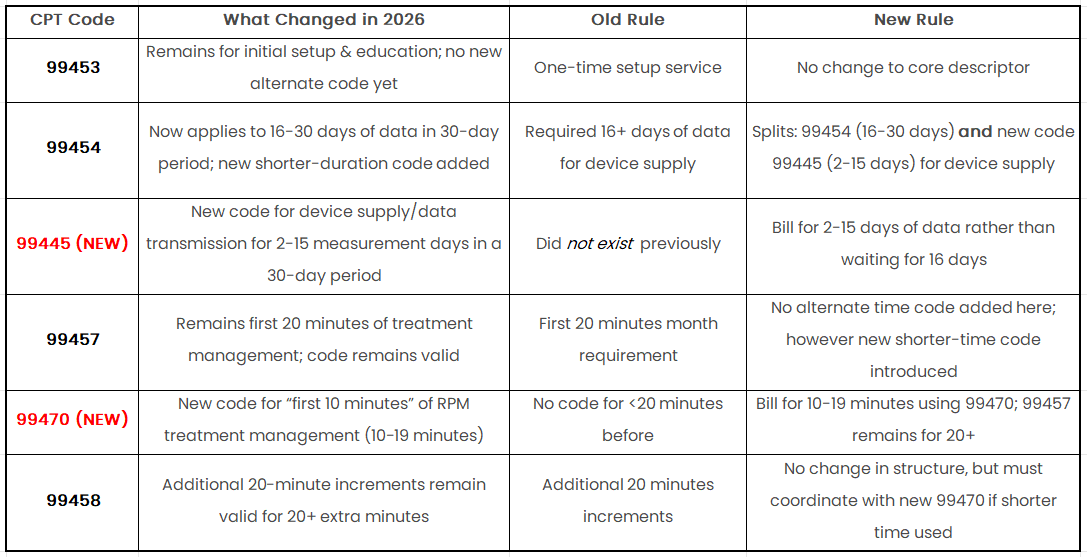

Historically, RPM reimbursement was constrained by rigid thresholds. Providers could bill for device setup and patient education under CPT 99453, and for device supply and data transmission under CPT 99454 only when at least 16 days of data were collected within a 30-day period. Clinical management services under CPT 99457 and 99458 required a minimum of 20 minutes of documented staff time. While clinically reasonable, these requirements often left portions of legitimate care activity unreimbursed, creating financial uncertainty and limiting program scalability.

Effective January 1, 2026, CMS introduced CPT 99445, allowing reimbursement for device supply and data transmission when data are collected on 2–15 days within a 30-day cycle, and CPT 99470, covering the first 10 minutes of clinical management per month with at least one real-time patient interaction. CMS stated that these changes are intended to provide "greater flexibility for providers managing patient conditions remotely," better reflecting real-world care delivery.

This shift is particularly important for chronic disease management, where patient engagement naturally fluctuates. Conditions such as hypertension, diabetes, and chronic respiratory disease require continuous monitoring, yet adherence is rarely consistent month to month. The updated reimbursement framework allows healthcare organizations to sustain long-term monitoring programs without being penalized for short-term variations in patient behavior.

As reimbursement barriers decline, operational execution becomes a defining factor in RPM success. With data continuity and documentation now directly linked to financial performance, technologies that simplify deployment and ensure reliable data transmission are gaining importance.

Transtek's 4G-connected devices align closely with this evolving environment. By eliminating dependence on home Wi-Fi and smartphone pairing, these cellular-enabled solutions streamline patient onboarding, reduce technical failure points, and improve data consistency—allowing providers to more effectively realize the reimbursement opportunities created by the new Medicare framework.

As reimbursement models continue to evolve, the RPM market is entering a new phase focused on scalability, sustainability, and operational efficiency—foundations that will shape the next generation of remote care.

Photos: (Click photo to enlarge)

Source: Guangdong Transtek Medical Electronics Co.,Ltd.

Read Full Story - Updated Medicare Rules Lower Barriers for RPM Adoption | More news from this source

Press release distribution by PRLog