Let’s dig into the relative performance of Endeavor (NYSE: EDR) and its peers as we unravel the now-completed Q3 media earnings season.

The advent of the internet changed how shows, films, music, and overall information flow. As a result, many media companies now face secular headwinds as attention shifts online. Some have made concerted efforts to adapt by introducing digital subscriptions, podcasts, and streaming platforms. Time will tell if their strategies succeed and which companies will emerge as the long-term winners.

The 8 media stocks we track reported a satisfactory Q3. As a group, revenues were in line with analysts’ consensus estimates.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

Weakest Q3: Endeavor (NYSE: EDR)

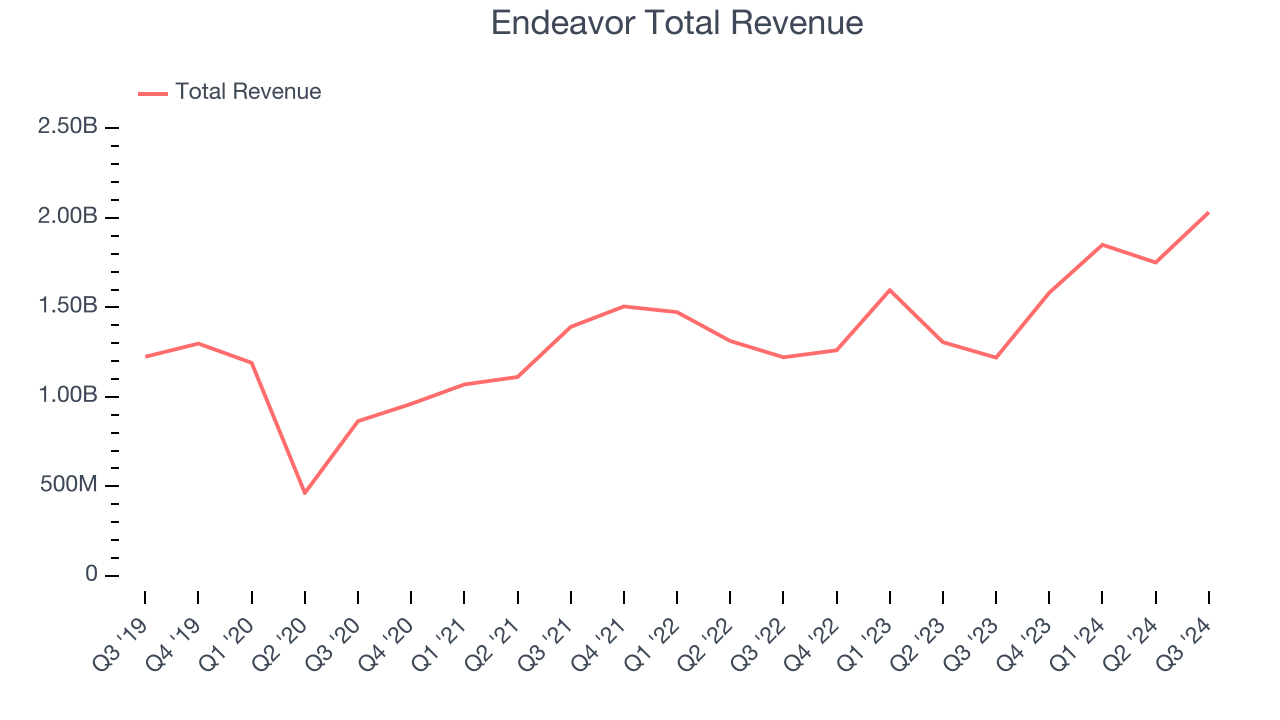

Owner of the UFC, WWE, and a client roster including Christian Bale, Endeavor (NYSE: EDR) is a diversified global entertainment, sports, and content company known for its talent representation and involvement in the entertainment industry.

Endeavor reported revenues of $2.03 billion, up 66.6% year on year. This print fell short of analysts’ expectations by 5.5%. Overall, it was a disappointing quarter for the company with a significant miss of analysts’ adjusted operating income estimates.

“During the quarter, our owned sports and representation segments delivered solid results driven by continued consumer demand for live events and content,” said Ariel Emanuel, CEO, Endeavor.

Endeavor pulled off the fastest revenue growth but had the weakest performance against analyst estimates of the whole group. The stock is up 6.6% since reporting and currently trades at $30.92.

Read our full report on Endeavor here, it’s free.

