Let’s dig into the relative performance of Under Armour (NYSE: UAA) and its peers as we unravel the now-completed Q2 apparel, accessories and luxury goods earnings season.

Within apparel and accessories, not only do styles change more frequently today than decades past as fads travel through social media and the internet but consumers are also shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel, accessories, and luxury goods companies have made concerted efforts to adapt while those who are slower to move may fall behind.

The 17 apparel, accessories and luxury goods stocks we track reported a slower Q2. As a group, revenues missed analysts’ consensus estimates by 1.4% while next quarter’s revenue guidance was 12.6% below.

Inflation progressed towards the Fed's 2% goal recently, leading the Fed to reduce its policy rate by 50bps (half a percent or 0.5%) in September 2024. This is the first cut in four years. While CPI (inflation) readings have been supportive lately, employment measures have bordered on worrisome. The markets will be debating whether this rate cut's timing (and more potential ones in 2024 and 2025) is ideal for supporting the economy or a bit too late for a macro that has already cooled too much.

In light of this news, apparel, accessories and luxury goods stocks have held steady with share prices up 2.5% on average since the latest earnings results.

Best Q2: Under Armour (NYSE: UAA)

Founded in 1996 by a former University of Maryland football player, Under Armour (NYSE: UAA) is an apparel brand specializing in sportswear designed to improve athletic performance.

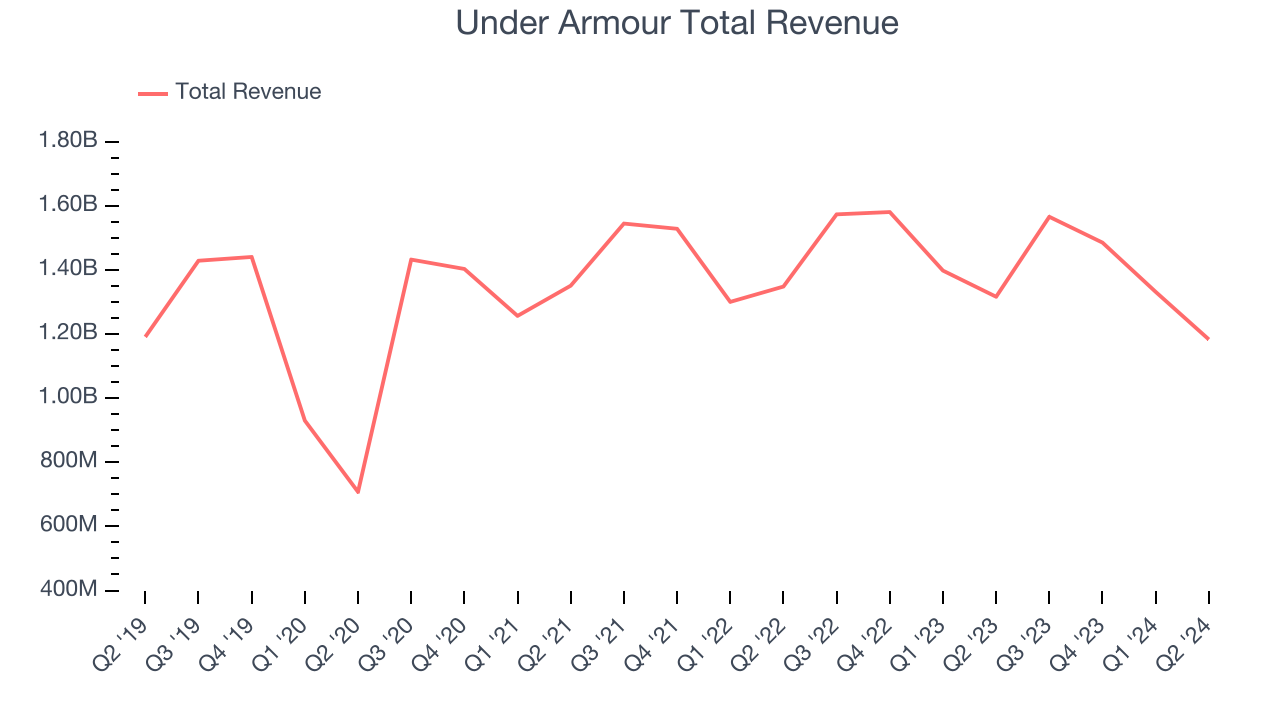

Under Armour reported revenues of $1.18 billion, down 10.1% year on year. This print exceeded analysts’ expectations by 3.9%. Overall, it was a very strong quarter for the company with an impressive beat of analysts’ earnings and EBITDA estimates.

Interestingly, the stock is up 38.4% since reporting and currently trades at $8.96.

Is now the time to buy Under Armour? Access our full analysis of the earnings results here, it’s free.

Figs (NYSE: FIGS)

Rising to fame via TikTok and founded in 2013 by Heather Hasson and Trina Spear, Figs (NYSE: FIGS) is a healthcare apparel company known for its stylish approach to medical attire and uniforms.

