Electronic signatures were not mainstream until the 2020 COVID-19 pandemic forced businesses and government agencies to accept e-signatures during the lockdowns. This unforeseen event accelerated the adoption of e-signatures and propelled DocuSign Inc. (NASDAQ: DOCU) into the spotlight. This little-known computer and technology sector company was a pioneer and a leading provider of e-signatures at the time. The pandemic drove DocuSign shares up from $74.11 in December 2019 to a peak of $314.76 by August 2021.

DocuSign’s AI-Powered IAM Is Revitalizing Its Top and Bottom Lines

The stock has since fallen due to normalization and growing competition from other e-signature players, Adobe Inc. (NASDAQ: ADBE) and Dropbox Inc. (NASDAQ: DBX). DocuSign has expanded its services to encompass contract lifecycle management (CLM), integrating artificial intelligence (AI) and rolling out its AI-assisted Contract Review for CLM in FQ3. CLM is part of its larger intelligent agreement management (IAM) system. The launch of its AI-powered end-to-end IAM platform in April 2024 has been its most significant post-pandemic launch. IAM combines its previously standalone products under a unified platform that includes its e-signature, CLM, and new services, including Navigator and DocuSign Maestro. Maestro enables users to automate the creation of agreements without any required coding.

IAM Adoption Traction Underscored Fiscal Q3 2025

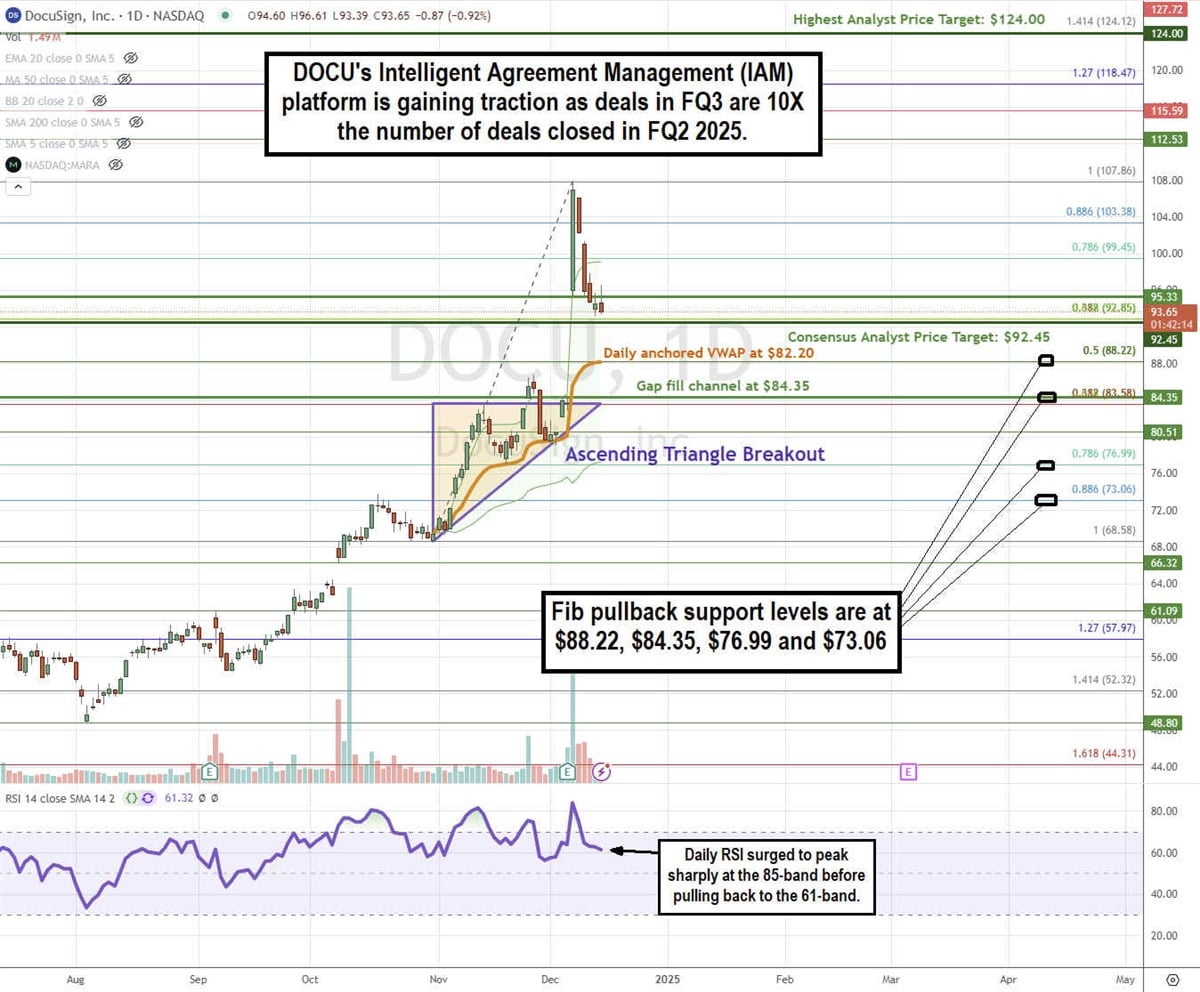

IAM gained traction in DocuSign's fiscal third quarter of 2025. IAM deals and volumes accelerated. Its sales teams reported that over 80% of its reps closed over three deals, and 60% of its sales reps closed over six deals in the quarter. In FQ3, DocuSign closed 10x more IAM deals than in FQ2.

This impacted top and bottom line results. DocuSign reported EPS of 90 cents, which beat consensus analyst estimates by 3 cents. Revenue rose by 7.8% YoY to $754.8 million, firmly beating consensus estimates of $745.25 million. Billing grew 9% YoY to $752.3 million.

Non-GAAP gross margin was 82.5%. Operating cash flow was $234.2 million, down from $264.2 million in the year-ago period. DocuSign closed the quarter with $1.1 billion in cash and cash equivalents. The company repurchased $172.7 million of stock.