Best Q3: fuboTV (NYSE: FUBO)

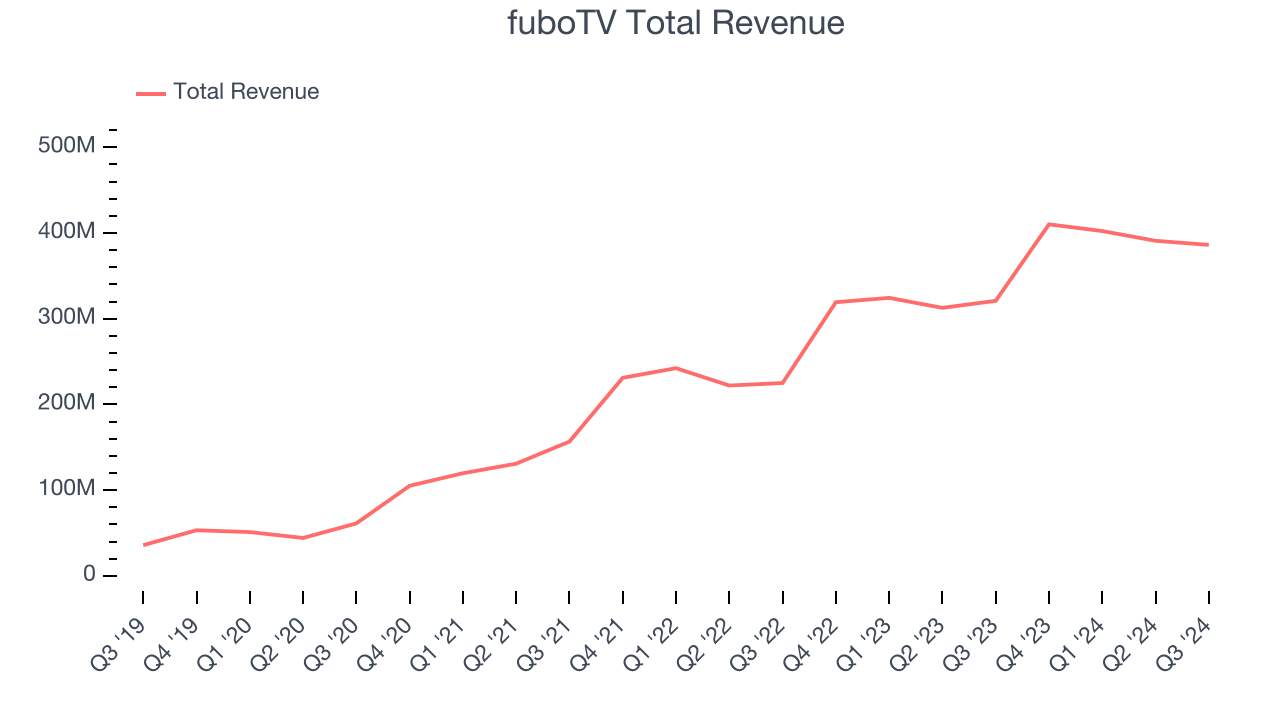

Originally launched as a soccer streaming platform, fuboTV (NYSE: FUBO) is a video streaming service specializing in live sports, news, and entertainment content.

fuboTV reported revenues of $386.2 million, up 20.3% year on year, outperforming analysts’ expectations by 2.5%. The business had a very strong quarter with a solid beat of analysts’ EPS and EBITDA estimates.

fuboTV delivered the biggest analyst estimates beat among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 12.6% since reporting. It currently trades at $1.52.

Is now the time to buy fuboTV? Access our full analysis of the earnings results here, it’s free.

The New York Times (NYSE: NYT)

Founded in 1851, The New York Times (NYSE: NYT) is an American media organization known for its influential newspaper and expansive digital journalism platforms.

The New York Times reported revenues of $640.2 million, up 7% year on year, in line with analysts’ expectations. It was a mixed quarter as it posted a decent beat of analysts’ EPS estimates but a miss of analysts’ subscribers estimates.

As expected, the stock is down 4.3% since the results and currently trades at $54.38.

Read our full analysis of The New York Times’s results here.

Warner Music Group (NASDAQ: WMG)

Launching the careers of legendary artists like Frank Sinatra, Warner Music Group (NASDAQ: WMG) is a music company managing a diverse portfolio of artists, recordings, and music publishing services worldwide.

Warner Music Group reported revenues of $1.63 billion, up 2.8% year on year. This print surpassed analysts’ expectations by 2%. Taking a step back, it was a satisfactory quarter as it also recorded a decent beat of analysts’ adjusted operating income estimates.

The stock is down 4.9% since reporting and currently trades at $32.02.

Read our full, actionable report on Warner Music Group here, it’s free.

Disney (NYSE: DIS)

Founded by brothers Walt and Roy, Disney (NYSE: DIS) is a multinational entertainment conglomerate, renowned for its theme parks, movies, television networks, and merchandise.

Disney reported revenues of $22.57 billion, up 6.3% year on year. This number was in line with analysts’ expectations. Aside from that, it was a satisfactory quarter as it also produced a solid beat of analysts’ adjusted operating income estimates but a miss of analysts’ Entertainment revenue estimates.

The stock is up 12.6% since reporting and currently trades at $115.61.

Read our full, actionable report on Disney here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), has fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty heading into 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.