Shanghai, China--(Newsfile Corp. - November 24, 2025) - Frost & Sullivan has conducted comprehensive research on the global medical device industry and published the "2025 Blue Book on the Current Status and Trends of Global Expansion of Chinese Medical Devices" on May 30, 2025. The blue book aims to provide a comprehensive analysis of the current landscape, market prospects, challenges, and opportunities for Chinese medical device companies expanding overseas. The Blue Book begins by examining the market size of medical devices in China and globally. (To read the 2025 Blue Book on the Current Status and Trends of Global Expansion of Chinese Medical Devices, visit: https://hub.frost.com/current-status-and-trends-of-global-expansion-of-chinese-medical-devices/)

According to Frost & Sullivan's data analysis, China's overall medical device market size grew from 729.8 billion RMB in 2020 to 941.7 billion RMB in 2024, with a CAGR of 6.6%.

During the same period (2020-2024), the global medical device market expanded from 456.6 billion USD to 623.0 billion USD, achieving a CAGR of 8.1%.

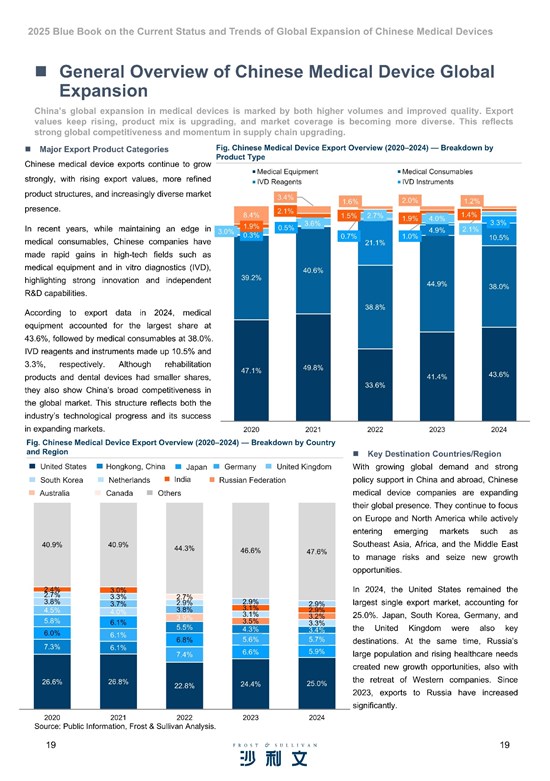

Chinese medical device enterprises are actively expanding into global markets, driven by a combination of internal and external factors. Internally, the sector faces intense domestic competition with numerous manufacturers possessing substantial production capacity yet relatively low per-unit output. The implementation of centralized procurement policies has further intensified price pressures on medical devices, prompting companies to seek new growth opportunities overseas. Meanwhile, China's medical device industry has demonstrated steady improvements in R&D and innovation capabilities. Supportive government policies actively encourage the global expansion of innovative medical devices, and pioneering Chinese medical device companies have accumulated substantial global operational experience through early globalization efforts. Furthermore, China's growing international influence continues to facilitate market access for Chinese medical device companies seeking global expansion.

The medical device sector is highly R&D- and capital-intensive. Early Chinese companies focused on basic healthcare segments. After China's accession to WTO in 2001, pioneer companies began global expansion by leveraging cost advantages to export low-value consumables to Europe and the U.S. After 2010, companies with stronger R&D capabilities and mature distribution networks entered international markets. The pandemic accelerated globalization for molecular diagnostics companies, driven by demand for ventilators, test kits, and PCR machines. By 2023, amid a global economic slowdown, Chinese companies shifted focus to product and compliance upgrades, moving from low-end to mid-high-end markets to enhance global competitiveness.

