Toronto, Ontario--(Newsfile Corp. - October 2, 2025) - Silver Birch Growth Inc. (SBG), a collaborative ecosystem connecting tech innovators, today introduces its Revenue Bundling Initiative. This program facilitates partnerships among founders to share resources from recurring revenue streams, supporting collective growth through non-dilutive, partnership-based collaborations.

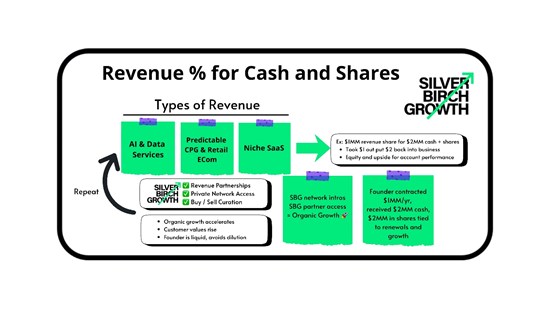

Revenue % for Cash and Shares

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11788/268849_69fba019a463194f_001full.jpg

"Tech founders build resilient software and IT solutions with dedicated customer bases, yet opportunities for collaboration often remain untapped," said Randy Gilling, Founder of SBG. "Our initiative connects like-minded innovators to explore shared revenue arrangements, fostering alignments that can enhance mutual scaling without the complexities of traditional structures."

Key Program Elements

- Target Revenue Collaborations: Focus on $500K-$2M in established, recurring contracted revenue to form joint $5MM-$10MM shared bundles.

- Revenue Sharing: Participants contribute 10-30% of bundled contracts, maintaining majority control.

- Resource Access: Gain access to shared ecosystem resources at program start, based on partnership fit and alignment.

- Equity Collaboration Potential: Explore optional equity-sharing discussions within a consolidator network for enhanced partnerships.

- Alignment Framework: Supported by mutual audit rights to ensure collaborative transparency, without new sales requirements.

- Ecosystem Support: Tap into SBG's network of 90+ industry leaders experienced in digital transformation and tech implementation. Benefit from strategic introductions, fractional guidance, and exclusive ecosystem perks. Aim: Collaborative growth through enhanced partnerships and opportunities.

Participant Opportunities Ideal for family offices, private equity groups, strategic partners, and AI/software collaborators interested in aligned, low-risk revenue-sharing arrangements. This focuses on established products with loyal customers, emphasizing partnership synergies over financial instruments.

SBG's curated network of executives, advisors, and founders-experts in real-world tech applications-creates collaborative flywheels: providing guidance on implementations, supporting organic expansion, and offering perks for participants. Curating bundles now for November/December activation-founders access resources plus a supported growth path.

Inquiries

Contact Sales@SilverBirchGrowth.com or visit www.silverbirchgrowth.com to explore collaboration.

This press release is for informational purposes only and does not constitute an offer to sell, or a solicitation of an offer to buy, any security, revenue stream, or investment. No securities are being offered; this initiative involves business partnerships exempt from registration under applicable Canadian securities laws, including NI 45-106. All collaborations are subject to mutual agreement and carry inherent business risks; consult qualified professionals. Forward-looking statements are based on current assumptions and may differ from actual results. Distribution restricted where prohibited by law.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/268849