TORONTO, Jan. 21, 2025 – Power Nickel Inc. (the “Company” or “Power Nickel”) (TSXV:PNPN) (OTCBB:PNPNF) (Frankfurt:IVV) is pleased to announce the return of the 3 holes of the fall campaign. These holes were testing the depth and western extensions of the Lion zone.

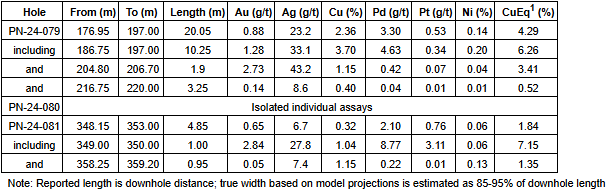

Hole PN-24-079 tested the interpreted plunge of the Lion zone below Hole PN-24-078 (news release December 18, 2024), and intersected the main high grade zone. Hole PN-24-080, drilled approximately 75 meters further west from hole PN-24-79, intersecting the mineralized horizon above the interpreted plunge of the zone and only returned sporadic metal values (0.38% Cu, 0.213 g/t Pd and 0.36% Cu in separate assays). Drill hole PN-24-081 tested approximately 100m below hole PN-24-080 and caught the top edge of the main Lion Zone returning 4.85 meters of 1.85% CuEq1. Results are outlined in Table 1 below.

Table 1 below presents the significant results of the current assays. Previously released results are included at the end of this news release (Table 2). The current results validate the expected strike, dip and plunge extensions to the Lion deposit model and increase the level of confidence about the continuity of the zone.

Table 1: Significant assay results from this news release – Lion zone

1Copper Equivalent Rec Calculation

CuEq Rec represents CuEq calculated based on the following metal prices (USD) : 2,360.15 $/oz Au, 27.98 $/oz Ag, 1,215.00 $/oz Pd, 1000.00 $/oz Pt, 4.00 $/lb Cu, 10.00 $/lb Ni and 22.50 $/lb Co., and a recovery grade of 80% for all commodities, consistent with comparable peers.

Terry Lynch, CEO of the Company, commented, “These holes continue to inspire the team on how exciting the Lion zone is so far and its potential as we expect to complete the remaining 15,000 meters of drilling between now and the end of April 2025. We have 14 more holes to report from the autumn drilling program that will inform the current winter program. The assay labs have been backed up but we hope to update the market in the coming weeks with more results along with clarity around the plans and objectives for the rest of this program.”

The Lion Zone continues to provide excellent intersections and grades, conforming to interpreted geological modeling, and extending the mineralized area of the high-grade copper, gold, silver, and platinum group metals within the Lion zone.

“Our understanding of the Lion zone continues to improve, with the excellent continuity and consistency of the zone allowing us to confidently forecast where individual holes will intersect the target mineral horizon of each hole whether it’s the Lion zone itself or, for example, deploying downhole EM to amplify the aggressive step out exploration efforts. As we disclosed to the market in December, our visual logging of hole PN-24-95a (assays pending) suggests the high-grade trend will extend to depth. This bodes well for continued success expanding the zone in 2025, leading to a future robust initial mineral resource estimate.” – commented Joe Campbell, VP of Exploration.

The 2025 program is now underway, with a technical crew carrying out core cutting of the remaining December drill core, preparing winter drill roads and pads, and upgrading the core logging and sampling facilities to manage multiple drills. The drill contractor has collared the first drill on to the initial 2025 drill site. By the first week of February a second drill will be operating, and by mid-February a third drill will be added. The increased drill capacity will allow for a much quicker turnaround of drill results, building the potential mineral resource in a shorter time

In addition to the drilling program, ongoing expert interpretations of the 2024 EM ground and borehole surveys is expected to identify multiple conductive targets that will allow for a much greater expansion of the exploration effort. The EM is expected to identify extensions to the Lion zone as well as providing additional targets of similar zones along several kilometers of strike on the mineralized structures. The geophysical targets promise to keep the additional drills busy during this winter’s drill campaign.

Qualified Person

Joseph Campbell, P.Geo, VP Exploration at Power Nickel, is the qualified person who has reviewed and approved the technical disclosure contained in this news release.

About Power Nickel Inc.

Power Nickel is a Canadian exploration company focusing on developing the High-Grade Nickel Copper PGM, Gold and Silver Nisk project into Canada’s next poly metallic mine.

