While the S&P 500 is up 11.2% since May 2024, Shyft (currently trading at $13.42 per share) has lagged behind, posting a return of 5.2%. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Is there a buying opportunity in Shyft, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.We don't have much confidence in Shyft. Here are three reasons why you should be careful with SHYF and one stock we like more.

Why Do We Think Shyft Will Underperform?

Notably receiving an order from FedEx for electric vehicles, Shyft (NASDAQ: SHYF) offers specialty vehicles and truck bodies for various industries.

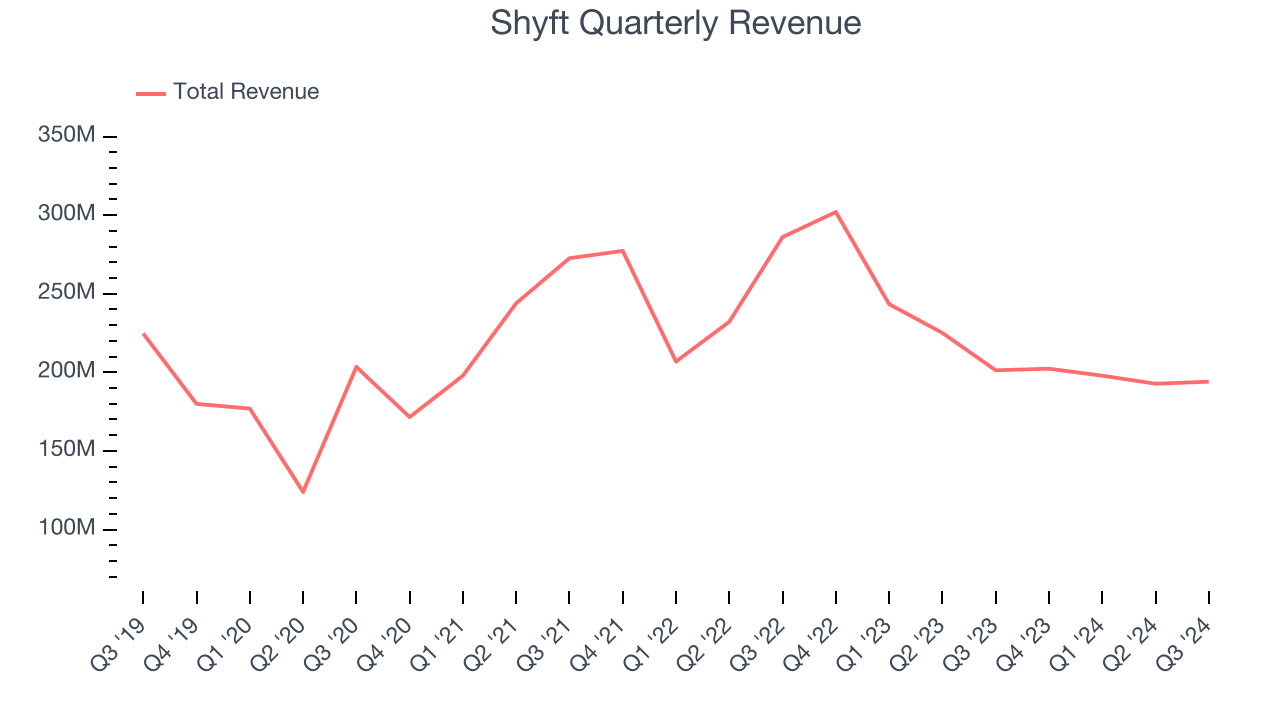

1. Long-Term Revenue Growth Flatter Than a Pancake

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Shyft struggled to consistently increase demand as its $787.1 million of sales for the trailing 12 months was close to its revenue five years ago. This was below our standards and is a sign of poor business quality.

