Data infrastructure software company, Confluent (NASDAQ: CFLT) reported Q3 CY2024 results exceeding the market’s revenue expectations, with sales up 25% year on year to $250.2 million. Its non-GAAP profit of $0.10 per share was also 95.3% above analysts’ consensus estimates.

Is now the time to buy Confluent? Find out by accessing our full research report, it’s free.

Confluent (CFLT) Q3 CY2024 Highlights:

- Revenue: $250.2 million vs analyst estimates of $245.1 million (2.1% beat)

- Adjusted EPS: $0.10 vs analyst estimates of $0.05 ($0.05 beat)

- Adjusted Operating Income: $15.8 million vs analyst estimates of $510,040 (large beat)

- Management raised its full-year Adjusted EPS guidance to $0.25 at the midpoint, a 25% increase

- Gross Margin (GAAP): 74.5%, up from 71.9% in the same quarter last year

- Operating Margin: -37.4%, up from -54.3% in the same quarter last year

- Free Cash Flow Margin: 3.7%, up from 1.2% in the previous quarter

- Customers: 1,346 customers paying more than $100,000 annually

- Market Capitalization: $7.43 billion

“Confluent was founded with the mission of setting data in motion for organizations around the world,” said Jay Kreps, co-founder and CEO, Confluent.

Company Overview

Started in 2014 by the team of engineers at LinkedIn who originally built it as an internal tool, Confluent (NASDAQ: CFLT) provides infrastructure software for organizations that makes it easy and fast to collect and move large amounts of data between different systems.

Data Infrastructure

Generating insights from system level data is an increasing priority for most businesses, but to do so requires connecting and analyzing piles of data stored and siloed in separate databases. This is the demand driver for cloud based data infrastructure software providers, who can more readily integrate, distribute and process information vs. legacy on-premise software providers.

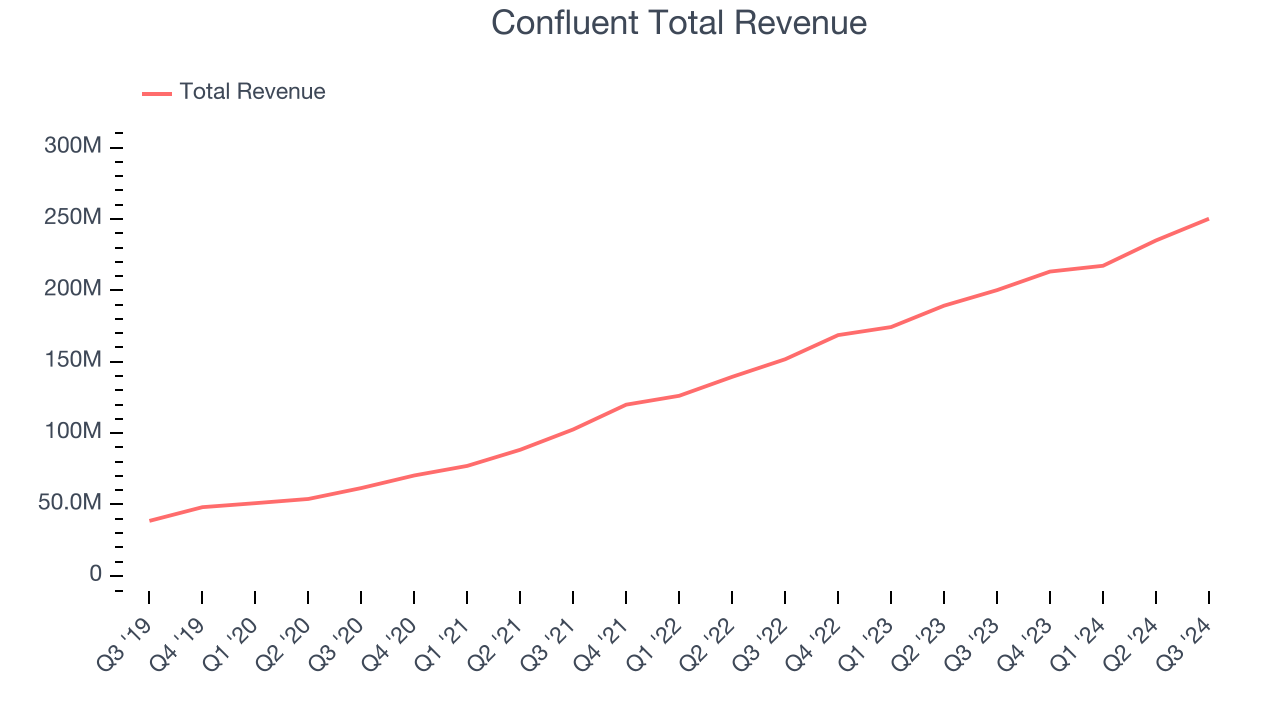

Sales Growth

A company’s long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years. Over the last three years, Confluent grew its sales at an exceptional 39.4% compounded annual growth rate. This is encouraging because it shows Confluent’s offerings resonate with customers, a helpful starting point.