On February 1, 2021, Power Nickel (then called Chilean Metals) completed the acquisition of its option to acquire up to 80% of the Nisk project from Critical Elements Lithium Corp. (CRE: TSXV).

The NISK property comprises a large land position (20 kilometres of strike length) with numerous high-grade intercepts. Power Nickel is focused on expanding the high-grade nickel-copper PGM, Gold and Silver mineralization with a series of drill programs designed to evaluate the initial Nisk discovery zone, the Lion discovery zone and to explore the land package for adjacent potential poly metallic deposits.

In addition to the Nisk project, Power Nickel owns significant land packages in British Colombia and Chile. Power Nickel is expected to reorganize these assets in a related public vehicle through a plan of arrangement.

Neither the TSX Venture Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

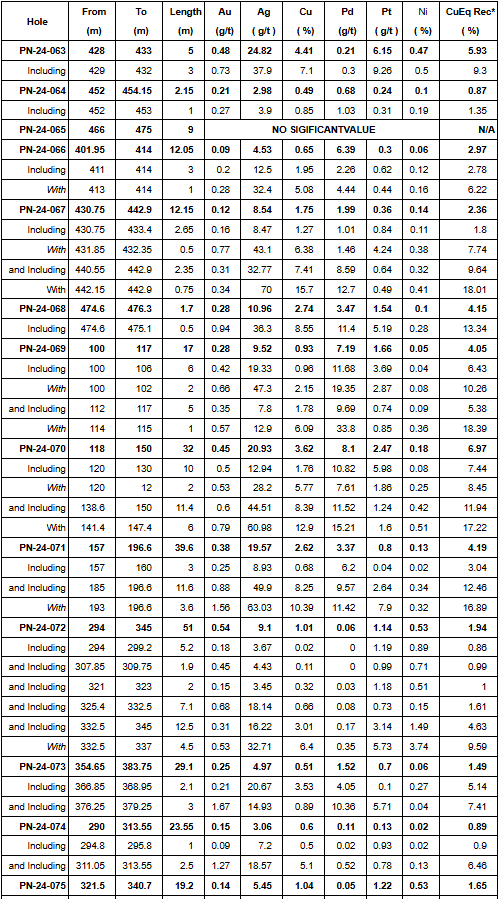

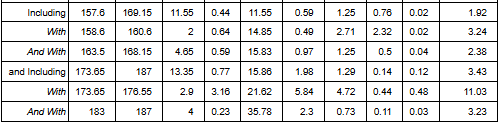

Table 2: Significant assay results previously reported – Lion zone

Cautionary Note Regarding Forward-Looking Statements

This message contains certain statements that may be deemed “forward-looking statements” concerning the Company within the meaning of applicable securities laws. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words “expects,” “plans,” “anticipates,” “believes,” “intends,” “estimates,” “projects,” “potential,” “indicates,” “opportunity,” “possible” and similar expressions, or that events or conditions “will,” “would,” “may,” “could” or “should” occur. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance, are subject to risks and uncertainties, and actual results or realities may differ materially from those in the forward-looking statements. Such material risks and uncertainties include, but are not limited to, among others; the timing for various drilling plans; the ability to raise sufficient capital to fund its obligations under its property agreements going forward and conduct drilling and exploration; to maintain its mineral tenures and concessions in good standing; to explore and develop its projects; changes in economic conditions or financial markets; the inherent hazards associates with mineral exploration and mining operations; future prices of nickel and other metals; changes in general economic conditions; accuracy of mineral resource and reserve estimates; the potential for new discoveries; the ability of the Company to obtain the necessary permits and consents required to explore, drill and develop the projects and if accepted, to obtain such licenses and approvals in a timely fashion relative to the Company’s plans and business objectives for the applicable project; the general ability of the Company to monetize its mineral resources; and changes in environmental and other laws or regulations that could have an impact on the Company’s operations, compliance with environmental laws and regulations, dependence on key management personnel and general competition in the mining industry.

Featured Image @ Freepik

- Featured News RSS feed

- Investing News RSS feed

- Daily Press Releases RSS feed

- Trading Tips RSS feed

- Investing Videos RSS feed

Follow PressReach on Twitter

Follow PressReach on TikTok

Follow PressReach on Instagram

Subscribe to us on Youtube