CRM, or customer relationship management, is a hot industry. It is supported by the persistent shift to digitization and the rapid advancement of technology, including AI. AI is well-suited to automation, and customer service is an industry that can thrive with automation. The 2024 business trends include double-digit growth, sequential acceleration, outperformance, and improving guidance that suggests the trends will continue. With stocks up by high double-digit to triple-digit amounts in 2024 and strong business trends, the stock prices are also likely to continue to trend higher in 2025.

Salesforce: The Leading Player in Customer Relationship Management

Salesforce (NYSE: CRM) is the leading player in CRM, as shown in the numbers. The company is the largest in terms of market cap, revenue, and earnings power, and it uses its cash flow to fund growth investments, leading to sustained outperformance quarterly. Revenue growth slowed in 2024 and will slow again in 2025 but to low double-digit figures that produce strong margins, robust cash flow, and the ability to return capital to investors. Capital returns include dividends and repurchases, with repurchases the bulk of the return and reducing the share count. The dividend is young, and the company is positioned to increase it, which will be a tailwind for share prices over time.

The analysts provide another tailwind for the market. The number of analysts is increasing, the sentiment is solid at Moderate Buy and firming, and the consensus price target is rising, up roughly 50% in 2024. The revision trend leads to new all-time highs likely reached in early 2025. Given the business trends, the analysts' forecasts for 2025 are solid but likely low and easily beaten. The company may also extend the acquisition trend, boosting the long-term outlook and improving the valuation. As it is, CRM stock is highly valued at 35x this year’s earnings but aligns with other top tech investments.

Hubspot: Growing and Outperforming the Estimates

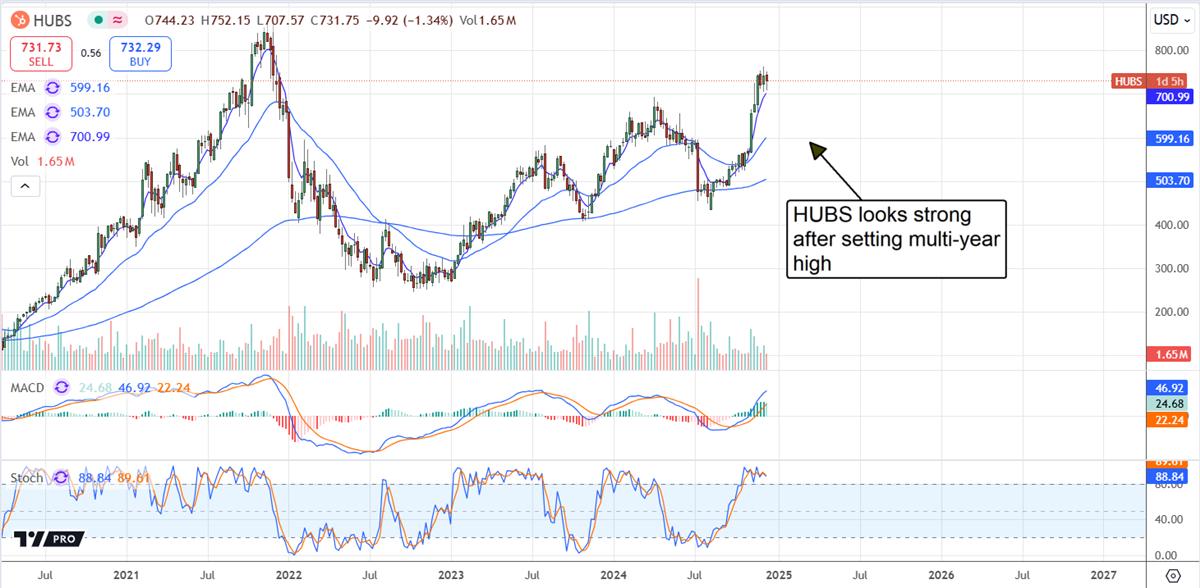

Hubspot (NYSE: HUBS) is a smaller CRM firm operating a cloud-based platform offering automation tools, including live chat, call management, and lead generation. Its growth is expected to slow in 2024 and again in 2025, but still reach solid rates of 20% and 15%, respectively, with a strong chance of exceeding expectations. The company has outperformed the consensus 100% of the time for over five years, supported by a growing client base and deepening service penetration. Regarding size, it’s about 10% the size of Salesforce and a potential acquisition target.

Analysts' sentiment supports the action in 2024, and the consensus price target is rising but lags the market. The more significant market force is institutional activity, which is robustly bullish in 2024. The institutional group owns more than 90% of the stock and is buying at a pace of two-to-one compared to sellers.

Pegasystems: Reverting to Growth in F2025

Pegasystems' (NASDAQ: PEGA) results have been erratic for the last several years, with one quarter producing growth and contraction in the next. However, the company sustains a healthy cash flow, and the outlook for next year is a reversion to growth. The growth forecast may be cautious because the company reported a strong backlog in Q3, which suggests it is gaining traction.

Analysts’ sentiment toward the AI-powered automation stock is firm at Moderate Buy, and the price target is rising due to the revision trend, but the gains may be capped at the $100 level. This aligns with a previous support level and the analysts' high-end, which may only increase with strong results. As it is, the analysts are lifting their forecasts for CQ4 results but have still set the bar low, expecting revenue to remain flat compared to the previous year.

Freshworks Is Poised for a Major Rebound in 2025

Freshworks (NASDAQ: FRSH) is the cheapest CRM stock in the group, trading at 33x this year’s earnings and on track to sustain 20% growth next year. Highlights from 2024 include 20% growth, outperformance, improved guidance, and sufficient cash flow to commence share repurchases. The authorization is worth $400 million, or about 7.75% of the market cap. Analysts response to the news was good, resulting in a shifting sentiment. Analysts cooled toward the name early in 2024. Still, they began to warm up following the Q3 release, issuing numerous price target increases that led to the high-end range, setting it up for a positive revision trend in 2025.