This quarter, Confluent reported robust year-on-year revenue growth of 25%, and its $250.2 million of revenue topped Wall Street estimates by 2.1%.

Looking ahead, sell-side analysts expect revenue to grow 20.6% over the next 12 months, a deceleration versus the last three years. Still, this projection is healthy and indicates the market sees success for its products and services.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

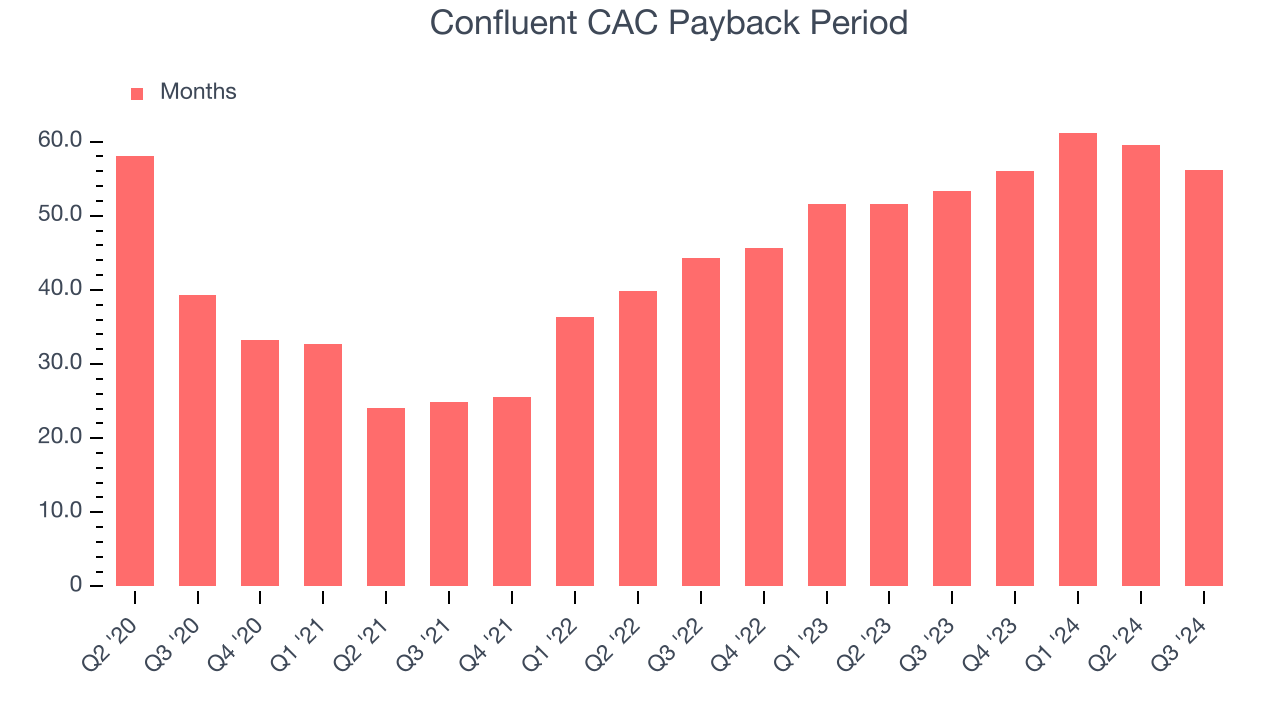

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

It’s relatively expensive for Confluent to acquire new customers as its CAC payback period checked in at 56.2 months this quarter. The company’s performance indicates that it operates in a competitive market and must continue investing to maintain its growth trajectory.

Key Takeaways from Confluent’s Q3 Results

We were impressed by Confluent’s optimistic full-year EPS forecast, which blew past analysts’ expectations. We were also glad its gross margin improved. On the other hand, its EPS forecast for next quarter missed and its new large contract wins shrunk. Zooming out, we think this was a decent quarter featuring some areas of strength but also some blemishes. The stock traded up 13.1% to $26.11 immediately after reporting.

Is Confluent an attractive investment opportunity right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.