News Source: iEmergent

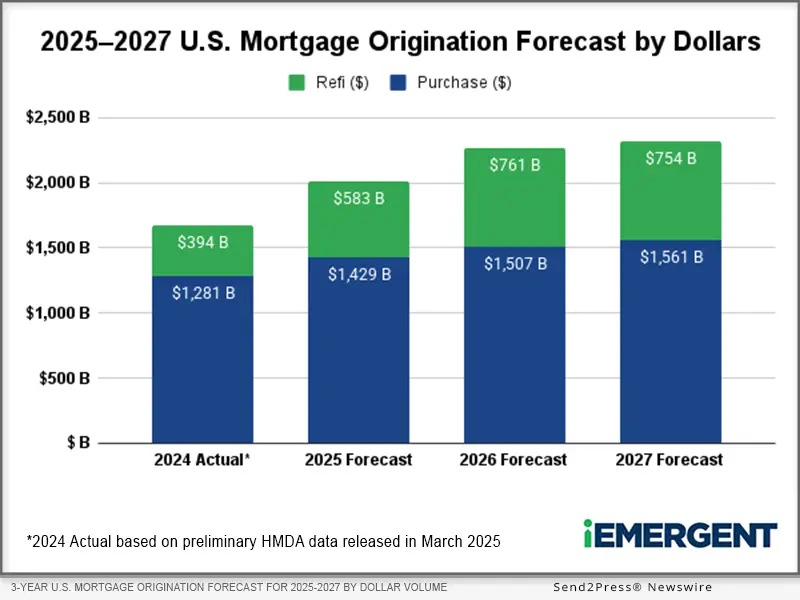

New three-year outlook also sees dollar originations growing 13% to reach $2.27 trillion next year

DES MOINES, Iowa, Oct. 8, 2025 (SEND2PRESS NEWSWIRE) — iEmergent, a forecasting and advisory services firm for the financial services, mortgage and real estate industries, today announced the availability of its 2025–2027 U.S. Mortgage Origination Forecast. The firm projects total originations will climb to $2.27 trillion in 2026, a 13% increase over 2025, as slowing economic growth and easing interest rates fuel a rebound in refinance activity alongside modest purchase gains.

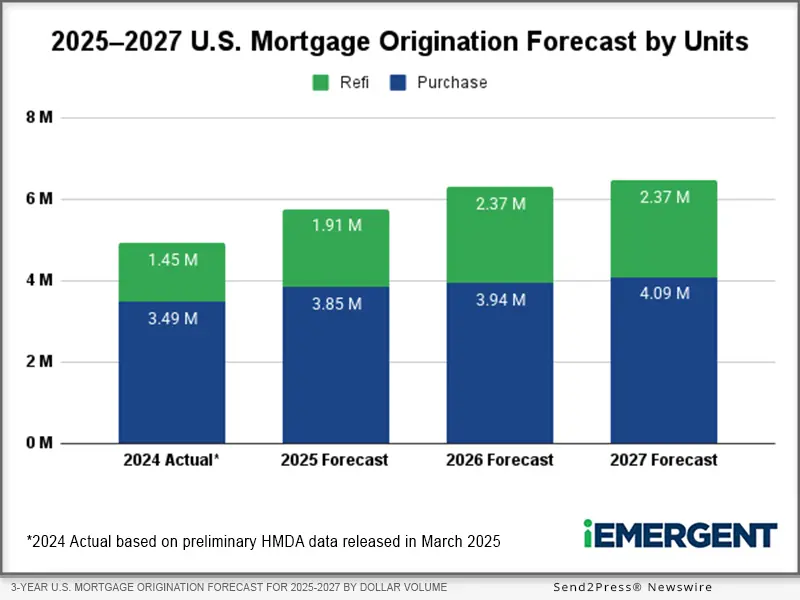

Image caption: Bar graph showing iEmergent’s 3-year U.S. Mortgage Origination Forecast for 2025-2027 by loan count/units.

