Microsoft Corporation (NASDAQ: MSFT) has been one of the best-performing Magnificent Seven stocks in 2025. The stock increased over 23% in the three months ending June 10, which corresponds to a broader market move. This also takes into account the company’s April earnings report. The company beat on revenue and earnings and confirmed its full-year guidance.

That guidance included a commitment to maintain its spending on data centers. However, that spending proves the axiom that a company is different from a stock. Being a category leader in AI requires a commitment to spending.

But that spending is one reason that year-over-year (YOY) earnings per share (EPS) growth is expected to decline from a range of 14% to 17% in 2025 to around 11% to 14% in 2026. That’s not a sign of concern for the stock on a long-term basis, but it means MSFT stock may be priced for much stronger growth than it will deliver.

Microsoft Is Expensive, But Maybe Not Overvalued

As of June 10, MSFT stock is trading at around 37x earnings and about 36x forward earnings. That’s about a 5% premium to the stock’s historical norms. However, investors have shown a willingness to pay a premium for stocks, and particularly technology stocks, that are strong performers. Microsoft certainly fits into that category.

It’s also helpful to put Microsoft’s valuation into context. For example, MSFT stock compares favorably with Amazon.com Inc. (NASDAQ: AMZN), its direct competitor in the cloud computing sector. AMZN stock trades around 39x earnings. But AMZN stock is down about 1.3% this year while MSFT stock is up 11%.

A more interesting comparison is with Apple Inc. (NASDAQ: AAPL), which is trading around 31x earnings, and the stock’s growth prospects are not considered nearly as strong as Microsoft’s.

MSFT Just Formed a Golden Cross Pattern

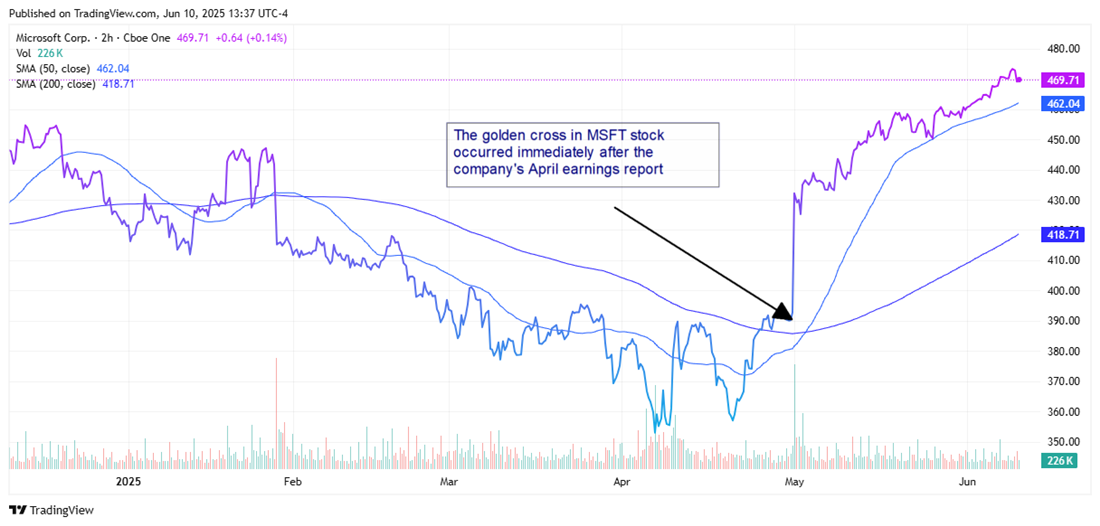

With nothing to drive up the stock from a fundamental perspective at the moment, traders and investors may rely more closely on technical signals. In the case of MSFT stock, a golden cross signal occurred in the last month.

A golden cross is when a stock’s 50-day simple moving average crosses above its 200-day simple moving average. That move by itself doesn’t symbolize a breakout unless you start seeing an uptrend in the 50-day. As you can see on the MSFT stock chart, the gap (or channel) between the two moving averages widened.

However, the tricky part about technical signals is that they can look different in shorter periods of time. That's why it's important to note that this golden cross pattern is based on the stock’s six-month chart.

Do Retail Investors Have Enough Juice?

[content-module:Forecast|NASDAQ: MSFT]While there’s plenty to like about Microsoft stock, the one concern that could hold the stock back is the lack of institutional volume. This isn’t just a seasonal factor. Institutions have lightened their buying in the last three months. They’re not selling, but buying dropped by nearly 50% in the last quarter.

There’s nothing to signal that this is anything more than a pause in activity as the stock approaches all-time highs. It also does nothing to take away from Microsoft's bullish outlook. As its deepening partnership with OpenAI shows, the company will remain a key player in the age of enterprise AI adoption.

But it does suggest that the rally in MSFT stock may be losing steam. That doesn’t detract from Microsoft's long-term outlook one bit. But it may be time for retail investors to consider taking some profit, or simply to hold the stock and wait for a better opportunity to add to a position.

Where Should You Invest $1,000 Right Now?

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...