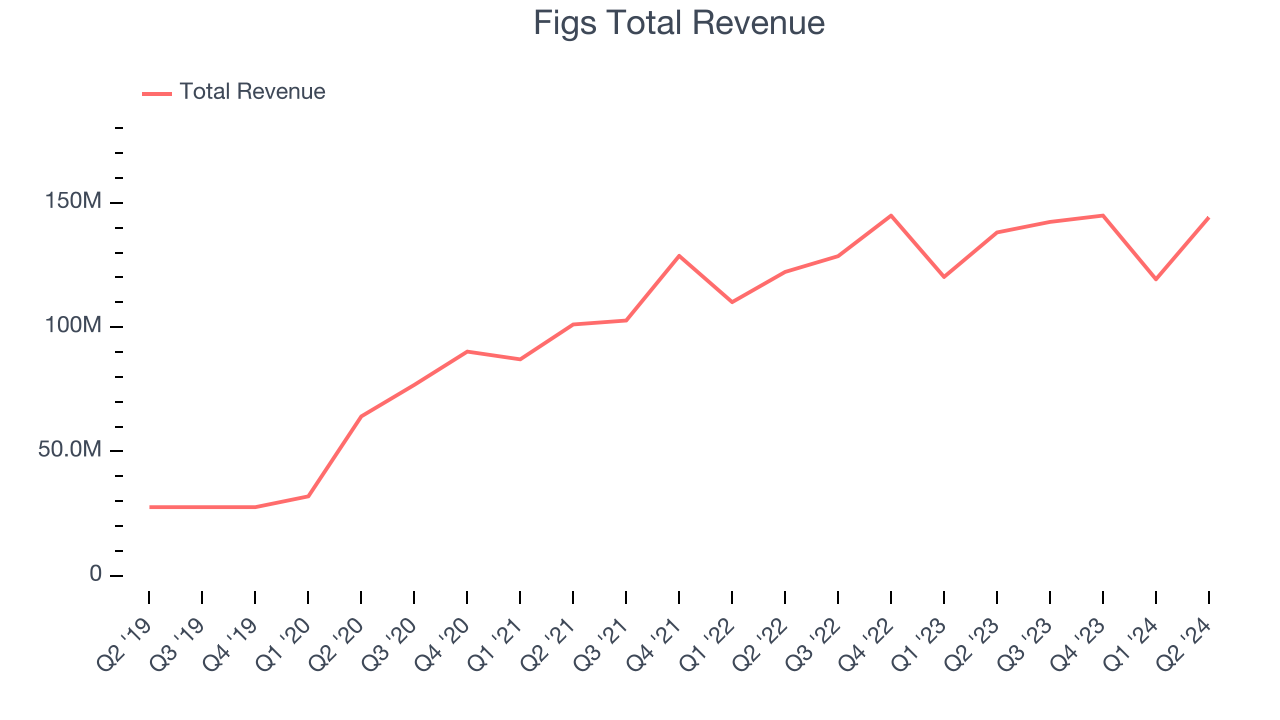

Figs reported revenues of $144.2 million, up 4.4% year on year, outperforming analysts’ expectations by 1.4%. The business had a very strong quarter with an impressive beat of analysts’ earnings estimates.

The market seems happy with the results as the stock is up 8.2% since reporting. It currently trades at $6.18.

Is now the time to buy Figs? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Guess (NYSE: GES)

Flexing the iconic upside-down triangle logo with a question mark, Guess (NYSE: GES) is a global fashion brand known for its trendy clothing, accessories, and denim wear.

Guess reported revenues of $732.6 million, up 10.2% year on year, in line with analysts’ expectations. It was a softer quarter as it posted underwhelming earnings guidance for the next quarter.

As expected, the stock is down 8% since the results and currently trades at $18.58.

Read our full analysis of Guess’s results here.

Oxford Industries (NYSE: OXM)

The parent company of Tommy Bahama, Oxford Industries (NYSE: OXM) is a lifestyle fashion conglomerate with brands that embody outdoor happiness.

Oxford Industries reported revenues of $419.9 million, flat year on year. This print missed analysts’ expectations by 4.2%. It was a disappointing quarter as it also logged underwhelming earnings guidance for the full year.

The stock is down 9.5% since reporting and currently trades at $75.61.

Read our full, actionable report on Oxford Industries here, it’s free.

Tapestry (NYSE: TPR)

Originally founded as Coach, Tapestry (NYSE: TPR) is an American fashion conglomerate with a portfolio of luxury brands offering high-quality accessories and fashion products.

Tapestry reported revenues of $1.59 billion, down 1.8% year on year. This print surpassed analysts’ expectations by 1.1%. However, it was a slower quarter as it produced a miss of analysts’ earnings estimates. In addition, full-year revenue guidance missed analysts’ expectations.

The stock is up 15.7% since reporting and currently trades at $43.93.

Read our full, actionable report on Tapestry here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.