Keurig Dr Pepper Inc. (NASDAQ: KDP) is a beverage company that also specializes in single-serve coffee brewer machines and pods. In fact, Keurig started the single-serving NASDAQ: SBUX">coffee market with its brewers and Green Mountain Coffee K-Cups. The consumer staples sector giant was formed through the merger between Keurig Green Mountain and Dr Pepper Snapple Group.

The consumer staples sector company is a powerhouse in the beverage market. It competes with The Coca-Cola Co. (NYSE: KO), PepsiCo Inc. (NASDAQ: PEP), Monster Beverage Co. (NASDAQ: MNST), Celsius Holdings Inc. (NASDAQ: CELH) and Nestle S.A. (OTCMKTS: NSRGF) in the carbonated beverage, juice, water, tea and coffee segments. The company recently reaffirmed its guidance. With shares trading at 16.06X forward earnings discounted to the 21X industry average, value players may get interested.

Over 125 Brands

Keurig Dr Pepper has a portfolio of over 125 owned, partnered, licensed and allied brands. Some of its popular brands include Canada Dry, Snapple, Yoohoo, Mistic, Nantucket Nectars, Mr. & Mrs. T, RC Cola, Stewart's, A&W, and Core. Xyience Energy, Rose's and Venom Energy. Its popular partnered brands include Evian, Polar, Starbucks, Dunkin, Lipton, Folgers, Gevalia, Eight O'Clock Celestial Seasonings, Café Bustelo, Caribou Coffee, Peet's, Tazo, Tim Horton's, illy and Maxwell House.

Steady Q4 2023 Earnings

Keurig Dr Pepper reported Q4 2023 EPS of 55 cents, beating 54 cents consensus analyst estimates by a penny. Revenues rose 1.7% to $3.87 billion versus $3.92 billion.

Soft Guidance

The company expects net sales to grow in a mid-single-digit range and adjusted diluted EPS growth in the high single-digit range in 2024.

CEO Insights

Keurig Dr Pepper CEO Robert Gamgort commented that 2023 was a significant year for the company as it grew market share across most of its business. The company entered multiple high-growth white spaces, including sports hydration and ready-t-drink coffee. The company returned more than $1.8 billion to investors, including a 7.5% dividend increase and the repurchase of 22 million shares. Dr Pepper Strawberries and Cream was the top innovation launch in the carbonated soft drink (CSD) category in 2023.

RTD Low and No Alcohol Growth

Gamgort commented, "For instance, the launch of Schweppes mocktails in LatAm will build on our experience in ready-to-drink low and no-alcohol products in Canada. While the upcoming introductions of Dr Pepper Dark Berry in Mexico and an expansion of 0 CSDs in Canada leverage successful playbooks out of the U.S. Since the merger, we have grown our international business at a strong double-digit CAGR from slightly over $1 billion in annual sales to almost $2 billion. We continue to see outsized growth potential in this segment, and it will remain a meaningful contributor to KDP's total results in 2024 and beyond."

JAB Holdings Group Trims Down Its Stake

JAB is a private equity firm that specializes in acquiring beverage companies. They orchestrated the acquisition and privatization of Keurig Green Mountain for $13.8 billion in 2016. The company was instrumental in the merger between Keurig and Dr Pepper Snapple Group. JAB held a controlling interest in both Snapple Beverage Group and Dr Pepper and helped merge the two companies. In 2018, JAB helped orchestrate the Keurig and Dr Pepper Snapple merger. JAB became a major stakeholder in the new company, owning nearly 74% of the shares. JAB has since reduced its holdings, cashing out most of its stake. On March 8, 2024, JAB lowered its active stake to 23.9%, down from 27.6%

Keurig Dr Pepper analyst ratings and price targets are at MarketBeat. Keurig Dr Pepper peers and competitor stocks can be found with the MarketBeat stock screener.

