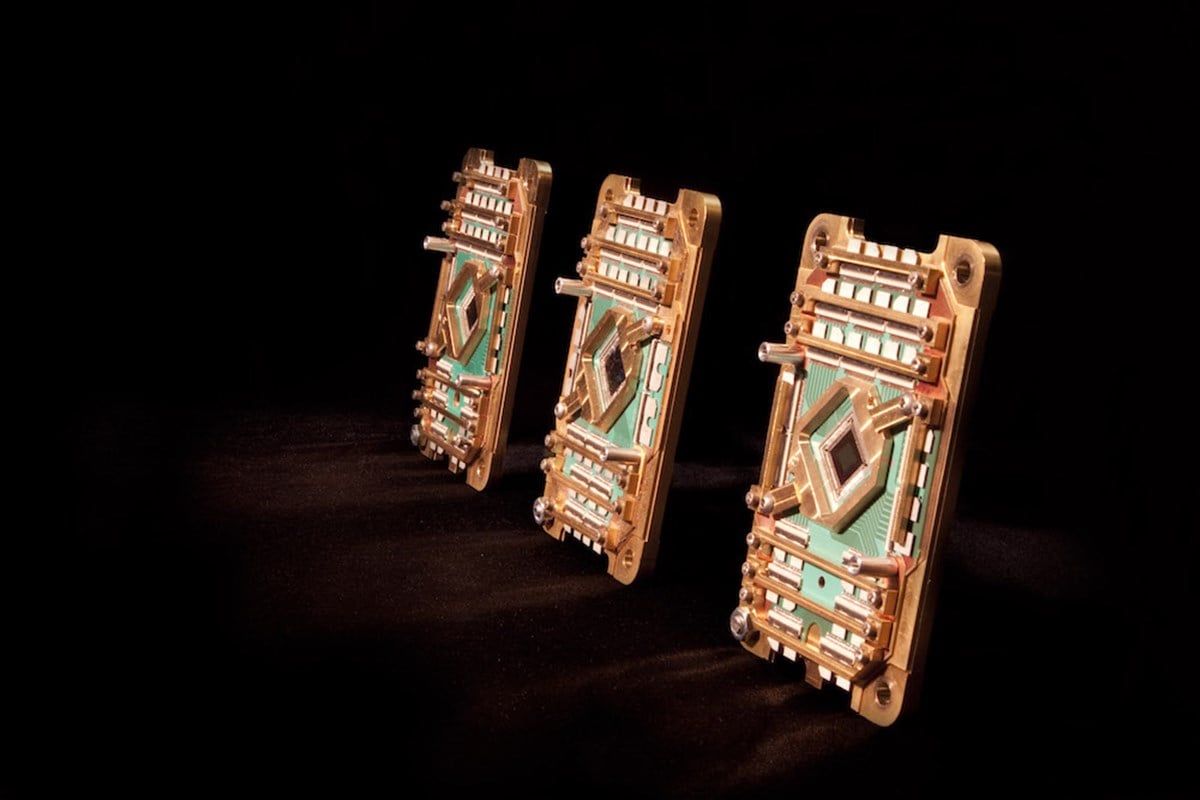

March has been a big month of research developments for D-Wave Quantum Inc. (NYSE: QBTS). First, the company announced what it claims is the first-ever successful feat of quantum supremacy: D-Wave's Advantage2 prototype annealing quantum computer solved a magnetic materials problem many orders of magnitude faster than a leading supercomputer. Then, just a few days later, D-Wave introduced a new blockchain architecture using the same techniques utilized in the demonstration of quantum supremacy.

These two breakthroughs could greatly affect D-Wave's business—one in the fast-growing quantum computing field and the other in cryptocurrencies and any company using today's blockchain tech. But what does this mean for investors today, particularly given D-Wave's inconsistent earnings performance and small size?

What Is Quantum Blockchain and What Does It Mean for D-Wave?

In essence, D-Wave's recent paper on its quantum blockchain achievement shows that the company used quantum computing techniques to generate and validate blockchain hashes, the primary tool used by blockchain networks to encrypt transactions. D-Wave utilized four cloud-based annealing quantum computers to execute distributed quantum computing, likely for the first time ever. So far, blockchain hashing has only ever been done on classical computers running increasingly powerful hardware.

One major issue with the current method for hashing is that it is massively energy-inefficient. As D-Wave notes, the annual power consumption of Bitcoin, one of the largest blockchain applications, but still only a single use case—is roughly equal to the annual power demand of Poland. D-Wave believes its quantum blockchain could be used to dramatically reduce energy needs by a factor of 1,000 or greater.

This technology is promising, undoubtedly, and D-Wave's Leap real-time quantum cloud service could see a spike in interest as a result. Still, D-Wave's distributed network included four quantum computers, while many preexisting blockchain networks use a significantly higher number of nodes. Investors may want to watch to see how this technology scales and whether any changes or limitations emerge as a result of the focus on quantum computing.

Impact on D-Wave's Stock

Interestingly, D-Wave shares fell by roughly 20% in the 24 hours starting in after-hours trading on March 19, the day before the announcement. Coincidentally, D-Wave's quantum blockchain announcement came the same day as remarks from NVIDIA Corp.'s (NASDAQ: NVDA) CEO Jensen Huang at that company's annual conference. In January, Huang suggested that 15 years might not be enough time for quantum computing technology to become broadly useful; shares of QBTS and other quantum companies plummeted.

On March 20, Huang walked back those earlier comments in a show of support for the quantum industry, although stocks still fell. D-Wave was one of several companies that declined that day, alongside rivals Rigetti Computing Inc. (NASDAQ: RGTI) and others.

To be sure, the declines in QBTS price in January and again in March are relatively small compared with the company's capital appreciation over a longer time span. As of March 21, QBTS shares had roughly quadrupled in value in the last year despite being down nearly 18% from their multi-year high just a week prior.

[content-module:TradingView|NYSE: QBTS]Why D-Wave May Require a Long-Term Investment Horizon

D-Wave remains very highly valued, with a price-to-sales ratio of 255.3. What's more, the company's ramping up of revenue has been and is expected to remain slow, and it currently trades at several dozen times its projected sales for 2027. That's all to say that investors feeling good about D-Wave's technological advances should be prepared to wait years for the company to be consistently profitable and should also keep in mind that a great deal of D-Wave's potential value is already priced into shares.

This may be one reason why, despite all six Wall Street analysts that have rated the firm offering a Buy assessment, it has a consensus price target of just $8.42—just five cents above the price on March 21 following the post-NVIDIA conference sell-off.

Indeed, someday, D-Wave's share price in late March 2025 may seem comically low. But for now, investors should keep in mind that despite the promise of the company's recent developments, an investment in this quantum computing leader remains risky.

Where Should You Invest $1,000 Right Now?

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...