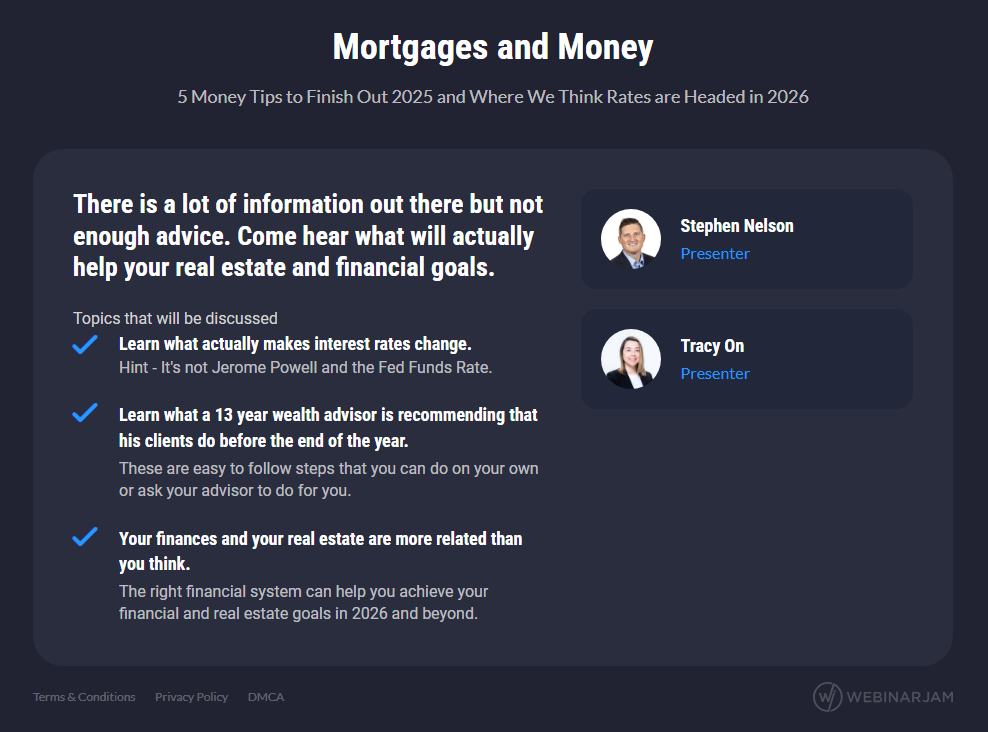

Mills Wealth Advisors, LLC announced a live, no-cost online masterclass on Friday, November 14, 2025, at 11 AM CST / 10 AM MST, focused on the practical actions households can take before December 31 to strengthen their 2026 financial position while navigating an evolving interest-rate environment. The session, “Mortgages and Money: 5 Money Tips to Finish Out 2025 and Where We Think Rates are Headed in 2026,” will be presented by Stephen Nelson, CFP®, CEPA®, AIF®, Partner and Senior Wealth Manager at Mills Wealth Advisors, with co-presenter Tracy On, PMP®, CSM®. Registration is open via the event’s registration page, and attendance is limited.

The announcement comes as year-end planning windows close and several federal thresholds for 2025 affect retirement savers and taxpayers. For the 2025 tax year, the Internal Revenue Service increased the employee deferral limit for 401(k), 403(b), and similar workplace plans to $23,500, while the IRA contribution limit remains $7,000 (with a $1,000 catch-up for those age 50 and older). The SECURE 2.0 Act’s RMD framework also continues to apply: most account owners begin required minimum distributions at age 73, with the first distribution due by April 1 of the year following the year they reach that age and subsequent distributions due by December 31 each year. Qualified charitable distributions from IRAs remain available beginning at age 70½, subject to annual limits indexed for inflation. Investors who intend to realize capital losses, complete charitable gifts, or finalize other time-sensitive actions generally must do so by December 31 for them to count in the current tax year. These rules and deadlines are described in recent IRS notices and guidance as well as independent summaries.

“Each year we see a consistent pattern: families who take care of the fundamentals before December 31 tend to enter the new year with clearer cash flow, better tax positioning, and fewer surprises,” said Stephen Nelson, CFP®, CEPA®, AIF®, Partner and Senior Wealth Manager at Mills Wealth Advisors. “Our goal on November 14 is to translate the latest IRS limits and the current interest-rate backdrop into a short list of actions that individuals can evaluate with their advisors, without jargon.” Nelson noted that the session will address coordination between retirement contributions, potential tax-loss realization, and charitable-giving strategies in a way that helps households prepare for 2026 under the current rules. Recent reporting highlights the 2025 contribution limit changes and the ongoing application of SECURE 2.0’s age-73 RMD start date.

Tracy On, PMP®, CSM®, who will co-present the segment on housing finance, added, “Real estate decisions and personal finances are more connected than many realize. Understanding what actually moves mortgage rates, and how to build a simple planning cadence around those dynamics, can help buyers and homeowners set realistic budgets for the year ahead.” The masterclass will discuss rate drivers and household planning considerations in a purely educational format, without product recommendations.

The November 14 program is designed for working professionals, pre-retirees, and retirees who want an objective overview of time-sensitive planning topics as the calendar year closes. The agenda will cover how to align retirement plan deferrals with the 2025 limits, considerations for those who reach RMD age in 2025 or 2026, and the timing rules generally applicable to charitable gifts and capital-loss realization by year-end. Independent resources summarizing these topics underscore the importance of completing such actions before December 31 to affect the current tax year.

The event reflects Mills Wealth Advisors’ evidence-based planning approach and its commitment to investor education. The firm advises business owners, corporate leaders, and multigenerational families on comprehensive financial planning, retirement income strategies, and portfolio management through its CORE+™ framework. Additional information about the firm and its services is available at Mills Wealth Advisors.

Event Details

Title: “Mortgages and Money: 5 Money Tips to Finish Out 2025 and Where We Think Rates are Headed in 2026”

Date/Time: Friday, November 14, 2025, 11 AM CST / 10 AM MST

Format: Live webinar (no charge to attend)

Registration: https://event.webinarjam.com/nxlw1/register/pvznwu9

Mills Wealth Advisors is an SEC-registered investment adviser based in Southlake, Texas, serving businesses, individuals, and families since 1999 and operating as an independent registered investment adviser since 2012. Through its CORE+ process, the firm provides evidence-based portfolio management and comprehensive financial planning, including retirement-income strategies, tax planning, exit planning, and 401(k) consulting. As of December 31, 2024, Mills Wealth Advisors oversaw approximately $402 million in discretionary and $38 million in non-discretionary client assets, plus $3.27 million under advisement.

###

For more information about Mills Wealth Advisors, LLC, contact the company here:

Mills Wealth Advisors

Michael Mills

(817) 541-1553

info@millswealthadvisors.com

1207 S. White Chapel Blvd. Suite 150 Southlake, TX 76092