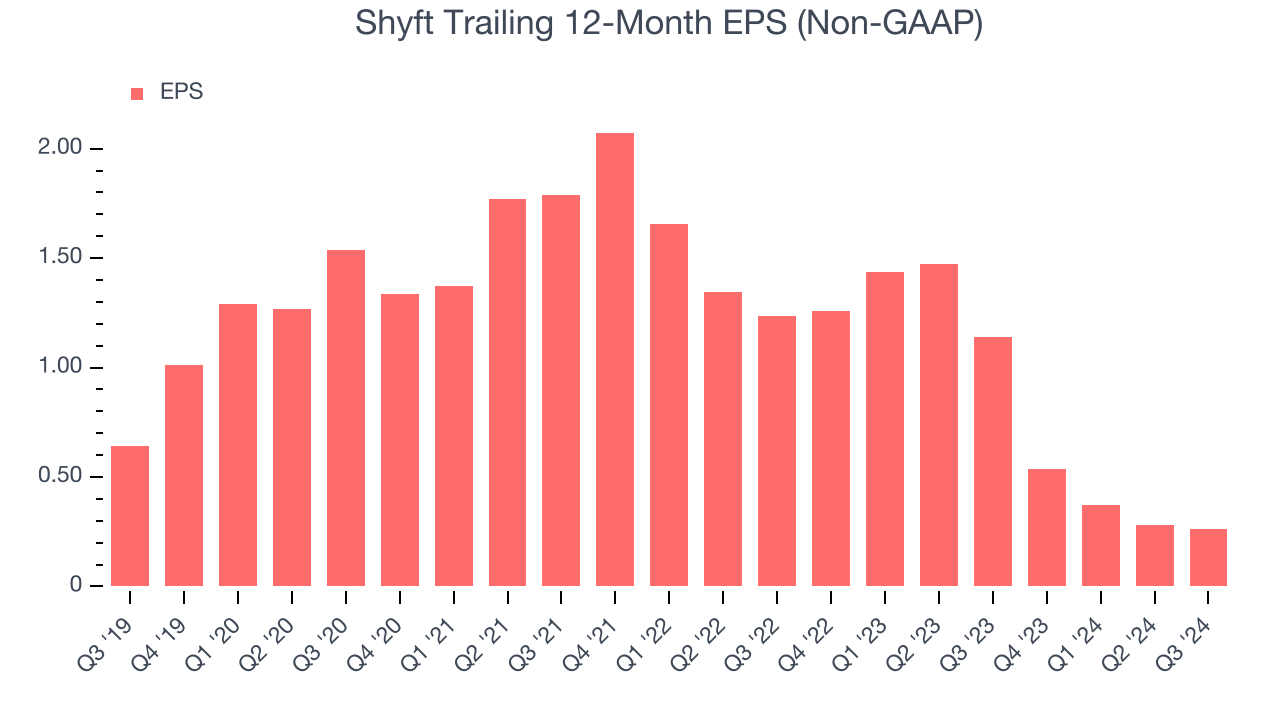

2. EPS Trending Down

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Shyft, its EPS declined by 16.4% annually over the last five years while its revenue was flat. This tells us the company struggled because its fixed cost base made it difficult to adjust to choppy demand.

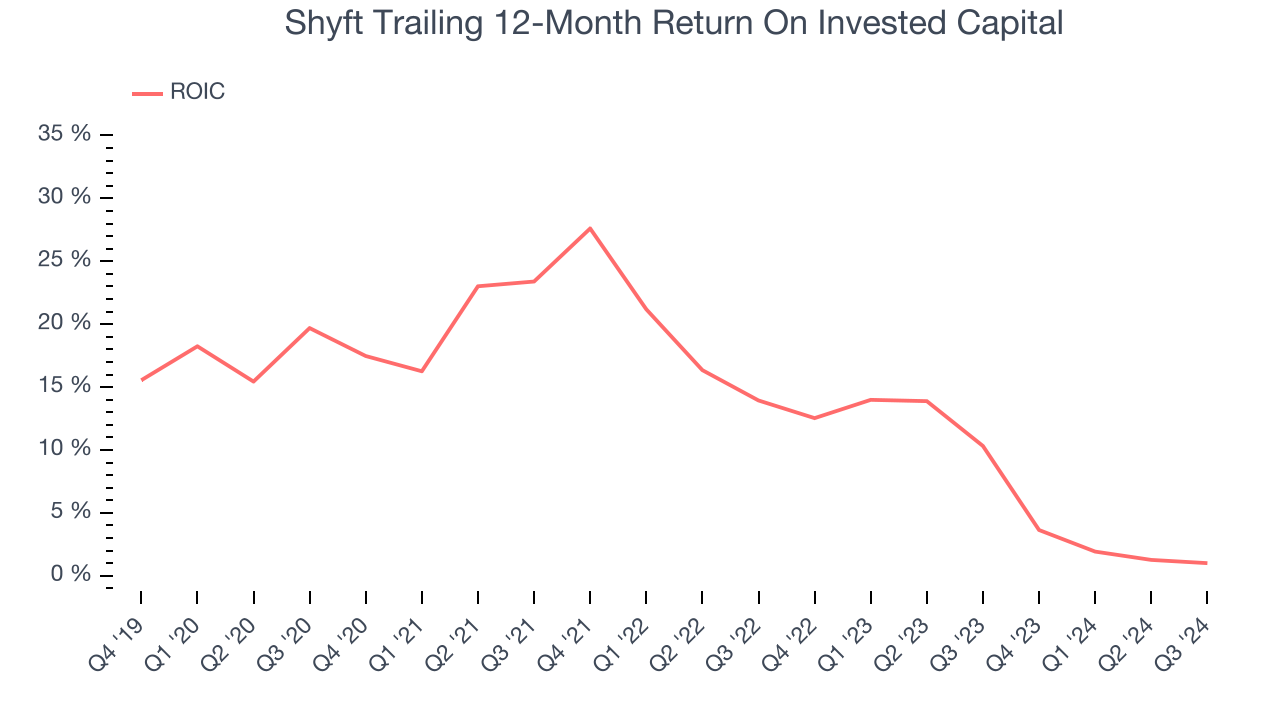

3. New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We typically prefer to invest in companies with high returns because it means they have viable business models, but the trend in a company’s ROIC is often what surprises the market and moves the stock price. Unfortunately, Shyft’s ROIC has decreased significantly over the last few years. We like what management has done in the past but are concerned its ROIC is declining, perhaps a symptom of fewer profitable growth opportunities.

Final Judgment

Shyft falls short of our quality standards. With its shares trailing the market in recent months, the stock trades at 18.7x forward price-to-earnings (or $13.42 per share). At this valuation, there’s a lot of good news priced in - we think there are better stocks to buy right now. We’d suggest taking a look at Costco, one of Charlie Munger’s all-time favorite businesses.

Stocks We Would Buy Instead of Shyft

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.