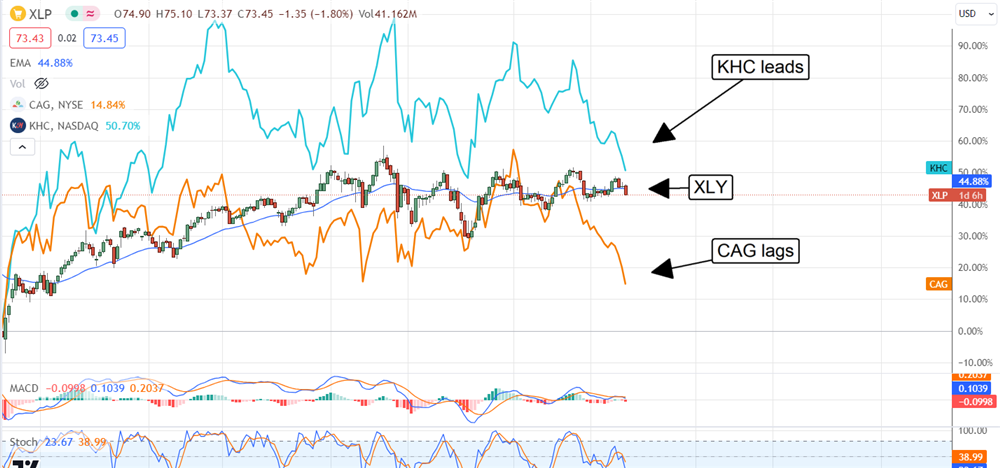

Kraft Is Leading The Staples Market

As tepid as the action in KHC shares has been this year, it is leading the Consumer Staples market. CAG is lagging, and both are trading at the bottom of a long-term trading range. While both may bottom at the current levels, only KHC has the backing of institutional investors, including Warren Buffet.

Berkshire Hathaway hasn’t purchased KHC recently, but it owns more than 26% of the company, and total institutional holdings, which stand at 72%, are rising. In this scenario, shares of KHC could easily gain the 26% expected by analysts and trade near $40 by the end of the year.