Investing in business growth, acquisitions, improving margins, cash flow, dividends and share repurchases are among the leading drivers of shareholder value today. Oddly, too few companies rely on balanced, long-term strategies that can drive significant increases in value, choosing instead to focus only on growth.

Growth is good but can come at a cost detrimental to stock prices, and some investors are looking for income more than growth. The four stocks on the list today have foresighted management. They are leaning into value-building strategies that have been and will deliver value to shareholders year in and year out throughout the business and economic cycle.

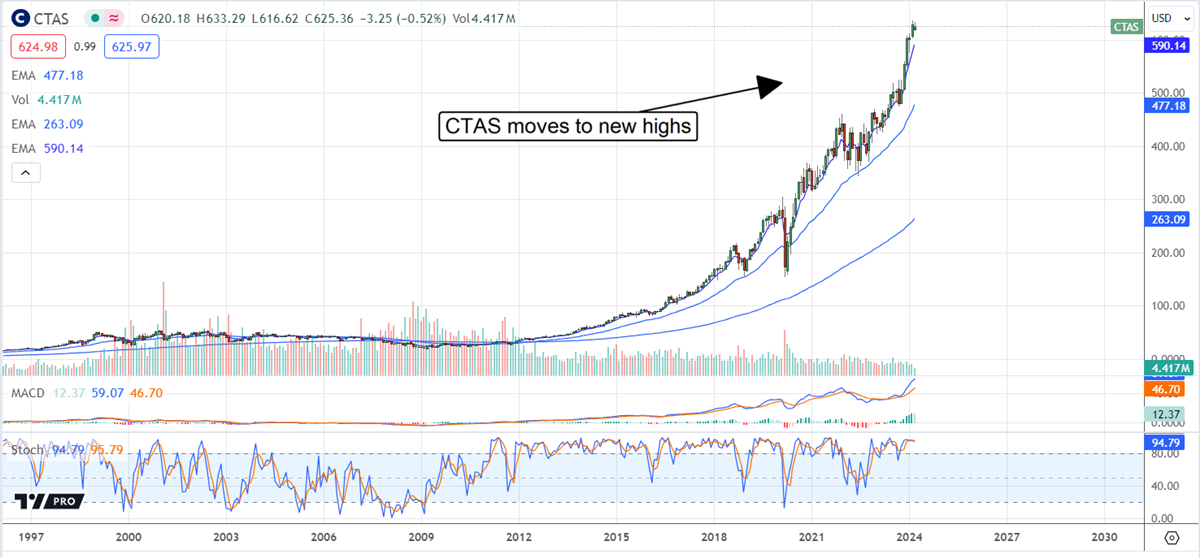

Cintas: Half a Century Building Value for Shareholders

Cintas (NASDAQ: CTAS) is a poster child for value-building companies, having grown its business and improved its share price for over half a century. If you doubt the company’s ability to deliver value, you only have to look at the stock chart. The CTAS stock price has been up 120% in the last five years and 1000% in the previous ten, and holders who invested in the stock before 2010 count their gains near 3000%. The takeaway is that Cintas continues to lean into the strategies that drove those gains, and future gains are in store.

Takeaways from the to-date fiscal 2024 results are that revenue is growing near 10%, accelerating sequentially, and the margin is widening, leading the company to improve guidance mid-year. Cash flow growth led the top line, allowing for dividend distribution and opportunistic share repurchases. The dividend is low-yielding, below 1%, but safe at 36% of earnings, reliable and growing aggressively. Repurchases brought the quarter-ending GAAP share count down less than 0.1% but enough to offset share-based compensation and aid a 3.3% gain in shareholder equity. Cintas is expected to post 9% growth for FQ3 and will likely exceed the forecast.

UniFirst Can Deliver Value Similiar to Cintas

UniFirst (NYSE: UNF) is another uniform and employer-services specialist and a near-twin to Cintas. Among the differences are age, size, and margin, which are improving over time. In this light, Unifirst could increase its dividend over time without revenue and earnings growth, sustaining higher earnings with margin efficiency, and there is distribution growth in the forecast.

The dividend payout is running near 36% of profits and 0.85% in yield, aligning with Cintas, and earnings are forecast to grow this year and next, so the 20% CAGR can be sustained. Regarding the balance sheet, the company has no long-term debt, assets are increasing, liabilities are down, and shareholder equity is rising.

Williams-Sonoma is Moving Higher on Capital Strength

Williams-Sonoma (NYSE: WSM) rocketed higher after its Q4 release, and the stock may double in price again. The Q4 results highlight the strength of the business model and resiliency in end-markets, which did not balk at full-price selling. The company’s margin came in above 20%, well above the target range, and left earnings, cash and the balance sheet in better condition than before (and they were solid before). Details include a 25% increase in the dividend, dividend safety, and a new repurchase program. The new repurchases are worth $1 billion or about 5.5% of the market cap, with shares at the new highs.

Casey’s General Stores is Building Value for Shareholders

Casey’s General Stores (NASDAQ: CASY) reported a contraction in revenue for FQ3 2024, but that is the worst news. The company’s results declined on deleveraging fuel prices but were stronger than expected on volume and inside sales strength. The company also added new stores and plans to add another 5.5% this year.

Salient details include margin, which contracted less than expected, and cash flow. Cash flow allowed for share repurchases and an increase to the repurchase authorization worth about 2.75% of the market cap. The dividend also yields a solid 0.6%, and the distribution is growing and incredibly safe. The payout ratio is less than 15% of earnings, with no red flags on the balance sheet. This balance sheet is another fortress with ample liquidity and low leverage. Leverage is running about 0.25X on a debt-to-asset basis and 1.1X on a liability-to-equity basis.