News Source: Optimal Blue

Optimal Blue's January 2025 Market Advantage mortgage data report highlights a softening purchase market, boost in refi demand among elevated rates

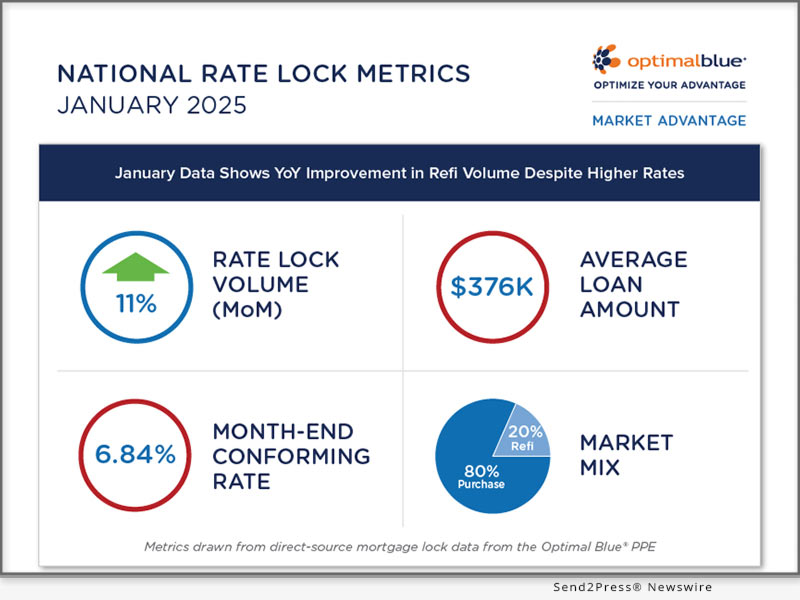

PLANO, Texas, Feb. 13, 2025 (SEND2PRESS NEWSWIRE) — Optimal Blue today released its January 2025 Market Advantage mortgage data report, revealing a sharp rise in year-over-year (YoY) refinance activity alongside a drop in purchase lock counts. The decline in purchase lock counts marks the lowest January count since Optimal Blue began tracking this data in 2019. Meanwhile, refinance lock volume surged even though the Optimal Blue Mortgage Market Indices (OBMMI) 30-year ticked above 7% for the first time since May.

Image caption: Optimal Blue’s January 2025 Market Advantage mortgage data report.

“January lock data shows two important ways constrained affordability is impacting the housing finance market. On one hand, refinance activity saw impressive YoY growth despite elevated rates, signaling a growing pool of homeowners with mortgage rates high enough to justify a refinance. On the other hand, purchase lock counts declined YoY, marking the lowest January figures since we began tracking this data in 2019,” said Brennan O’Connell, director of data solutions at Optimal Blue. “A combination of high home prices and rates are curbing purchase activity, while at the same time fueling refinance demand among homeowners who purchased when rates were even higher.”

Key findings from the Market Advantage report, derived from direct-source mortgage lock data, include:

- Refinance activity surges YoY: Despite rates remaining above 6.8%, total refinance lock volume grew more than 20% YoY for both rate-and-term and cash-out refinances. This indicates that a growing share of borrowers with higher-rate mortgages are finding opportunities to refinance, such as those who purchased between August and November of 2023.

- Purchase lock volume rises MoM but declines YoY: Purchase lock volume climbed 16% from December, reflecting typical seasonal momentum at the start of the year. However, YoY purchase lock counts – which control for home price appreciation – were down 6%, marking the lowest January figures in six years. This follows a strong end to 2024 and will be an important trend to watch moving forward.

- Rates hold steady after an early-month jump: The OBMMI 30-year conforming rate started January above 7% but rallied late in the month, ending at 6.84% (up just 1 basis point). Other key rate indices followed a similar pattern, with jumbo rates up 2 bps, FHA rates unchanged, and VA rates up 4 bps.

- Conforming loan share remains near record lows: After hitting a multi-year low in December, conforming loan share edged up slightly to 51% of total production but remained near historical lows. This was offset by small declines in nonconforming and FHA loan share. VA lending share held steady.

- Credit scores show mixed trends: The average credit score for purchase and rate-and-term refinance loans rose by 1 point to 738 and 728, respectively. Meanwhile, the average credit score for cash-out refinances declined by 4 points to 693.

- Home prices increase while loan amounts remain stable: The average home purchase price rose from $473.7K to $476.2K, while the average loan amount dipped slightly from $376.9K to $376.4K.

The full Market Advantage report, which provides more detailed findings and additional insights into U.S. mortgage market trends, can be viewed at (PDF): https://www2.optimalblue.com/wp-content/uploads/2025/02/OB_MarketAdvantage_MortgageDataReport_Jan2025.pdf.

This month’s Market Advantage podcast, which was recorded on-site at the Optimal Blue Summit, features HousingWire Editor in Chief Sarah Wheeler as a guest commentator. Access the podcast: https://market-advantage.captivate.fm/listen.

About the Market Advantage Report:

Optimal Blue issues the Market Advantage mortgage data report each month to provide early insight into U.S. mortgage trends. Leveraging lender rate lock data from the Optimal Blue PPE – the mortgage industry’s most widely used product, pricing, and eligibility engine – the Market Advantage provides a view of early-stage origination activity. Unlike self-reported survey data, mortgage lock data is direct-source data that accurately reflects the in-process loans in lenders’ pipelines.

Nothing herein shall be construed as, nor is Optimal Blue providing, any legal, trading, hedging, or financial advice.

About Optimal Blue:

Optimal Blue effectively bridges the primary and secondary mortgage markets to deliver the industry’s only end-to-end capital markets platform. The company helps lenders of all sizes and scopes maximize profitability and operate efficiently so they can help American borrowers achieve the dream of homeownership. Through innovative technology, a network of interconnectivity, rich data insights, and expertise gathered over more than 20 years, Optimal Blue is an experienced partner that, in any market environment, allows lenders to optimize their advantage from pricing accuracy to margin protection, and every step in between. To learn more, visit https://OptimalBlue.com/.

This press release was issued on behalf of the news source (Optimal Blue), who is solely responsible for its accuracy, by Send2Press Newswire.

To view the original story, visit: https://www.send2press.com/wire/january-mortgage-lock-data-shows-year-over-year-improvement-in-refinance-volume-despite-higher-rates/

Copr. © 2025 Send2Press® Newswire, Calif., USA. -- REF: S2P STORY ID: S2P124020 FCN24-3B

INFORMATION BELOW THIS PAGE, IF ANY, IS UNRELATED TO THIS PRESS RELEASE.