The medical device value chain covers R&D, manufacturing, distribution, and sales, forming an interconnected global ecosystem. Manufacturers drive innovation through product development and quality control, while distributors link manufacturers and healthcare providers by managing logistics, market education, and product adoption. Group Purchasing Organizations (GPOs) further streamline procurement by consolidating hospital demand to reduce costs. By optimizing every stage-from innovation to commercialization-companies can expand globally, building an end-to-end ecosystem that enhances market reach and patient impact.

The 2025 Blue Book on the Current Status and Trends of Global Expansion of Chinese Medical Devices highlights the following:

- Chapter 1: Overview of Chinese Medical Device Global Expansion (Market size, internal and external drivers, history)

- Chapter 2: Strategies and Case Studies of Chinese Medical Device Companies Going Global (overview of expansion strategies, distribution model, overseas manufacturing, OEM/ODM, M&A, E-acquisitions)

- Chapter 3: Sub-sector Analysis of Chinese Medical Device Global Expansion (current states and prospects of Chinese medical device global expansion including Life support equipment, medical imaging equipment, vascular intervention products, orthopedic material, IVD, etc.)

- Chapter 4: Regional Analysis of Chinese Medical Device Global Expansion (United States, European Union, Japan, Canada, Countries and Regions of the "Belt and Road Initiative" including Southeast Asia, Middle East, Latin America, Africa, Russia, etc.)

- Chapter 5: Key Difficulties and Trends of Chinese Medical Device Global Expansion

- Chapter 6: Profiles of Selected Globalized Medical Device Companies and Service Providers

Key Topics Covered:

- Drivers of Chinese Medical Device Global Expansion - Internal Factors

- Numerous Chinese Manufacturers with Large Capacity but Low Output per Company

- Centralized Procurement Brings Pricing Pressure

- Steady Growth in Chinese Medical Device R&D and Innovation Capacity

- Pandemic Strengthened Overseas Channels and Brand Awareness

- Chinese Policies Support Global Expansion of Innovative Devices

- Leading Chinese Medical Device Companies Started Globalization Early with Rich Experience

- Drivers of Chinese Medical Device Global Expansion - External Factors

- Broad Global Medical Device Market

- Price Competitiveness of Chinese Medical Devices

- Rising Global Influence of China

- Strategies for Global Expansion for Chinese Medical Device Companies

- Medical Device Value Chain and Expansion Strategies

- Introduction of Different Strategies, Their Advantages and Challenges, Key Steps of Each Strategy

- Global Expansion Paths and Case Studies for Chinese Medical Device Companies

- Sub-sector Analysis of Chinese Medical Device Global Expansion

- Current Status and Prospects of Chinese Medical Device Global Expansion (including medical equipment, medical imaging equipment, vascular intervention products, orthopedic material, IVD, etc.)

- Regulatory Challenges and Solutions of Chinese Medical Device Global Expansion

- Regional Analysis of Chinese Medical Device Global Expansion

- Macroeconomy and Demographics of each market

- Medical insurance system and payment model

- Current Status of Chinese Medical Device Global Expansion in Each Market

- Key Regulatory Requirements and Solutions

- Key Difficulties and Solutions of Chinese Medical Device Global Expansion

- Unclear global expansion direction

- Inaccurate expansion destination assessment

- Lack of Understanding of Market Access Procedures

- Still Early Stage of Localization

- Trends Analysis of Chinese Medical Device Global Expansion

- Increased R&D Investment and Product Innovation

- Alignment with International Standards, Pursuit Global Certification

- Improved Cross-cultural Communication and Regulatory Awareness

- Diversified Strategies for Global Branding

Source: Frost & Sullivan Analysis

About Frost & Sullivan

Frost & Sullivan, the Growth Partnership Company, works in collaboration with clients to leverage visionary innovation that addresses the global challenges and related growth opportunities that will make or break today's market participants. For more than 60 years, Frost & Sullivan has been supporting the Global 1000, emerging businesses, the public sector, and investors in developing growth strategies.

Media Contact

Contact: Qian Li

Company Name: Frost & Sullivan

Website: http://www.frostchina.com

Email: qian.li@frostchina.com

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/275685