DocuSign Issues Upside FQ4 2025 Guidance

FQ3 ended with solid momentum. DocuSign issued upside guidance for fiscal fourth quarter 2024 revenues of $758 million to $762 million versus $755.87 million consensus. Billings are expected to be between $870 million and $880 million.

DocuSign CEO commented, "DocuSign delivered powerful innovation for customers highlighted by new capabilities to its Intelligent Agreement Management (IAM) platform. In Q3, early IAM momentum outpaced expectations, and we continued to drive improvement in our core business with strong revenue growth and operating profit."

DOCU Triggers an Ascending Triangle Breakout

An ascending triangle consists of a flat-top upper trendline resistance that converges with a rising lower trendline support. A breakout occurs when the stock moves above the upper trendline. If the breakout happens through a price gap, the prior closing price becomes the gap-fill level support.

DOCU formed an ascending triangle leading up to its earnings report, with the upper flat-top trendline resistance set at $83.58 before its FQ3 2025 results. Following the report, DOCU gapped up to $95.33 the next morning, reaching as high as $107.86 after beating top- and bottom-line consensus estimates and raising FQ4 guidance. However, the stock faced rejection at the weekly 200-period moving average (MA) resistance of $104.10. It later pulled back to its consensus price target of $92.45, with daily anchored VWAP support at $82.20. The $84.35 gap-fill support level will be crucial if further pullbacks occur. The daily RSI peaked sharply near the 85 band before sliding down to the 62 band. Fibonacci (Fib) pullback support levels are at $88.22, $84.35, $76.99, and $73.06.

DOCU's average consensus price target is $92.45, implying a 1.2% upside and its highest analyst price target sits at $124.00. Analysts have issued three Buy ratings, seven Hold ratings, and three Sell ratings for the stock. The stock has a 5.81% short interest.

Actionable Options Strategies: Bullish investors can consider using cash-secured puts at the Fib pullback support levels to buy the dip. If assigned the shares, writing covered calls at upside Fib levels executes a wheel strategy for income opportunities while hedging the downside by the premium received.