It is impossible to eliminate stock market risk. Risk and volatility are wily beasts and uncontainable, but they can be mitigated. One method is to use low-beta stocks, which tend to be less volatile than the S&P 500 (NYSEARCA: SPY). However, there are better reasons to invest than having a low beta, and it takes more than a low beta stock to mitigate volatility. Being less volatile than the S&P does not equate to risk-free, so quality still counts. Quality, which attracts dedicated buy-and-hold investors, is what it takes to offset risk over the long term.

A stock’s quality is best seen in the share price action, which is the focus of this article. Three high-quality stocks with steadily rising price action insulated from broader market turbulence. Their stocks have been uptrending for more than a decade on a combination of factors, including sustainable, self-funded growth, cash flow, and capital returns. The capital return includes share repurchases, dividends, and dividend growth, which improve shareholder value and drive market-beating total returns over time.

Casey’s General Stores Accelerates Growth in 2024

Casey’s General Stores (NASDAQ: CASY) is a chain of US gas stations and convenience stores. While it is not entirely insulated from economic conditions, it is supported by society's need for fuel and food, which is its primary business. The company is growing organically and through acquisitions, with growth accelerating in 2024. The primary takeaways from the results are that margins are widening along with the top-line growth, cash flow is improving, and the capital return is safe.

The company did not buy back any shares in Q1, but it had a good reason: closing on the Fikes deal. Fikes will add nearly 200 stores to its footprint, increasing it by 7.5%, and is immediately accretive to shareholders. Even so, the share count was down at the end of the quarter, and repurchases will resume soon.

The dividend is safe at 15% of the earnings, and the balance sheet has no red flags. Total liability is a little more than 1x equity and less than 0.5x assets, leaving it in nimble financial condition, ready to close on Fikes and move on to the next target.

Casey’s stock price action has two things going for it that investors will like: a low beta and an uptrend. The beta is running near 0.8x, and the uptrend appears to be gaining momentum. The Fikes deal accelerated the earnings outlook and the market, sending it into a parabolic curve with higher share prices still expected. Analyst activity is leading to an all-time high at consensus and the high-end range near $450 with revisions.

Chubb: Another Low Volatility Dividend Grower, Trending Higher

Chubb (NYSE: CB) operates as a P&C insurer globally. It is well regarded as a consistent growth stock with a reliable dividend. The dividend is worth about 1.25%, with shares near record highs and likely to decline over the next year as the share price rises.

Share price gains are driven by top-line growth and dividend growth, which has been sustained for over three decades. Chubb’s low 0.65x beta is due to that trend and the fact it is a Dividend Aristocrat.

Chubb's robust cash flow allows for aggressive share repurchases and dividends. The average share count was down 1.7% for the last reported quarter, in addition to the 2.3% decline posted in the previous year.

The net result is a nearly 50% share price increase in two years, with the trends driving price action not expected to end soon.

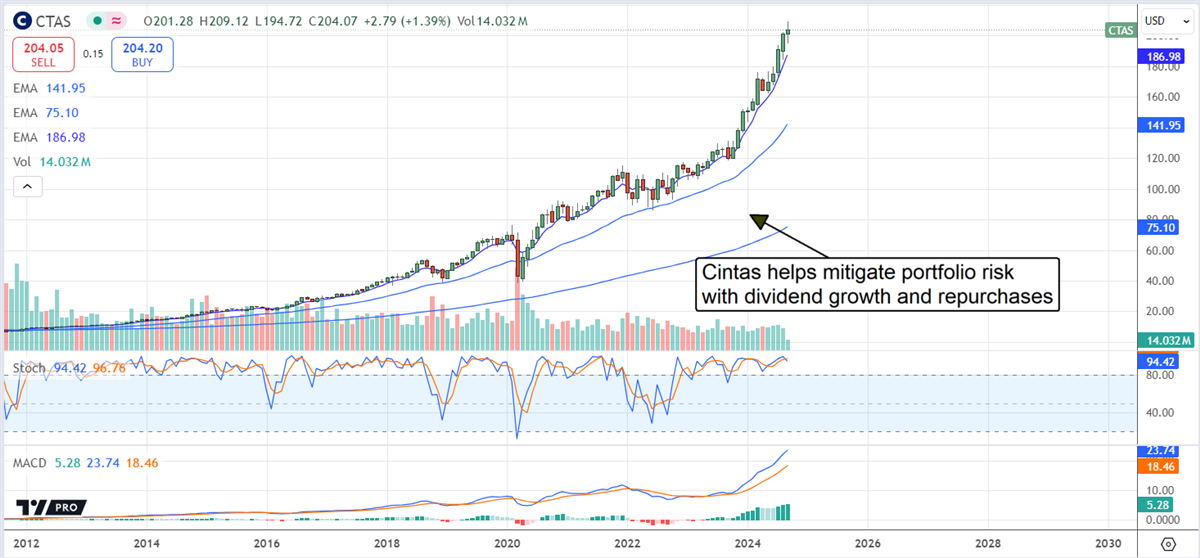

High-Volatility Cintas: Fight Fire with Fire

Cintas (NASDAQ: CTAS) does not have a low beta but has other qualities risk-averse investors favor, including self-funded growth, an industry-leading position, cash flow, and capital returns.

The capital return is impressive, with dividends growing by quadruple digits over the last year and expected to continue growing for the next ten. The payout ratio is very low, and the balance sheet is a fortress, so investors might expect the nearly 11% distribution CAGR to continue as well.

The critical takeaway is that the growth, balance sheet, and capital return don’t insulate the stock price from the news that moves the S&P 500, but they have supported CTAS price action for decades.

The stock is up a split-adjusted 40x since the lows set in 2009 and is on track to continue its trend. The analysts' consensus figure is lagging the price action today but rising on revisions that lead to the high-end range near $250, a 25% upside.