According to iEmergent Chief of Forecasting Mark Watson, the 2026 outlook reflects a shifting economic landscape. As tariff impacts spread, consumer confidence wanes and the labor market cools, GDP growth is expected to slow further, setting the stage for lower interest rates and a modest housing recovery. Long-term interest rates are expected to rise slightly by the end of 2025 but fall again in 2026 as growth weakens. That drop should spur a rebound in refinances and lift overall mortgage originations.

- 2025: Total mortgage origination volume is forecast to surpass $2 trillion for the first time since 2022, driven by a 48% jump in refinance dollars and 12% in purchase dollar gains, an overall 20% increase from 2024.

- 2026: Total mortgage origination volume is projected to reach $2.27 trillion, a 13% increase from 2025. Refinance units are expected to grow 24% as lower rates boost activity, and a 2.3% increase in purchase units will help push total loan count up nearly 10% year-over-year.

- 2027: Purchase activity is projected at 4.09 million loans totaling $1.56 trillion, while refinance units are expected to hold steady at 2.37 million, with dollars dipping slightly at $754 billion.

“Crossing back above $2 trillion in 2025 signals renewed strength in the mortgage market,” Watson said. “By 2026, lower rates and moderating home prices should support activity, though affordability challenges will persist—especially for first-time buyers.”

Image caption: Bar graph showing iEmergent’s 3-year U.S. Mortgage Origination Forecast for 2025-2027 by dollar volume.

“These national trends tell an important story, but they don’t tell the whole story,” said Laird Nossuli, CEO of iEmergent. “Every market will experience the next wave of recovery differently. iEmergent’s data gives lenders visibility into those differences, so they can see how mortgage activity is expected to shift in specific markets, even down to the census-tract level.”

Read Mark Watson’s latest blog for more detailed analysis and commentary on the forecast.

Methodology

For more than two decades, iEmergent has been predicting mortgage market trends with a level of precision that surpasses even the industry’s most trusted forecasts from the Mortgage Bankers Association, Freddie Mac and Fannie Mae. In fact, in almost 70% of the nation’s 84,414 census tracts, iEmergent’s U.S. Mortgage Origination Forecast has proven accurate to within 10 loans.

iEmergent’s proprietary forecasting method is a hybrid of several traditional demand forecast models. Many variables go into these forecasts, but there are two fundamental elements: first, the Purchase Mortgage Generation Rate (PMGR), which is the rate at which an individual market produces purchase mortgages. Second, the homebuyer pool: the number of households that are ready, willing and able to buy a home. By evaluating the relationship between each census tract’s homebuyer pool and PMGR, probability theory can be applied to estimate the number of purchase mortgage loans and dollars that will be originated in that market.

Read more about iEmergent’s approach to forecasting here: https://www.iemergent.com/insights/mortgage-opportunity-forecasting

About iEmergent

Founded in 2000, iEmergent provides mortgage lending forecasts and analytics to the lending, housing and real estate industries. The company offers an extensive variety of forecast and market intelligence products, including Mortgage MarketSmart, a visualization tool that helps lenders quantify how mortgage markets will change. For more information, visit https://www.iemergent.com/.

Tags: @iEmergent

Media Kit:

https://www.iemergent.com/docs/default-source/default-document-library/presskit_digitallinked.pdf

This press release was issued on behalf of the news source (iEmergent), who is solely responsible for its accuracy, by Send2Press Newswire.

To view the original story, visit: https://www.send2press.com/wire/u-s-mortgage-loan-originations-to-climb-nearly-10-in-2026-iemergent-forecasts/

Copr. © 2025 Send2Press® Newswire, Calif., USA. -- REF: S2P STORY ID: S2P129999 FCN24-3B

INFORMATION BELOW THIS PAGE, IF ANY, IS UNRELATED TO THIS PRESS RELEASE.