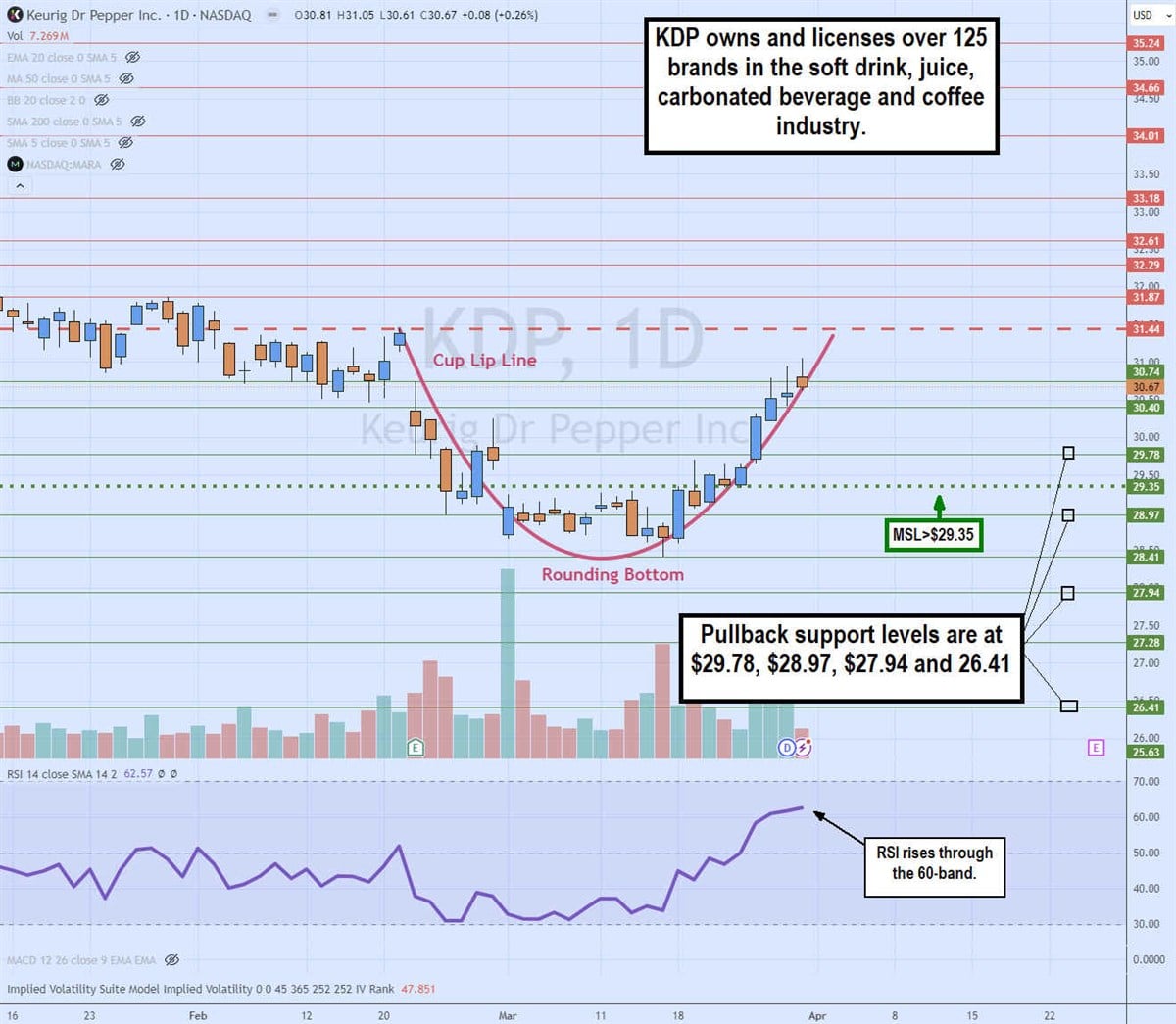

Daily Cup Pattern

The daily candlestick chart on KDP illustrates a cup pattern. The lip line started at $31.44 on February 21, 2024, as shares fell to a low of $28.41 by March 15, 2024. A rounding bottom formed as KDP triggered a daily market structure low (MSL) breakout through $29.35. Shares have been bouncing with the rising daily relative strength index (RSI), which lifted through the 60 band. Pullback support levels are at $29.78, $28.97, $27.94 and $26.41.